The New Help to Buy Scheme is Here

The New Help to Buy Scheme is Here

This new revised scheme will run from 2021 to 2023 allowing first time buyers to reserve their new build property as early as mid December 2020

Find out all the details below and RT for awareness

The Help to Buy Scheme has been somewhat successful so far allowing roughly 250,000 first time buyers to buy their first home

So it’s no wonder they are building on this especially at a time where first time buyers are finding it particularly difficult to save a large deposit

So it’s no wonder they are building on this especially at a time where first time buyers are finding it particularly difficult to save a large deposit

WHO IS ELIGIBLE?

The NEW help to buy scheme is ONLY eligible for first time buyers, no one on the application is allowed to have owned and land or property or had any form of sharia mortgage finance

You'll actually need to sign a declaration to state this is your first purchase

The NEW help to buy scheme is ONLY eligible for first time buyers, no one on the application is allowed to have owned and land or property or had any form of sharia mortgage finance

You'll actually need to sign a declaration to state this is your first purchase

HOW DOES IT WORK?

Similar to the original Help To Buy scheme it allows buyers to

- Put down a deposit as low as 5%

- Obtain a government loan up to 20% (up to 40% in London)

- Arrange a mortgage for the remaining amount

See this example of a £300k purchase for clarity

Similar to the original Help To Buy scheme it allows buyers to

- Put down a deposit as low as 5%

- Obtain a government loan up to 20% (up to 40% in London)

- Arrange a mortgage for the remaining amount

See this example of a £300k purchase for clarity

WHATS NEW?

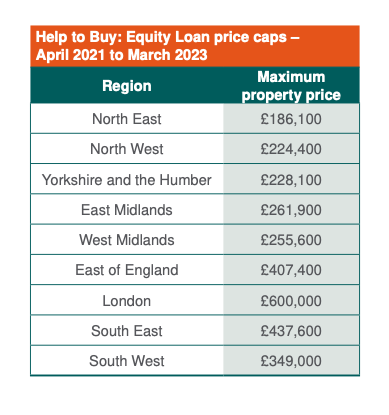

There are regional price limits set at 1.5 times the average first-time buyer price in each region in England. This is intended to manage the over inflated price tags new properties normally come with keeping prices in line with current averages

There are regional price limits set at 1.5 times the average first-time buyer price in each region in England. This is intended to manage the over inflated price tags new properties normally come with keeping prices in line with current averages

The equity loan itself can be worth as much as £240k but its important to know how it works

