1/In 2020, peak demand for oil has become a hot topic. Estimates range from a peak in 2040s to the peak having already passed. But the Trillion $$ Energy Transition question is what happens after the peak, and that hinges on Decline Rates, so, a THREAD.

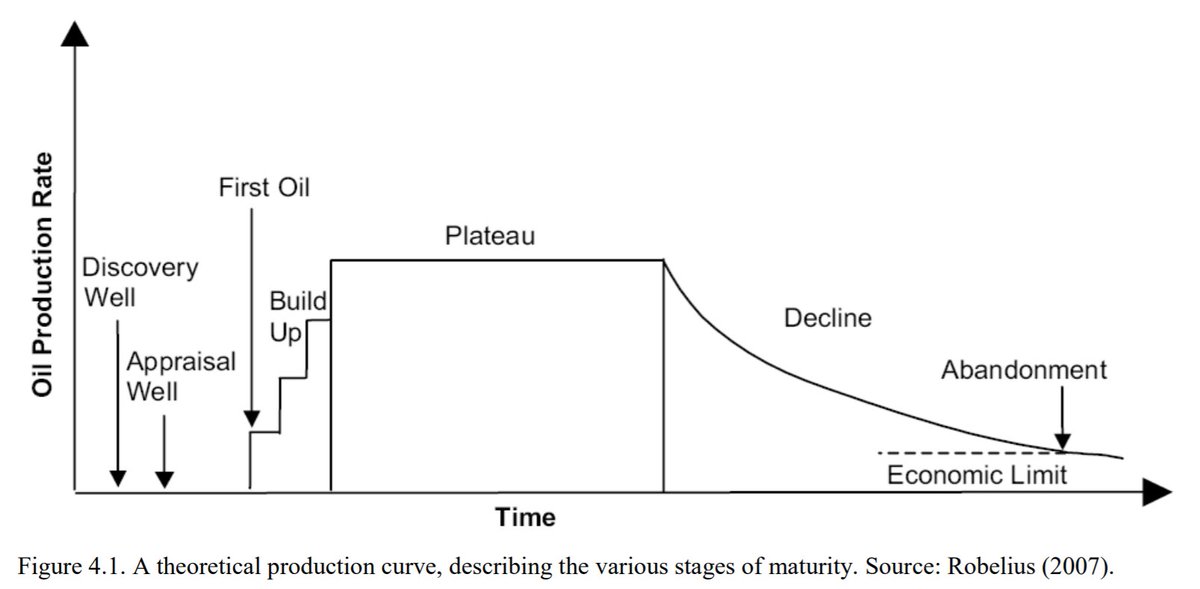

2/Every oilfield experiences decline. You can see a simplified diagram below. And the rate at which production falls off is referred to as the Decline Rate.

