Few important points considering #Centralbanks . A thread.

"When central bank accrues a loss beyond its stream of net interest rate income (gross interest income minus expenses) and seigniorage, it starts to eat through its capital." 1/12

@GnSEconomics

"When central bank accrues a loss beyond its stream of net interest rate income (gross interest income minus expenses) and seigniorage, it starts to eat through its capital." 1/12

@GnSEconomics

"A central bank thus follows normal accounting practice.

But, because the central bank has a control over the monetary base, it can create demand for its liabilities (currency) by buying government securities and earn seigniorage." 2/

But, because the central bank has a control over the monetary base, it can create demand for its liabilities (currency) by buying government securities and earn seigniorage." 2/

"This is the crucial difference between a central bank and a commercial bank.

The central bank can claim to be solvent, based on its future income stream from seigniorage, even with negative net worth." 3/

The central bank can claim to be solvent, based on its future income stream from seigniorage, even with negative net worth." 3/

"If, alternatively, a central bank continues to operate with negative net worth and/or without acknowledging its losses, it will interfere with its own monetary management (the setting of interest rates) and eventually jeopardize its independence and credibility. " 4/

"What this means as well is that financial market participants cannot be sure whether a central bank is conducting monetary policy according to its mandate or in an effort to cover its losses." 5/

"When trust in a central bank is broken, it loses any control it has over the markets and, eventually, the economy.

A central bank operating with negative capital is also a sign that the economy is not doing well. Volatility increases and, eventually,..." 6/

A central bank operating with negative capital is also a sign that the economy is not doing well. Volatility increases and, eventually,..." 6/

"... panic is likely to take hold especially if the asset markets are over-valued.

For these reasons, all major modern central banks have rules in place concerning re-capitalization. However, recapitalization is a political decision, which has its own risks and limitations." 7/

For these reasons, all major modern central banks have rules in place concerning re-capitalization. However, recapitalization is a political decision, which has its own risks and limitations." 7/

"Recapitalization of a central bank cannot therefore be considered to be “automatic”, although cases where recapitalization is not undertaken probably require exceptional considerations, such as very large losses, public anger towards central banks, and..." 8/

"... the political consequences such resentment is likely to produce."

"People tend to forget that central banks, compared to the economy, are a fairly new invention. They assumed their current role as setters of interest rates only in the 1920s, and..." 9/

"People tend to forget that central banks, compared to the economy, are a fairly new invention. They assumed their current role as setters of interest rates only in the 1920s, and..." 9/

"...became the guardians of inflation in the 1980s.

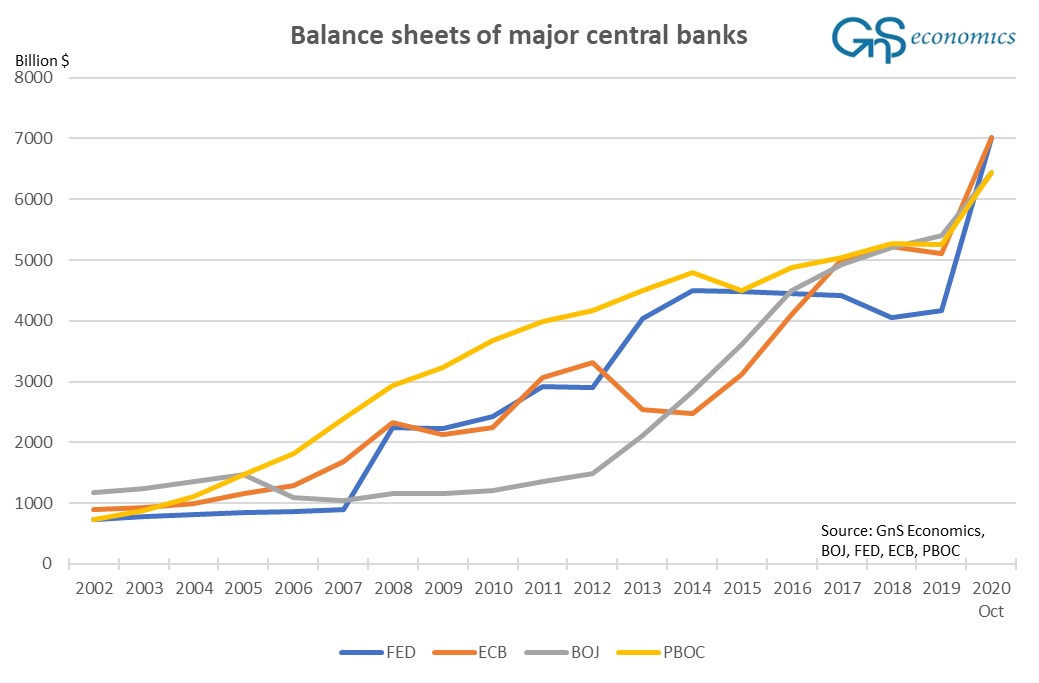

In the 2010s, they became the unwitting destroyers of the pricing mechanism in the capital markets. Their evolutionary path seems clear, and it is very detrimental to the overall economy." 10/

In the 2010s, they became the unwitting destroyers of the pricing mechanism in the capital markets. Their evolutionary path seems clear, and it is very detrimental to the overall economy." 10/

"That’s why we should not be surprised if central banks are not around after the coming crisis has passed.

Their pernicious asset buying-programs and negative rates have left them vulnerable to any larger shock, such as a crash in the asset markets." 11/ https://gnseconomics.com/2019/08/26/will-central-banks-survive/

Their pernicious asset buying-programs and negative rates have left them vulnerable to any larger shock, such as a crash in the asset markets." 11/ https://gnseconomics.com/2019/08/26/will-central-banks-survive/

Moreover, when people realize the destruction unleashed by the #Centralbanks on the economy and the livelihood of all of us, I consider their fate to be sealed.

They are the villains, not the heroes, in this tale.

/End

#ECB #Fed #ENDTHEFED https://gnseconomics.com/2020/10/08/the-destruction-of-the-world-economy-by-the-central-banks/

They are the villains, not the heroes, in this tale.

/End

#ECB #Fed #ENDTHEFED https://gnseconomics.com/2020/10/08/the-destruction-of-the-world-economy-by-the-central-banks/

Read on Twitter

Read on Twitter