New @BudgetHawks Analysis

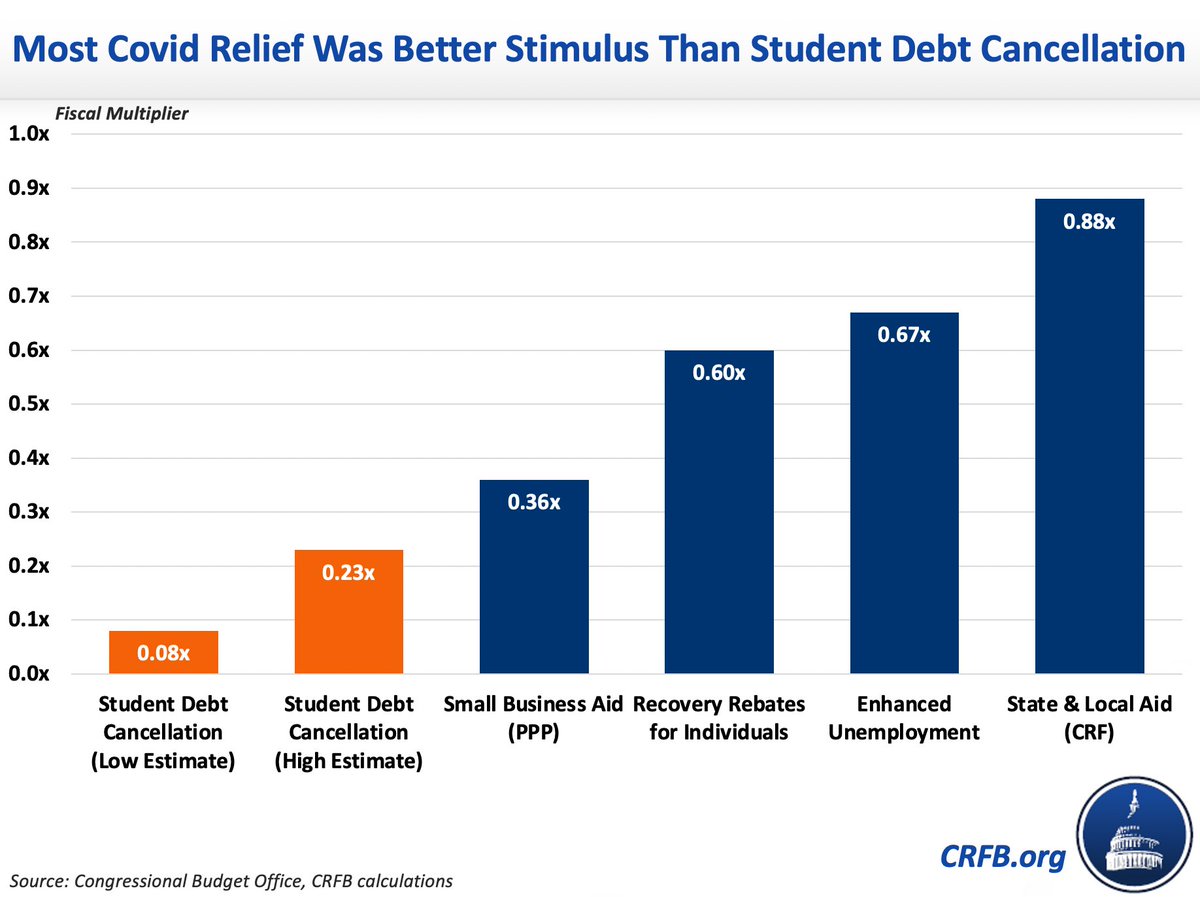

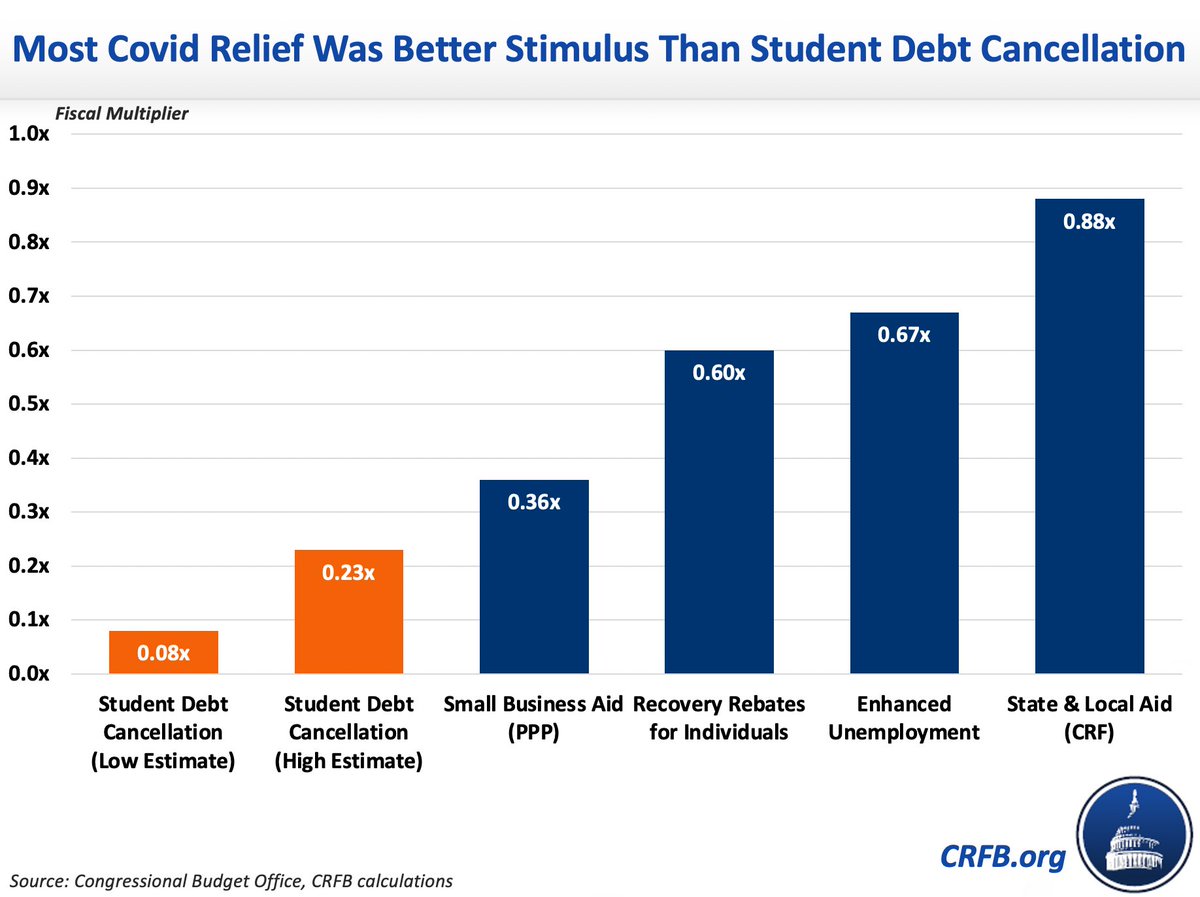

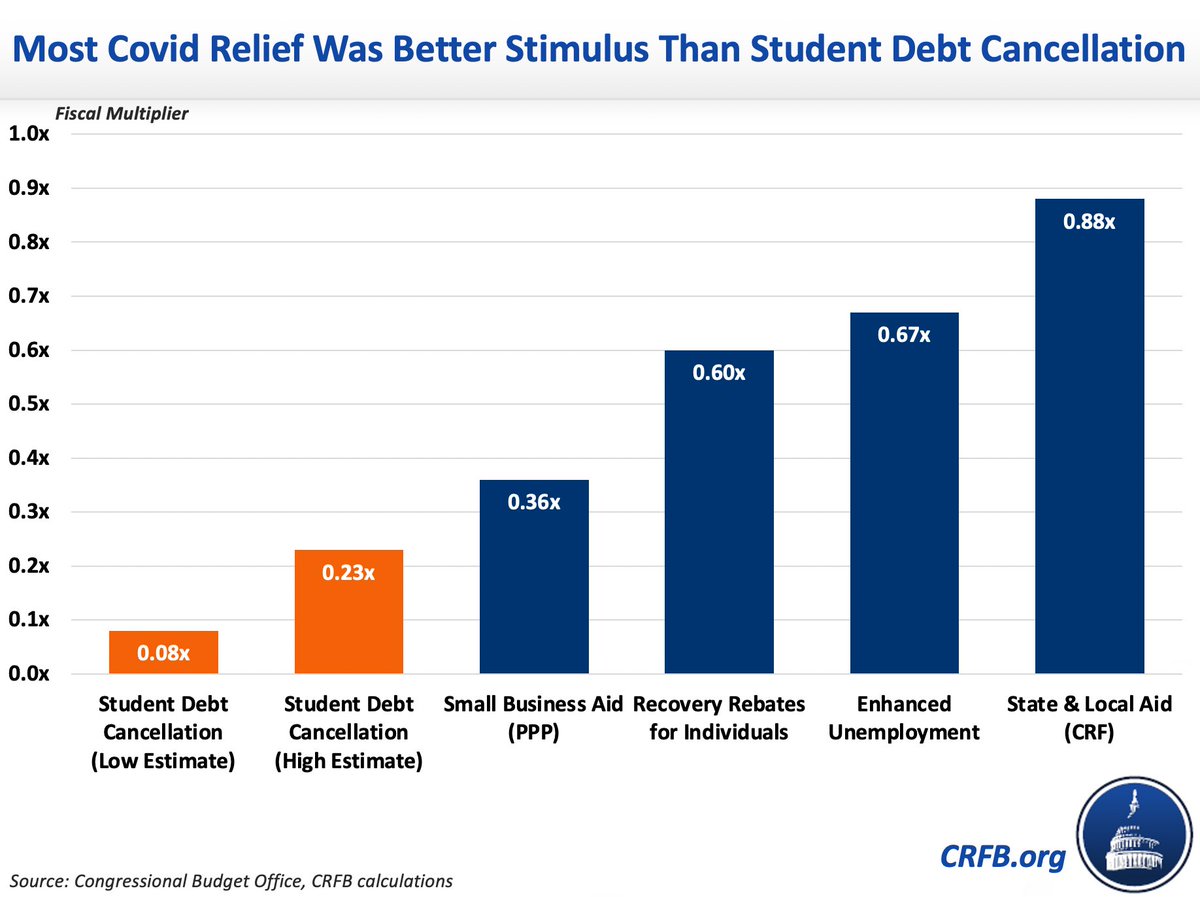

New @BudgetHawks Analysis - cancelling all student loan debt would have a 'multiplier' of between 0.08x and 0.23x.

- cancelling all student loan debt would have a 'multiplier' of between 0.08x and 0.23x.Regardless of its other merits, it would be *horrible* stimulus.

Read the analysis here: http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

Thread/

1) The economy remains weak thanks to the pandemic, and IMHO needs a fiscal boost.

Stimulus works by getting people to spend more money in the economy.

Cancelling student debt relief doesn't much do that.

For a $1.5 trillion cost, it would boost GDP $115b to $260b.

2/

Stimulus works by getting people to spend more money in the economy.

Cancelling student debt relief doesn't much do that.

For a $1.5 trillion cost, it would boost GDP $115b to $260b.

2/

Why does cancelling student debt have such a poor bang for buck?

Mainly because it doesn't much change spendable cash.

Full cancellation increases household wealth by $1.5 trillion. But it only increases annual cash flow by about $90 billion due to lower repayment 3/

Mainly because it doesn't much change spendable cash.