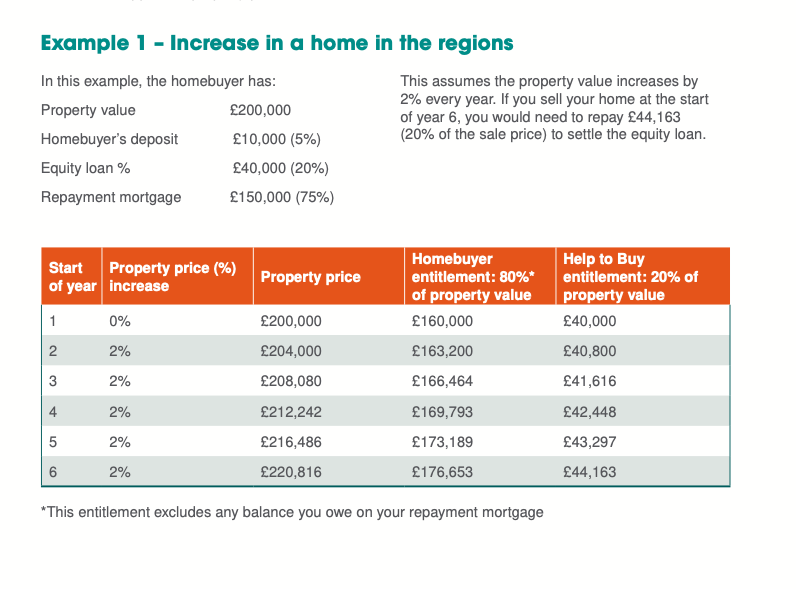

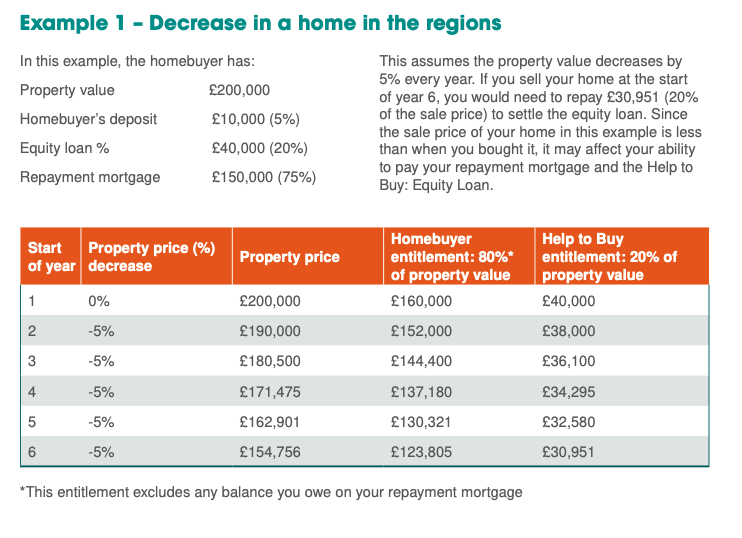

The use of an EQUITY loan means that the amount you repay can differ - the table below gives examples of how the amount you repay can change if your home increases or decreases in value

The use of an EQUITY loan means that the amount you repay can differ - the table below gives examples of how the amount you repay can change if your home increases or decreases in value

Repaying your equity loan

- for the first 5 years there is no interest payable

- from year 6 there is an interest rate of 1.75% on the loan

- this interest rate will rise each year with CPI, plus 2% (previously RPI plus 1%)

- can be paid in full or in part at any time

- for the first 5 years there is no interest payable

- from year 6 there is an interest rate of 1.75% on the loan

- this interest rate will rise each year with CPI, plus 2% (previously RPI plus 1%)

- can be paid in full or in part at any time

RESTRICTIONS

As expected, you cannot let out or sublet the property without seeking consent first

You also cannot make any structural alterations without seeking consent first, structural alterations such as an extension would be breaking these rules

As expected, you cannot let out or sublet the property without seeking consent first

You also cannot make any structural alterations without seeking consent first, structural alterations such as an extension would be breaking these rules

SUMMARY OF CHANGES

So what are the main differences between the old and the new help to buy scheme

- The new scheme is for first time buyers ONLY

- It also includes regional price caps

- Interest will increase annually by CPI plus 2% rather than RPI plus 1% previously

So what are the main differences between the old and the new help to buy scheme

- The new scheme is for first time buyers ONLY

- It also includes regional price caps

- Interest will increase annually by CPI plus 2% rather than RPI plus 1% previously

THINGS TO CONSIDER

When you use the Help to Buy Equity Loan you will now have TWO LOANS

A mortgage and an equity loan from the government - it is very important to consider this before and during the term of the loans as this will need to be affordable

When you use the Help to Buy Equity Loan you will now have TWO LOANS

A mortgage and an equity loan from the government - it is very important to consider this before and during the term of the loans as this will need to be affordable

