This rise in popularity for crypto caused govt to pay closer attention to crypto

Recently the IRS released new #crypto tax guidance & sent thousands of warning letters to noncompliant #crypto investors

The question everyone is asking: How is #cryptocurrency taxed?

THREAD 1/25

Recently the IRS released new #crypto tax guidance & sent thousands of warning letters to noncompliant #crypto investors

The question everyone is asking: How is #cryptocurrency taxed?

THREAD 1/25

According to official IRS guidance, #Bitcoin  and other cryptocurrencies should be treated as property for tax purposes NOT as currency

and other cryptocurrencies should be treated as property for tax purposes NOT as currency

This means that #crypto must be treated like owning other forms of property such as stocks, gold, or real-estate.

2/25

and other cryptocurrencies should be treated as property for tax purposes NOT as currency

and other cryptocurrencies should be treated as property for tax purposes NOT as currencyThis means that #crypto must be treated like owning other forms of property such as stocks, gold, or real-estate.

2/25

Just like you would with trading stocks, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. Failing to do so is considered tax FRAUD in the eyes of the IRS.

3/25

3/25

How Do You Calculate Your #Crypto Capital Gains/ Capital Losses?

Calculating capital gains & losses for your #Crypto trades is straightforward. However before doing the calculations, you need to understand TAXABLE EVENTS.

4/25

Calculating capital gains & losses for your #Crypto trades is straightforward. However before doing the calculations, you need to understand TAXABLE EVENTS.

4/25

A taxable event is an action that triggers a tax reporting liability. Whenever one of these taxable events happens, you trigger a capital gain or loss that needs to be reported. If any of the scenarios in the next thread apply to you, you have a tax reporting requirement

5/25

5/25

1. Trading #crypto to fiat

2. Trading #crypto to #crypto

3. Using #cryptocurrency for goods and services

4. Earning #cryptocurrency as income (mining, interest, etc)

6/25

2. Trading #crypto to #crypto

3. Using #cryptocurrency for goods and services

4. Earning #cryptocurrency as income (mining, interest, etc)

6/25

What is Not Considered a Taxable Event?

1. gifting #crypto

2. A transfer (transfer #crypto between exchanges or wallets without realizing capital gains and losses)

3. Buying cryptocurrency with USD (you dont realize gains until you trade, use, or sell your #crypto)

7/25

1. gifting #crypto

2. A transfer (transfer #crypto between exchanges or wallets without realizing capital gains and losses)

3. Buying cryptocurrency with USD (you dont realize gains until you trade, use, or sell your #crypto)

7/25

Determine Your Cost Basis

Now that it is clear when you must report your crypto transactions, it’s important to understand the exact process behind doing so.

The first step is to determine the COST BASIS of your holdings.

8/25

Now that it is clear when you must report your crypto transactions, it’s important to understand the exact process behind doing so.

The first step is to determine the COST BASIS of your holdings.

8/25

cost basis is how much money you put into purchasing your crypto. it includes the purchase price + all other costs associated with the purchase. (Other costs like transaction fees)

So to calculate your cost basis you would do the following:

9/25

So to calculate your cost basis you would do the following:

9/25

(Purchase Price of Crypto + Other fees) / Quantity of Holding = Cost Basis

10/25

10/25

EX: you invested $500 in $LTC back in Nov of 2017, that would have bought you about 5.1 Litecoin. Let’s say you also paid Coinbase a 1.49% transaction fee on the purchase. Your cost basis would be calculated:

($500.00 + 1.49%*500)/5.1 = $99.50 per $LTC

11/25

($500.00 + 1.49%*500)/5.1 = $99.50 per $LTC

11/25

The second step in determining your capital gain/loss is to subtract your cost basis from the sale price of your crypto. Sale price is also often referred to as the Fair Market Value. The equation below shows your capital gain/loss

FMV - Cost Basis = Capital Gain/Loss

12/25

FMV - Cost Basis = Capital Gain/Loss

12/25

As an example, let’s say you sold exactly one #Litecoin a month later because the price had doubled to $200 per coin. This would be considered a taxable event and you would calculate the gain as follows

200–99.50 = $100.50 Capital Gain

13/25

200–99.50 = $100.50 Capital Gain

13/25

$200 is the Fair Market Value in US Dollar at the time of the trade. $99.50 is your cost basis in the asset.