https://www.diva-portal.org/smash/get/diva2%3A338111/FULLTEXT01.pdfTh

https://www.diva-portal.org/smash/get/diva2%3A338111/FULLTEXT01.pdfTh

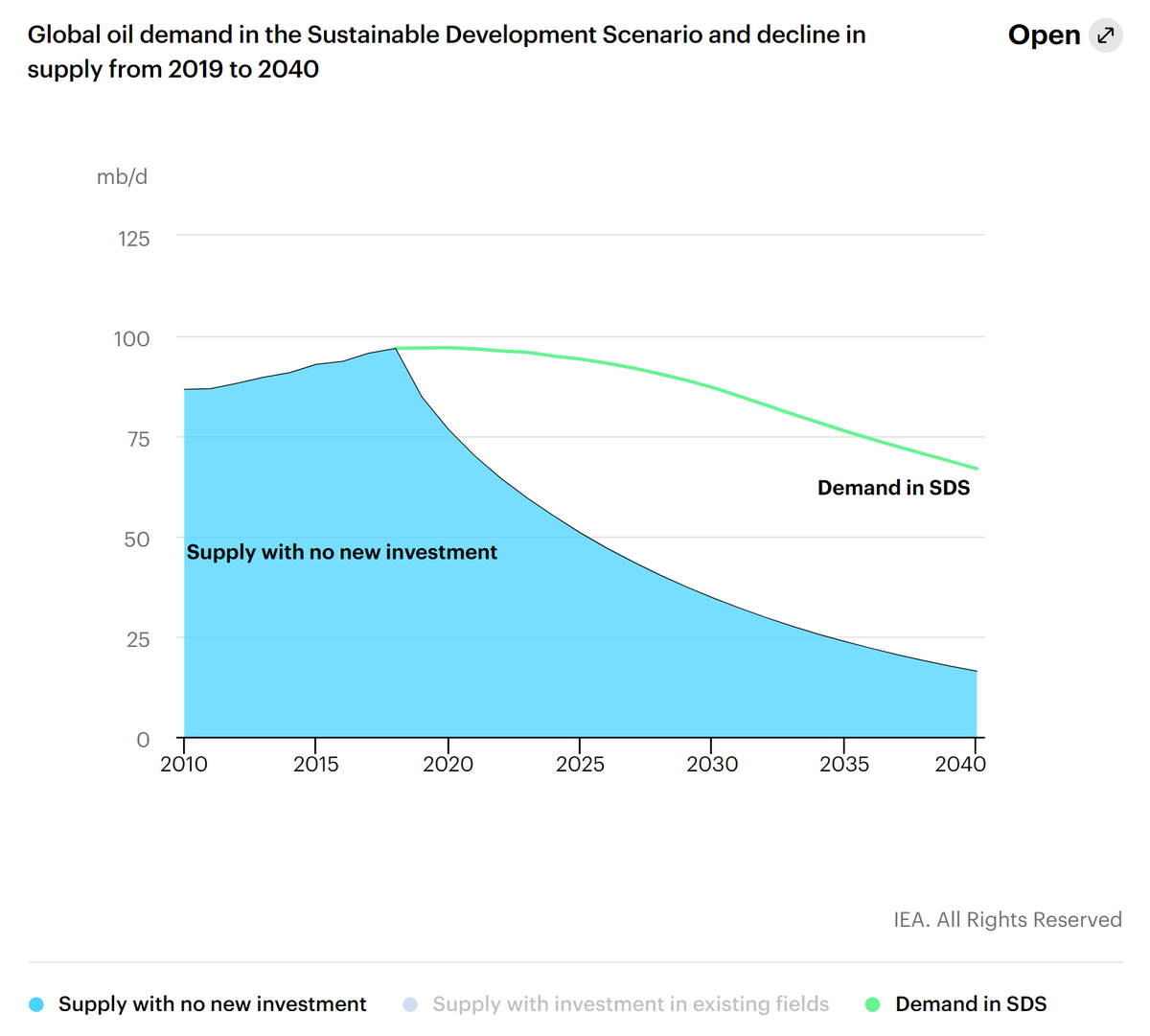

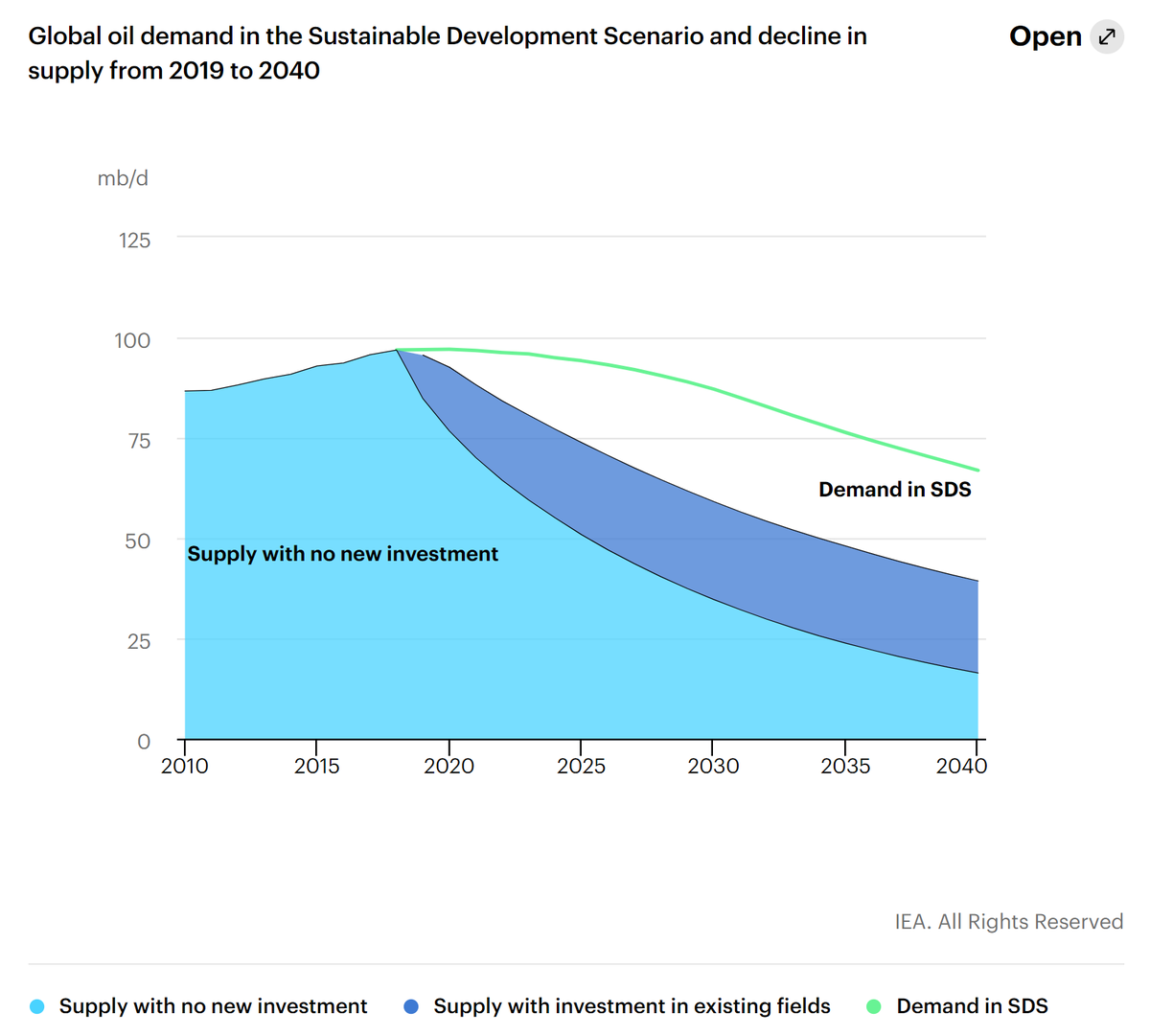

3/This means that even in scenarios where we have hit peak demand, like the IEA Sustainable Development Scenario, new oil investment is needed. This is one of the O&G industry’s key talking points.

https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions

https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions

4/And this is undoubtedly true! Without new investment, the shortfall would be very rapid and lead to great economic distress. But the rate of decline in demand and supply is subject to a host of assumptions, some of which might be way off. And that has trillion $$ implications.

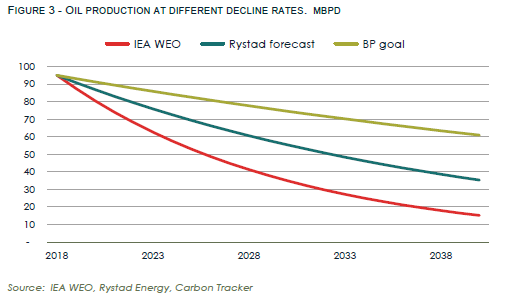

5/First off, let’s look at decline. IEA uses a number of 8%, but estimates are all over the map. Rystad thinks it’s closer to 4%. BP has stated a goal of 2%. Carbon Tracker has plotted what that looks like here, and it leads to wildly different outcomes.

https://carbontracker.org/reports/the-decline-rate-delusion/

https://carbontracker.org/reports/the-decline-rate-delusion/

6/Why such a divergence? Well it turns out forecasting decline rates isn’t that easy. Every field is different, technology changes, markets change. It’s a moving target. Aggregating to one global number can be a pretty subjective exercise.