THINGS TO CONSIDER

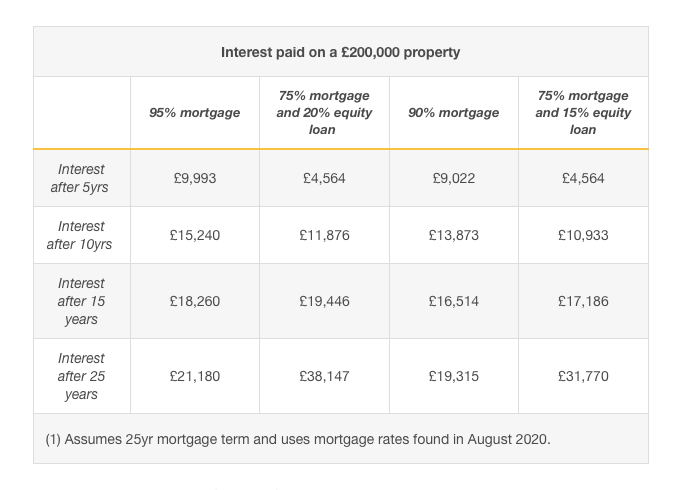

The below table considers interest paid on two standard mortgages and two equity loans

As you can see for the first 5 years the equity loan is a lot cheaper then becomes a lot more expensive as the interest increases

Source: Moneysavingexpert

The below table considers interest paid on two standard mortgages and two equity loans

As you can see for the first 5 years the equity loan is a lot cheaper then becomes a lot more expensive as the interest increases

Source: Moneysavingexpert

THINGS TO CONSIDER

The Help To Buy scheme has had a bad reputation in the past for a number of reasons such as

- Overpriced homes

- Poorly built homes

They have tried to combat this with the new regional price cap and a New Homes Ombudsman launching next year

The Help To Buy scheme has had a bad reputation in the past for a number of reasons such as

- Overpriced homes

- Poorly built homes

They have tried to combat this with the new regional price cap and a New Homes Ombudsman launching next year

THINGS TO CONSIDER

Do be weary of overpriced properties and ensure you check local sold house prices to ensure you are not paying too much

Also, where concerned about poorly built homes pick a reputable homebuilder, check reviews and if needs be hire a snagger to have a look

Do be weary of overpriced properties and ensure you check local sold house prices to ensure you are not paying too much

Also, where concerned about poorly built homes pick a reputable homebuilder, check reviews and if needs be hire a snagger to have a look

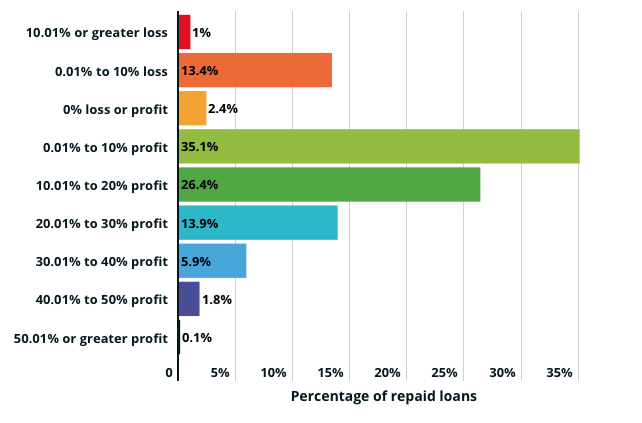

A report done by Which? studied the amount of homebuyers with repaid equity loans. It studies those who have made a profit and those who have made losses on their help to buy equity loans

The full article can be found here and is WELL WORTH A READ if you are considering HTB

The full article can be found here and is WELL WORTH A READ if you are considering HTB

I personally, am neither for or against the Help To Buy scheme - how can I be, everyones scenario is unique

As always I am a firm believer of people finding out all the information to see what works for them - everyones scenario is different

As always I am a firm believer of people finding out all the information to see what works for them - everyones scenario is different

There are a lot of talking points so feel free to share below

Are you for or against Help To Buy?

Have you used the Help To Buy scheme yourself?

Will the regional price cap actually work?

How will this affect the wider market?

Leave comments below and share

Are you for or against Help To Buy?

Have you used the Help To Buy scheme yourself?

Will the regional price cap actually work?

How will this affect the wider market?

Leave comments below and share

Read on Twitter

Read on Twitter