I will be live tweeting the Public Accounts Committee meeting with the Revenue Commissioners today at 11.30am. https://twitter.com/williamhboney1/status/1329373570192072712

B4 the Public Accounts Committee kicks off, a reminder of what this is all about. The Department of Social Welfare, the Revenue Commissioners & the Social Welfare Appeals Office are all using unlawful group/class decisions to label workers as self-employed https://tortoiseshack.ie/breaking-bogus-self-employment/

Brexit negotiations first. This ground was covered in the Finance Committee earlier this year by @paulmurphy_TD

Correction 24th January 2019.

Each member is limited to about 5 minutes of questions.

Matt Carthy on bogus self employment. Asks Revenue for an estimate of what bogus self employment costs.

Revenue have no figures.

Revenue have no figures.

Committee on Bogus Self Employment told last year that construction alone represented a loss of 240,000 million per year to the exchequer.

Intermediary type arrangements (Payroll companies, Employment Agencies, personal service companies)

This is the big growth area in bogus self employment. Traditionally bogus self-employment has been concentrated in self-employed persons with no employees, this model is changing.

This is the big growth area in bogus self employment. Traditionally bogus self-employment has been concentrated in self-employed persons with no employees, this model is changing.

The following clip is questioning of the Revenue by Paul Murphy about these intermediary structures -

Revenue argues that there is no legislation which allows them to look into these arrangements.

Matt Carthy raises the 'Test Case', Revenue claims not to know. I'll post a letter form the Revenue Chairperson acknowledging the use of the test case anon.

Revenue say they have no authority in the area of intermediaries. Revenue could dismiss intermediary structures as 'Tax Avoidance Smokescreens' as has happened in the UK with HM Revenue & Customs.

Revenue mentions the eRCT contract used in Revenue which allows the employer >

Revenue mentions the eRCT contract used in Revenue which allows the employer >

designate employment status of the worker without any input from the worker. Ireland is the only country in the EU which allows employers designate employment status of workers.

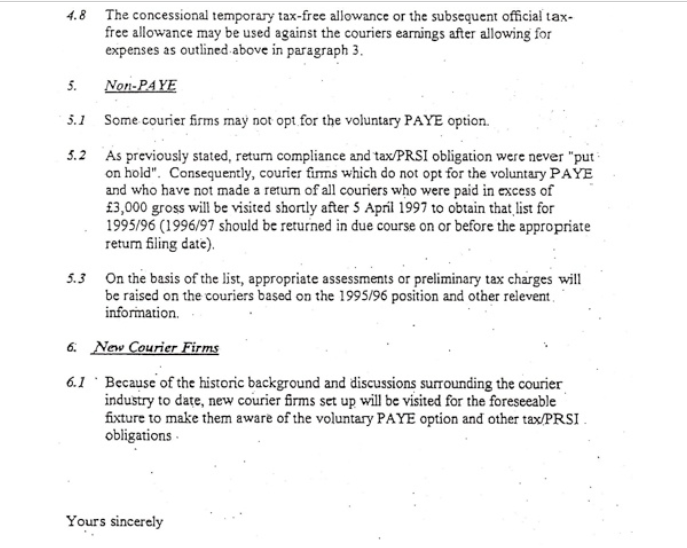

That letter from the Chairman of the Revenue Commissioner to the Chairman of the Public Accounts Committee acknowledging the use of a 'Test Case'. This is the 'Test Case' which Revenue just said they don't know about @mattcarthy

Chairperson - Revenue collect PRSI, SW decide status. Chairman refers to ad hoc arrangements.

PAC wrote to revenue in 2000, asking for reasons why all couriers are self employed. Revenue replied with a bespoke 'Special Tax Agreement' between courier employers and Revenue.

PAC wrote to revenue in 2000, asking for reasons why all couriers are self employed. Revenue replied with a bespoke 'Special Tax Agreement' between courier employers and Revenue.

In 1998 a special program of 6,200 visits to principal contractors in the construction industry. During the visits, the status of 63,000 sub-contract situations was examined and 12,000 were reclassified as employees.

Because concern was expressed at the Public Accounts Committee in 2000 that misclassification could still be rife, a similar campaign was commenced in the second half of the year.