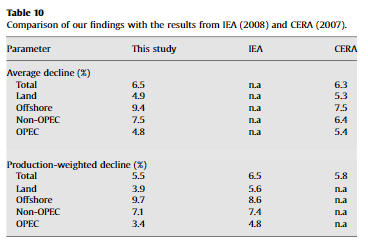

7/Take for example the impact on offshore/land or by operator from this study. The authors found Non-OPEC fields decline at 7.1% while OPEC fields decline at 3.4%. A huge difference.

https://reader.elsevier.com/reader/sd/pii/S0301421509001281?token=11EBA64B943B151764D81D8373F726ADD4E0590C618937B20C43FE8C7C737FEE4046BF6C23EB740466E839A633156741

https://reader.elsevier.com/reader/sd/pii/S0301421509001281?token=11EBA64B943B151764D81D8373F726ADD4E0590C618937B20C43FE8C7C737FEE4046BF6C23EB740466E839A633156741

8/So the type of oil production you assume makes a huge impact on the decline rate. I discussed in this THREAD why OPEC production might be a much bigger portion of production in the future. If so, that 8% number is likely way overstating actual decline. https://twitter.com/TimMLatimer/status/1315719825164054528?s=20

9/Furthermore, the type of investment needed to meet the gap will be a lot different. Increasing output at existing fields can yield output usually at lower cost and risk than new fields, so that will certainly be done. IEA looks at that here.

10/This BTW is the same reason WoodMac @ed_crooks found that banning new federal leases would have a minimal effect on GoM production this decade. There is just a lot more that can be done with existing fields. https://twitter.com/RobertClarke_WM/status/1325251438210117632?s=20

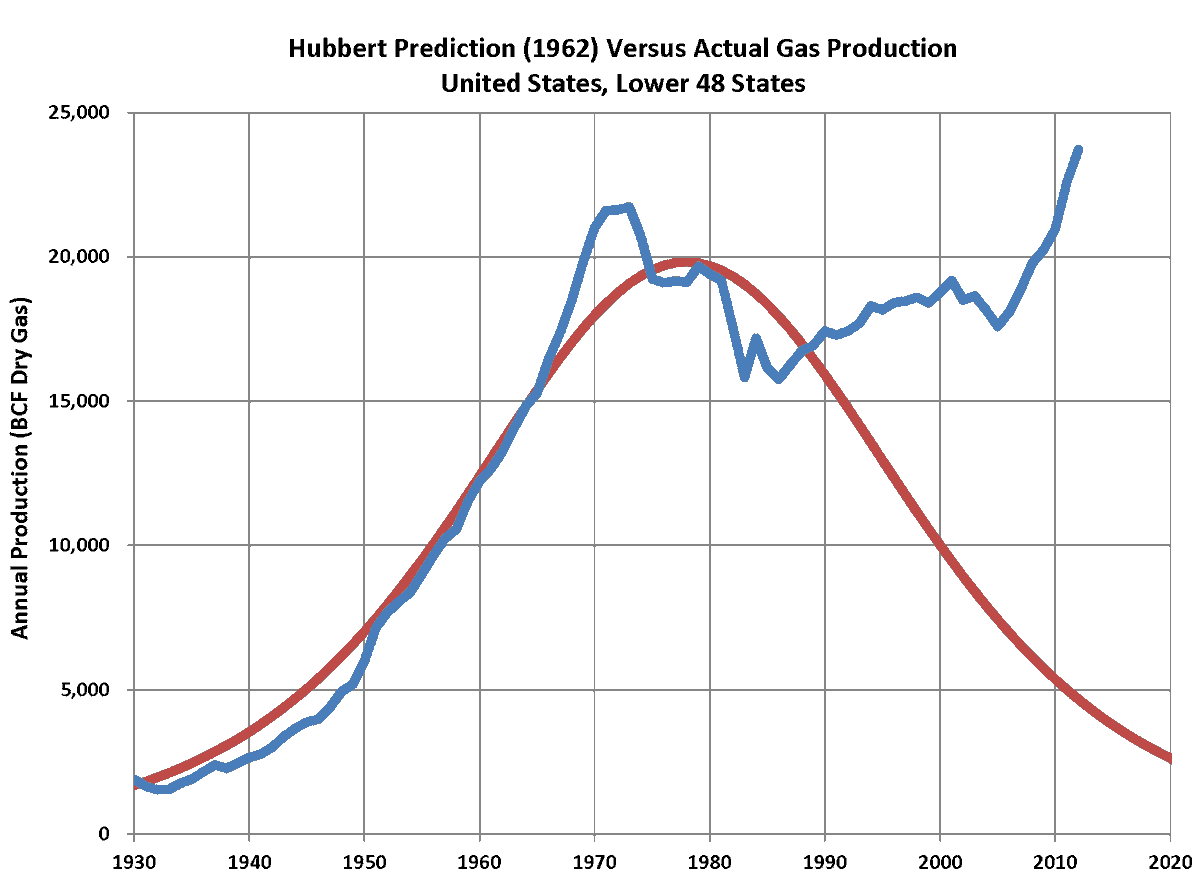

11/And finally O&G technology is improving all the time. So the amount that can be squeezed out of existing fields is probably higher than we forecast today. Forecasts of decline at any scale end up looking silly, like the original Hubbert Curve for the US.