Full cancellation increases household wealth by $1.5 trillion. But it only increases annual cash flow by about $90 billion due to lower repayment 3/

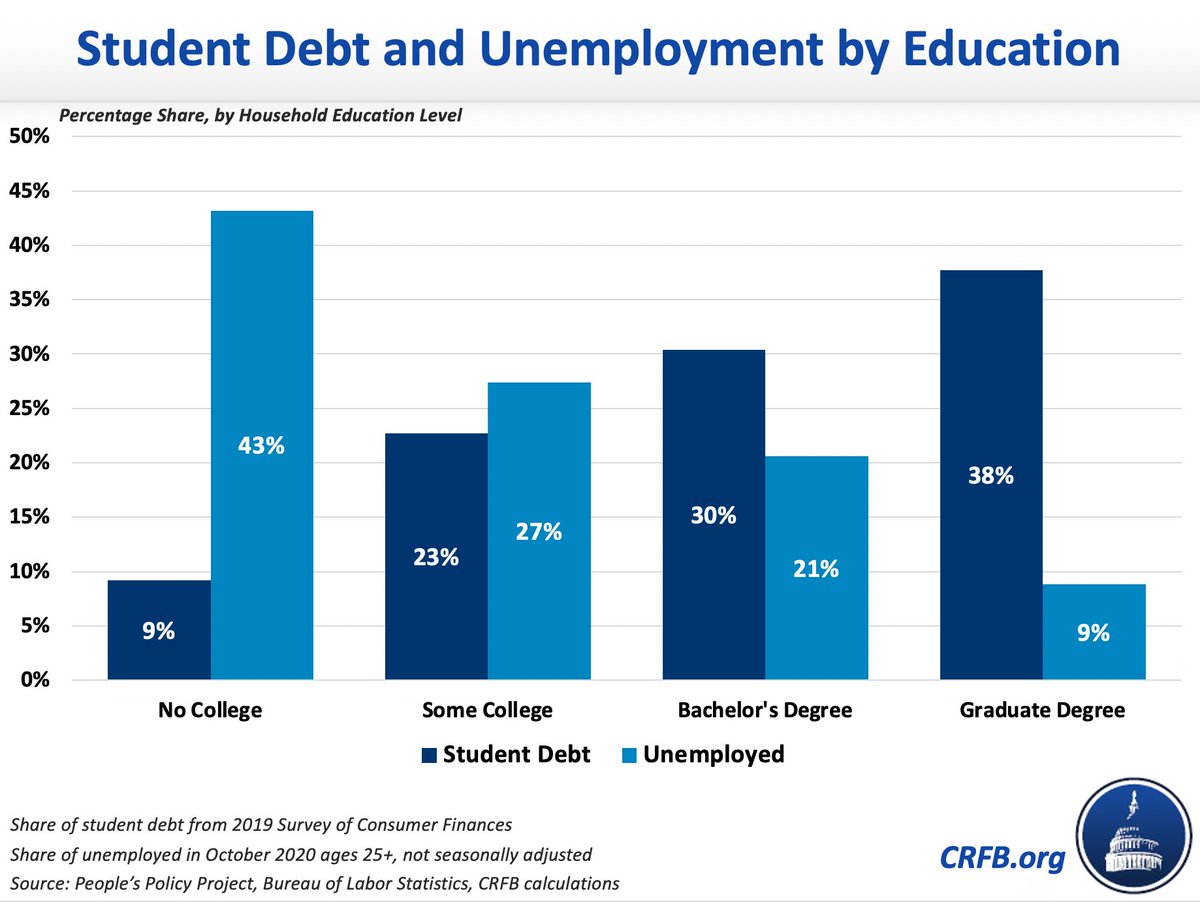

Debt cancellation is also very poorly targeted. To stimulate the economy, you want to get $$ to people who will spend it -- mainly those with low income or recent income loss.

Debt cancellation does neither.

http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

4/

Debt cancellation does neither.

http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

4/

70% of unemployed workers lack a bachelors degree. Those folks hold less than a third of total debt -- most have NO student debt because they didn't go to college.

Meanwhile, two fifths of student debt is held by those w grad degrees - they make up 1/10 of unemployed workers.

5/

Meanwhile, two fifths of student debt is held by those w grad degrees - they make up 1/10 of unemployed workers.