Chairperson asks how many investigations now, 20 years on. Total just over 1,600. A fraction of

Chairperson asks how many investigations now, 20 years on. Total just over 1,600. A fraction of

the numbers 20 years ago.

Fact -

Fact: In 1998 & 2000, because of concerns expressed by PAC and the C&AG,that bogus self employment may be 'rife' in construction. circa 120,000 subcontract situations were investigated by Revenue, approx 20% were found to be bogus self employed.

Fact -

Fact: In 1998 & 2000, because of concerns expressed by PAC and the C&AG,that bogus self employment may be 'rife' in construction. circa 120,000 subcontract situations were investigated by Revenue, approx 20% were found to be bogus self employed.

20 years later in the Social Welfare Committee examining Bogus Self-employment, General Secretary of ICTU, Patrica King, gave evidence that her extensive analysis identified bogus self employment in the construction sector at circa 22%

with a potential loss to the exchequer of 240 million euro in taxes and PRSI every year.

Since 2000, Revenue have known that bogus self employment in the construction sector is running between 20% & 23%. The potential loss to the exchequer in PRSI and taxes is in excess of 5 billion euro. Why hasn't Revenue acted to address this massive potential loss over 20 yrs

Couriers- a bespoke 'Special Tax Arrangement' agreed between the Revenue Commissioners and an accountancy co. which represented Courier Companies in protracted negotiations which spanned at several years. Courier companies lobbied Revenue to classify all couriers as self-employed

Correction 'Second half of 2000' not 'This year'. https://twitter.com/williamhboney1/status/1329407393969672194

Matt Carthy - Raises correspondence sent to committee in 2000. Refers to Special Tax Agreement and negotiations between Revenue and representatives of Courier employers. Revenue previously stated this was unknown at present.

Matt Carthy - Bogus Self Employment is an attack on the Social Contract.

Chairperson on bogus self employment refers to employers PRSI being low in EU terms, appears there is no effective legislation.

Revenue - the use of corporate structures there is no legal basis to look through the corporate structures. (Intermediary structures)

Lacuna in law.

Revenue - the use of corporate structures there is no legal basis to look through the corporate structures. (Intermediary structures)

Lacuna in law.

Recap - On 'Intermediary' type structures, there is a lacuna in the legislation which does not allow Revenue to look through these structures for bogus self employment. This is the biggest growth area in bogus self employment.

>

>

Between 2000 & 2020, it is estimated that bogus self employment in the construction sector has cost the exchequer between 4 & 5 billion. Revenue firmly point the finger at the Department of Social Welfare.

>

>

The Revenue spokesperson was asked about a 'Special Tax Agreement' between Revenue and Courier employer's representatives.

Revenue spokesperson claims not to know anything about it.

Deputy Carthy later supplies the reference number and extensive details of a bespoke tax >

Revenue spokesperson claims not to know anything about it.

Deputy Carthy later supplies the reference number and extensive details of a bespoke tax >

agreement sent in a letter from the Chairman of the Revenue Commissioners to the PAC in 2000.

Revenue are to refer back in writing to the PAC about this special tax agreement.

Test Case - Revenue spokesperson denies knowledge of test cases, existence of a test case is contained

Revenue are to refer back in writing to the PAC about this special tax agreement.

Test Case - Revenue spokesperson denies knowledge of test cases, existence of a test case is contained

in the letter from Revenue Chairperson to PAC Chairperson in 2000.

Revenue to respond in writing.

Chairperson raised (also Deputy Carthy) the issue of employer representatives lobbing the Revenue in relation to worker employment status. Again the Revenue spokesperson had

Revenue to respond in writing.

Chairperson raised (also Deputy Carthy) the issue of employer representatives lobbing the Revenue in relation to worker employment status. Again the Revenue spokesperson had

no knowledge of this and is to respond in writing.

Good questioning from the Chair and Deputies, poor replies from Revenue. Interesting written replies expected.

That's it, thank you for watching.

Good questioning from the Chair and Deputies, poor replies from Revenue. Interesting written replies expected.

That's it, thank you for watching.

Read on Twitter

Read on Twitter