Time and again we do mistakes and learn from them. This particular trade goes in my bucket of anti-Portfolio. Here is how I missed taking a trade on Prince Pipes Fittings #PRINCEPIPE, which went from 113 at the time of consideration to above 250 currently, without me.

Situation at the time of appearance in Watchlist:

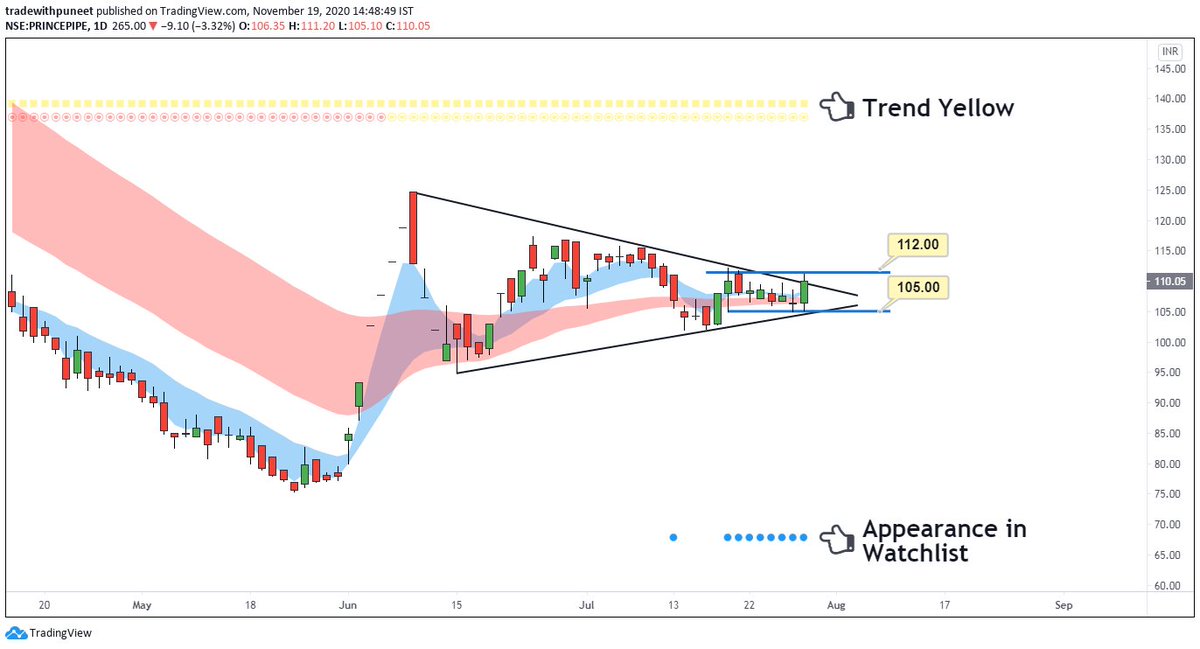

- Appeared in July end with good compression (high no. of blue dots)

- Didn't have much trading history, so Weekly Trend was Yellow

- Daily Trend had turned from Red to Yellow - indicating probable change in trend, a positive sign

- Appeared in July end with good compression (high no. of blue dots)

- Didn't have much trading history, so Weekly Trend was Yellow

- Daily Trend had turned from Red to Yellow - indicating probable change in trend, a positive sign

How I should have taken the trade:

- Ideally, my entry should have been on 30th July above Rs. 112, with Stop Loss below Rs. 105.

- However, the June quarter results were due the next day on 31st July, and I thought of avoiding high volatility.

- Ideally, my entry should have been on 30th July above Rs. 112, with Stop Loss below Rs. 105.

- However, the June quarter results were due the next day on 31st July, and I thought of avoiding high volatility.

Reasons for not taking the trade:

- Next day, Company announced 19% fall in Revenue & 57% fall in Profit.

- Poor results + ongoing COVID lockdown at that time turned me negative.

- The negative aura around was my primary reason for not taking the trade.

- Next day, Company announced 19% fall in Revenue & 57% fall in Profit.

- Poor results + ongoing COVID lockdown at that time turned me negative.

- The negative aura around was my primary reason for not taking the trade.

Read on Twitter

Read on Twitter