No, This is Not Your 2017 #Bitcoin  …

…

Despite its latest surge, the total market value of $BTC still represents less than ~0.4% of global M2 money supply.

More thoughts & charts from my latest Delphi Daily below https://www.delphidigital.io/reports/no-this-is-not-your-2017-bitcoin/

https://www.delphidigital.io/reports/no-this-is-not-your-2017-bitcoin/

…

…Despite its latest surge, the total market value of $BTC still represents less than ~0.4% of global M2 money supply.

More thoughts & charts from my latest Delphi Daily below

https://www.delphidigital.io/reports/no-this-is-not-your-2017-bitcoin/

https://www.delphidigital.io/reports/no-this-is-not-your-2017-bitcoin/

3 weeks ago, I began one of my Daily notes with the following statement.

I wrote this just as $BTC broke above $13K in the face

of rising market volatility and a 40 print on the $VIX.

Fast forward 3 weeks and $BTC is now within striking distance of a new ATH in USD...

I wrote this just as $BTC broke above $13K in the face

of rising market volatility and a 40 print on the $VIX.

Fast forward 3 weeks and $BTC is now within striking distance of a new ATH in USD...

But a fresh high is just the start, which is why I wanted to put a little more context around bitcoin's latest move.

For starters, compared to its prior cycle, $BTC appears to be right on track; though imperfect, the similarities between

cycles is notable.

For starters, compared to its prior cycle, $BTC appears to be right on track; though imperfect, the similarities between

cycles is notable.

Additionally, $BTC's monthly RSI just broke above 70 for the first time since its late 2017 run up.

See my previous tweet for more context https://twitter.com/Kevin_Kelly_II/status/1328696558972440576?s=20

https://twitter.com/Kevin_Kelly_II/status/1328696558972440576?s=20

See my previous tweet for more context

https://twitter.com/Kevin_Kelly_II/status/1328696558972440576?s=20

https://twitter.com/Kevin_Kelly_II/status/1328696558972440576?s=20

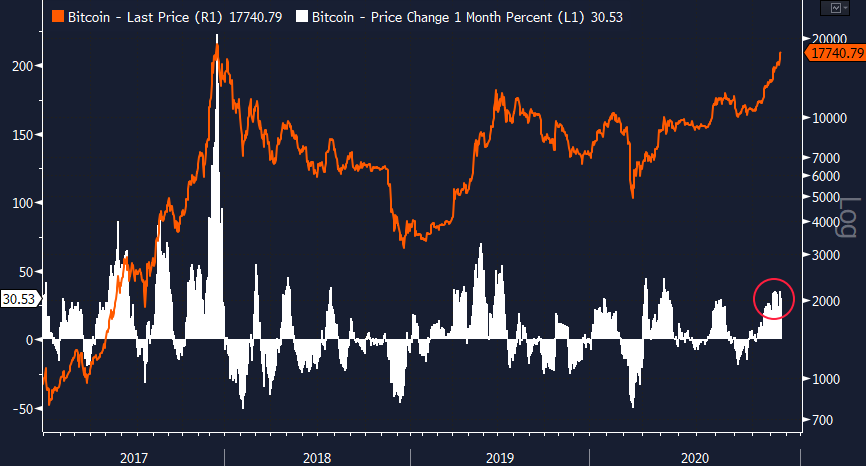

Despite its latest surge, the hype around BTC appears to be somewhat lackluster.

@GoogleTrends for “Bitcoin” both worldwide and in the US are nowhere close to 2017 levels. https://twitter.com/Kevin_Kelly_II/status/1328469147597074432?s=20

@GoogleTrends for “Bitcoin” both worldwide and in the US are nowhere close to 2017 levels. https://twitter.com/Kevin_Kelly_II/status/1328469147597074432?s=20

The speed of #bitcoin  ’s price move is also critical in ushering in new market participants.

’s price move is also critical in ushering in new market participants.

Many RIAs & FAs have cited $BTC's volatility as a key reason for their hesitancy.

Parabolic price moves can drive a “FOMO effect” but can also slow widespread adoption from this cohort.

’s price move is also critical in ushering in new market participants.

’s price move is also critical in ushering in new market participants.Many RIAs & FAs have cited $BTC's volatility as a key reason for their hesitancy.

Parabolic price moves can drive a “FOMO effect” but can also slow widespread adoption from this cohort.

Having said that, BTC’s returns over the last month appear somewhat mundane, at least relative to its own history.

During its late 2017 run, bitcoin surged more than 215% in the 30 trading days leading up to its peak; this past month’s move falls far short of such euphoria...

During its late 2017 run, bitcoin surged more than 215% in the 30 trading days leading up to its peak; this past month’s move falls far short of such euphoria...

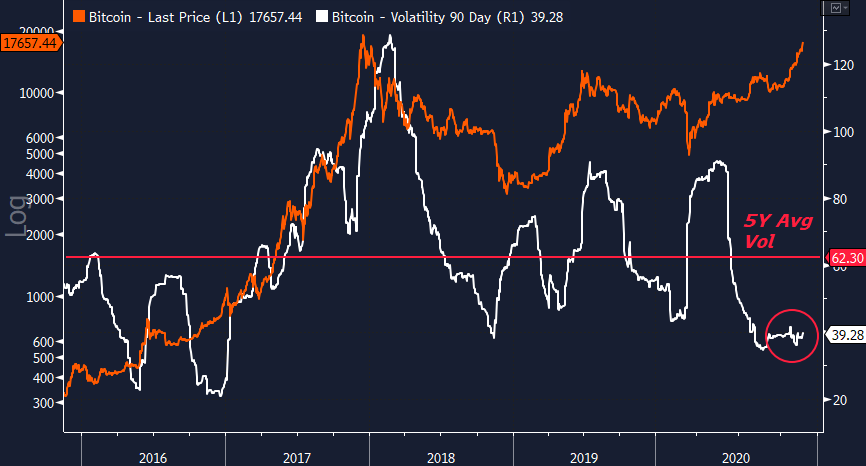

Similarly, despite trading within ~8% of its all-time closing high, BTC’s 90-day realized vol is near the low end of its 5-year average range.

Notably, $10+ trillion has been added to global M2 money

supply since the end of March.

$BTC has nearly tripled over the same period but its total market value still only represents ~0.4% of global M2.

supply since the end of March.

$BTC has nearly tripled over the same period but its total market value still only represents ~0.4% of global M2.

If our thesis proves to be correct, $BTC could replace a substantial portion of Treasury & sovereign debt in the average investor’s portfolio in the coming years, resulting in

immense capital flows for such a nascent asset.

immense capital flows for such a nascent asset.

And if $BTC closes out November anywhere near current levels, it will mark a new monthly closing high, surpassing its December 2017 close just above $14,000.

It's important to remember the road to the top is never linear; significant drawdowns are inevitable.

But make no mistake, this market is maturing.

#Bitcoin is garnering attention from the

is garnering attention from the

world’s top investors.

It’s permeating the inner circles of the world’s top

thinkers.

But make no mistake, this market is maturing.

#Bitcoin

is garnering attention from the

is garnering attention from theworld’s top investors.

It’s permeating the inner circles of the world’s top

thinkers.

And, critically, it is awakening an entire generation to the shortcomings of today’s financial system, amassing one of the strongest, most passionate communities on the planet in the process.

I don’t know about you, but that doesn’t sound like an asset I’d want to bet against…

I don’t know about you, but that doesn’t sound like an asset I’d want to bet against…

Read on Twitter

Read on Twitter