12/So what are the implications if:

-Decline rates are overestimated.

-Existing fields have a lot more runway

-Technology might extend that further

Well, a lot of forecasts may be dramatically overestimating the required new investment in oil and gas in the transition.

-Decline rates are overestimated.

-Existing fields have a lot more runway

-Technology might extend that further

Well, a lot of forecasts may be dramatically overestimating the required new investment in oil and gas in the transition.

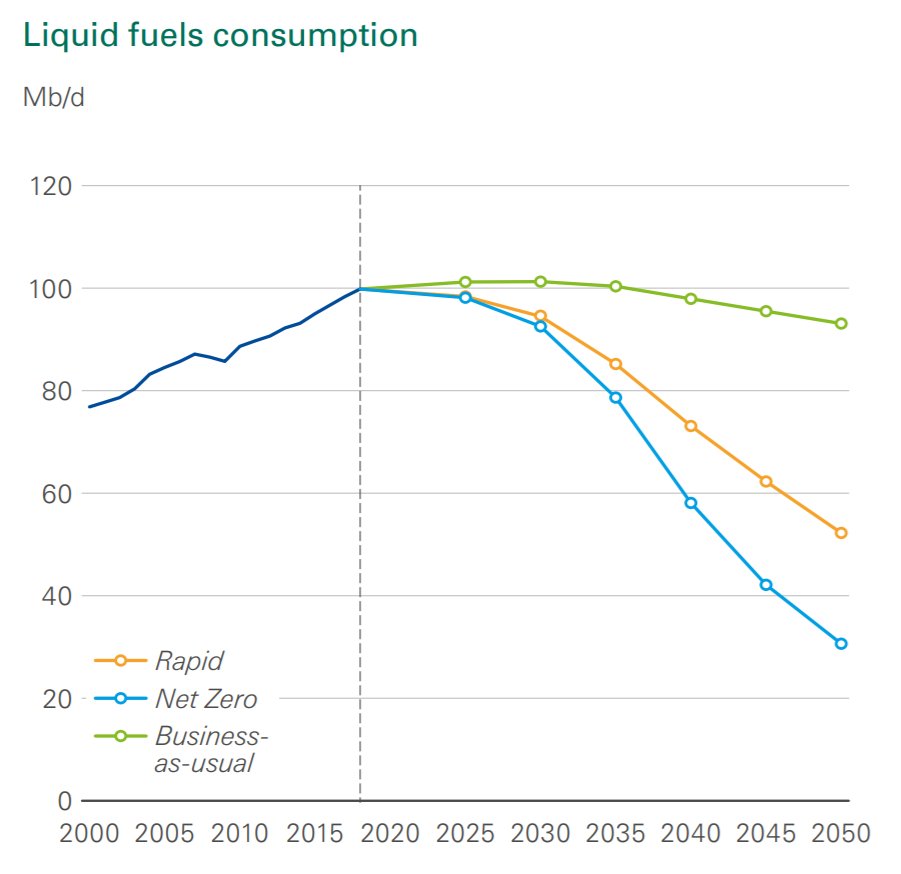

13/And the imbalance may be even more pronounced. The IEA SDS scenario is by no means an aggressive forecast. Just take a look at bp’s latest scenarios. Demand may fall a lot faster.

https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2020.pdf

https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2020.pdf

14/So a summary, the energy transition will necessarily bring about a peak demand for oil. New investment will certainly be required in O&G to offset decline, but there are a lot of indications that that decline is way overstated. END

PS/This doesn’t mean we will necessarily in a perma-bear low price environment. Getting supply/demand balance right in a world of declining demand will be just as tough. As @jasonbordoff points out here, price spikes are by no means a thing of the past. https://foreignpolicy.com/2020/10/05/climate-geopolitics-petrostates-russia-china/

Read on Twitter

Read on Twitter