Affidavit- Jack Blaine of Sequoia, concerning their dealings with Smartmatic of Venezuela. This outlines how Smartmatic "divested" due to US law and their continued dealings with US businesses. SVS was created as a holding co just for this.

Killer docs!

http://gofile.io/d/q4JCRH

Killer docs!

http://gofile.io/d/q4JCRH

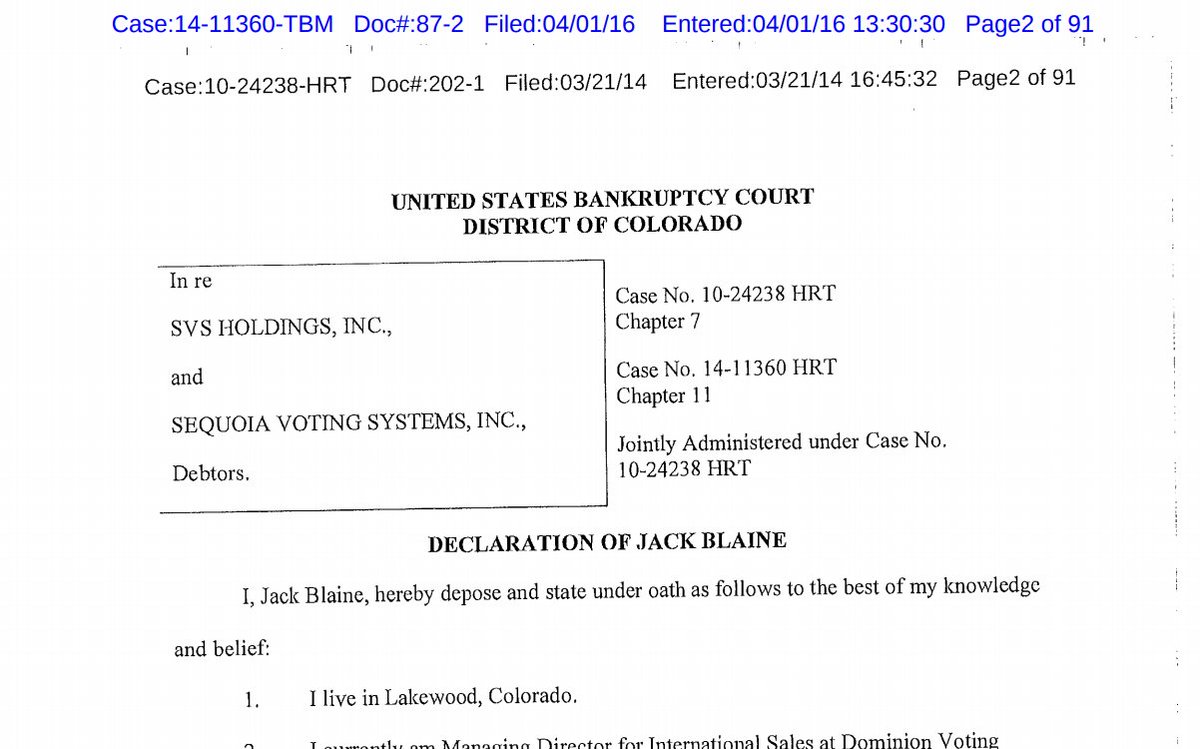

Jack Blaine Affidavit

-Managing Dir for International Sales at Dominion

-Formerly Sequoia Chief Executive Officer and dir

-Chief Executive Officer and a dir of SVS Holdings

-Former employee Smartmatic USA (External title was "President", tho not a formal corporate officer)

-Managing Dir for International Sales at Dominion

-Formerly Sequoia Chief Executive Officer and dir

-Chief Executive Officer and a dir of SVS Holdings

-Former employee Smartmatic USA (External title was "President", tho not a formal corporate officer)

-In 2005, assisted Smartmatic in purchasing Sequoia

-After Smartmatic's purchase of Sequoia, Jack Blaine was appointed President of Sequoia (for external purposes, although was not a corporate officer)

-After Smartmatic's purchase of Sequoia, Jack Blaine was appointed President of Sequoia (for external purposes, although was not a corporate officer)

- 18 months after the Smartmatie acquisition of Sequoia, the Committee on Foreign Investments in the United States ("CFTUS") began investigating the ownership of Sequoia by Smartmatic

- Smartmatic entered into a written agreement with the US gov to sell Sequoia within six months.

- Smartmatic entered into a written agreement with the US gov to sell Sequoia within six months.

-Smartmatic encouraged Sequoia's management team to purchase Sequoia

-Antonio Mugica, who controlled Smartmatic, indicated to Sequoia management that Smartmatic would sell Sequoia to us without an upfront cash payment,

-Antonio Mugica, who controlled Smartmatic, indicated to Sequoia management that Smartmatic would sell Sequoia to us without an upfront cash payment,

-Smartmatic and its lawyers and our lawyers encouraged Sequoia management to organize SVS as a holding

co that would purchase and own all of Sequoia's stock

- SVS did not exist until Smartmatic contemplated selling Sequoia to Sequoia's then-management,

co that would purchase and own all of Sequoia's stock

- SVS did not exist until Smartmatic contemplated selling Sequoia to Sequoia's then-management,

-SVS was created specifically for the purpose of that transaction

- September 2007, Smartmatic entered into a Stock Purchase Agreement between and among SVS, Sequoia and various members of Sequoia management,

- September 2007, Smartmatic entered into a Stock Purchase Agreement between and among SVS, Sequoia and various members of Sequoia management,

- Pursuant to the Stock Purchase Agreement, Smartmatic sold Sequoia to SVS for an unsecured promissory note issued and payable by SVS to Smartmatic and various contingent payments

-

-

- SVS, which had no significant cash or other liquid asses, paid nothing upfront for the stock in Sequoia. Sequoia was not a signatory to or obligated to pay the note issued by SVS to Sequoia, and did not guarantee SVS's obligations under the note.

- At or about the time of the Stocic Purchase Agreement, one Smartmatie affiliate entered into a Distribution Agreement with Sequoia and another Smartmatic affiliate entered into a Services Agreement with SVS,

-2008 SVS entered into a note Purchase Agreement whereby SVS agreed to purchase the promissory note from Smartmatic.

-SVS, as a holding company, had essentially only one significant asset —its stock

-SVS, as a holding company, had essentially only one significant asset —its stock

- Initially SV S also had essentially only one significant creditor --- Smartmatic —whose primary claim vas under an unsecured promissory note that only SVS, and not Sequoia, executed, and in respect of which Sequoia was not an obligor or guarantor,

-The only co other than Sequoia with which SVS had any significant involvement was Smartmatic,

-Sequoia, creditors, many of which pre-dated SVS's ownership of Sequoia, understood they were dealing with Sequoia, the operating co; there was virtually no discussion about SVS. ETC.

-Sequoia, creditors, many of which pre-dated SVS's ownership of Sequoia, understood they were dealing with Sequoia, the operating co; there was virtually no discussion about SVS. ETC.

Please read the documents for tons more insight! Attorneys, please examine to see just what we have here! These documents are also available on Pacer etc

US Bankruptcy Court

District of Colorado (Denver)

Bankruptcy Petition #: 10-24238-TBM

Next will be a statement by Dominion

US Bankruptcy Court

District of Colorado (Denver)

Bankruptcy Petition #: 10-24238-TBM

Next will be a statement by Dominion

Read on Twitter

Read on Twitter