5/

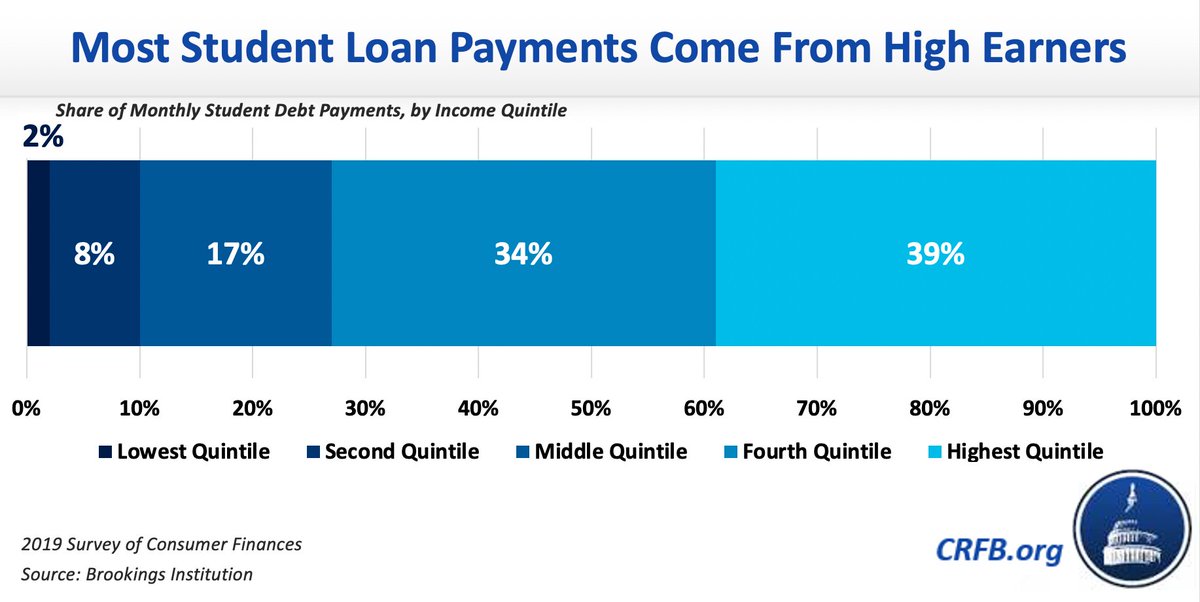

And almost three quarters of all loan repayments come from those in the highest two income quintiles.

Those most likely to spend the money, in the bottom 40 percent, make only 10% of all repayments!

6/

http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

Those most likely to spend the money, in the bottom 40 percent, make only 10% of all repayments!

6/

http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

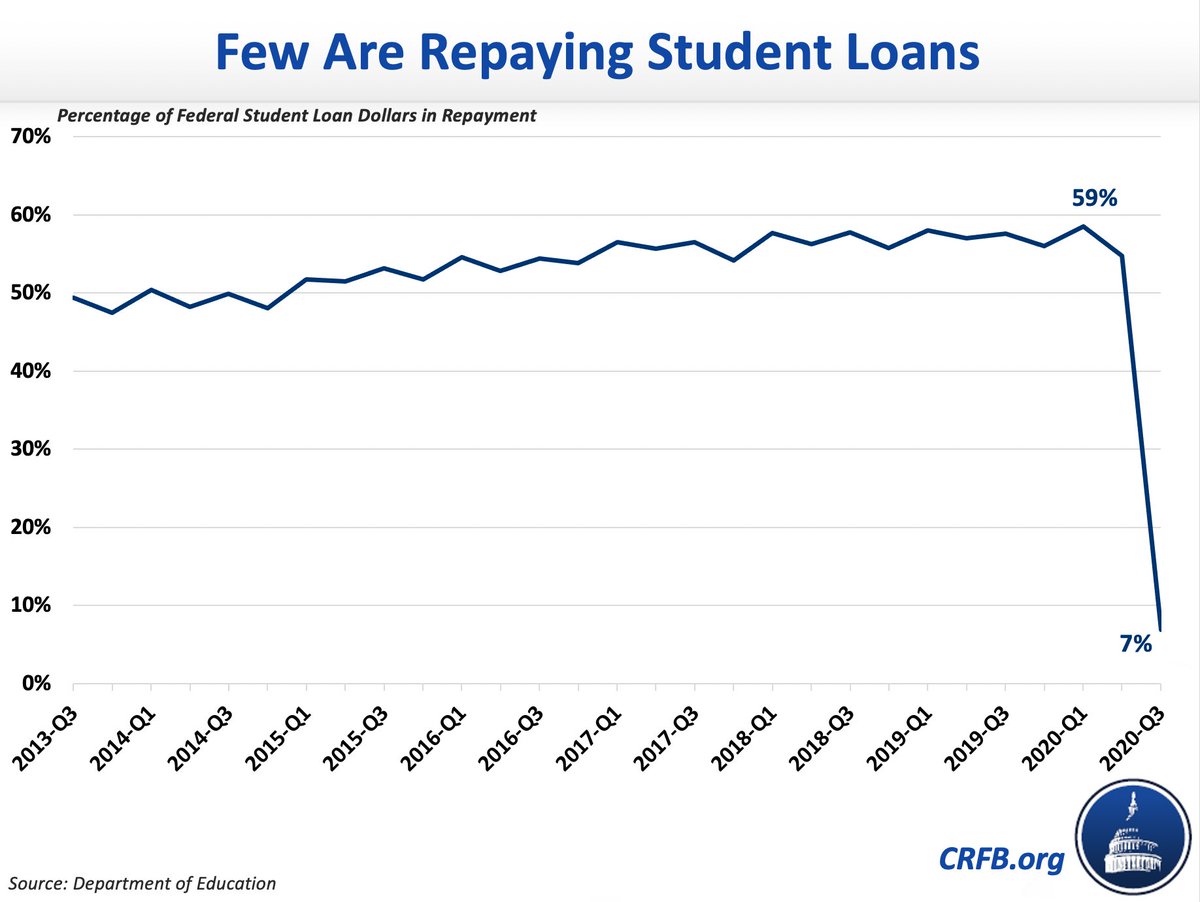

There's an easy alternative to debt cancellation that gets you most of the stimulus at a teeny tiny fraction of the cost.

Just continue the current deferral and interest cancellation through the pandemic!

Right now, no one is paying student loans anyway!

7/

Just continue the current deferral and interest cancellation through the pandemic!

Right now, no one is paying student loans anyway!

7/

The rest of this threat is the analytical twitter appendix where I explain the math.

A special shoutout to @alexdholt at @BudgetHawks who did the analysis.

Read the paper here: http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

APPENDIX TIME:

A special shoutout to @alexdholt at @BudgetHawks who did the analysis.

Read the paper here: http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

APPENDIX TIME:

Our low-end estimate finds cancelling student debt would have a multiplier of 0.08x.

This multiplier looks over 2 years, based on $90 billion per year of additional cash flow with a cash multiplier if 0.4x.

It adds a 3% "wealth effect".

That gets you $115 billion in GDP.

This multiplier looks over 2 years, based on $90 billion per year of additional cash flow with a cash multiplier if 0.4x.

It adds a 3% "wealth effect".

That gets you $115 billion in GDP.

Our high-end multiplier for debt cancellation is 0.23x. This is *very* generous. It assumes a cash-flow multiplier of 0.6x - as high as much more progressive rebate checks - and it looks over a 5 years period. It also assumes a wealth effect of 6%, very high for the literature.

Importantly, it's very possible the actual multiplier is closer to 0x. That's right, no net stimulus!

Why? Because debt relief might be taxable. @jasonfurman, who ran Obama's CEA, explains this well: https://twitter.com/jasonfurman/status/1328193936364539909?s=20

Why? Because debt relief might be taxable. @jasonfurman, who ran Obama's CEA, explains this well: https://twitter.com/jasonfurman/status/1328193936364539909?s=20

Partial loan cancellation (for example w a $10k or $50k cap) could have a higher multiplier than full forgiveness, since it would be less poorly targeted.

But it would also reduce repayments for fewer folks (such as those in income-based repayment).

We expect small improvement.

But it would also reduce repayments for fewer folks (such as those in income-based repayment).

We expect small improvement.

Read the full piece here, and reach out with any questions: http://www.crfb.org/blogs/canceling-student-loan-debt-poor-economic-stimulus

Read on Twitter

Read on Twitter