You then owe a percentage of this $100.50 gain to the government on your taxes.

14/25

You then owe a percentage of this $100.50 gain to the government on your taxes.

14/25

If you incurred a capital loss rather than a gain on your crypto trading, you can actually save money on your taxes by filing these losses. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year.

15/25

15/25

To properly file and report your #crypto transactions, you need IRS form 8949 and 1040 Schedule D

List all cryptocurrency trades and sells onto Form 8949 along with the date you acquired the #crypto, the date sold/traded, proceeds, cost basis, and gain or loss

16/25

List all cryptocurrency trades and sells onto Form 8949 along with the date you acquired the #crypto, the date sold/traded, proceeds, cost basis, and gain or loss

16/25

Once you have each trade listed, total them up at the bottom, and transfer this amount to your 1040 Schedule D. Include both of these forms with your yearly tax return.

17/25

17/25

One thing you should know is the rate of your capital gains tax. That is because this rate is dependent upon a number of factors. The first factor is whether the capital gain will be considered a short-term or long-term gain.

18/25

18/25

shortterm capital gain which occurs when you hold a crypto for less than a year & sell the #crypto at more than your cost basis

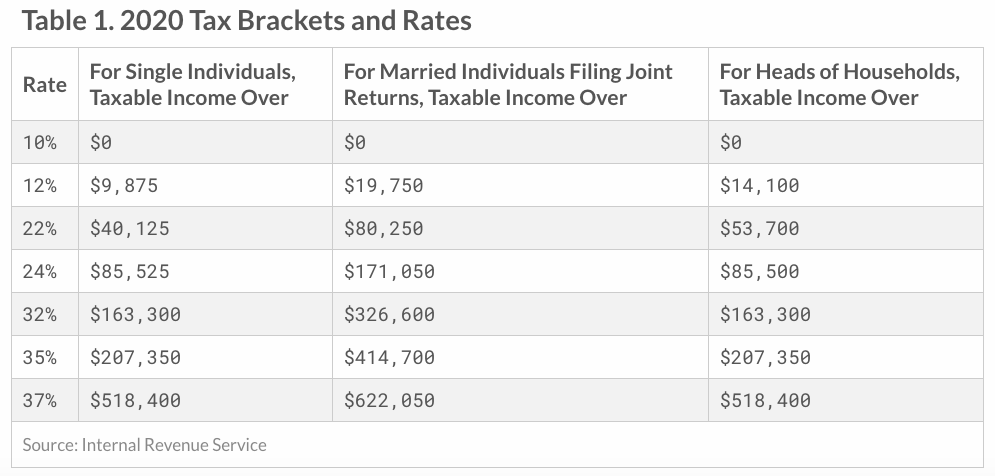

Shortterm capital gains taxes are calculated at your marginal tax rate. Below is a table

19/25

Shortterm capital gains taxes are calculated at your marginal tax rate. Below is a table

19/25

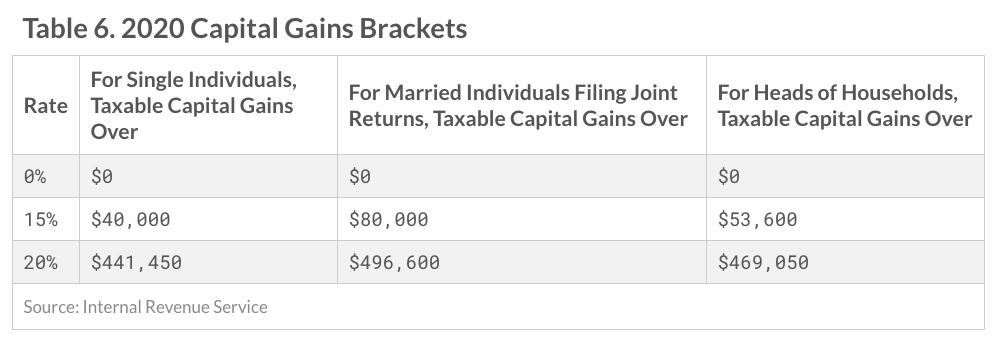

For all of the holders out there, if you held your #cryptocurrency for a year or more, you qualify for a lower long-term capital gains rate. The table below details the tax brackets for long term capital gains:

20/25

20/25

Receiving interest income from a crypto loan or similar service is treated as a form of taxable income similar to mining or staking rewards. This type of income should be reported under the “other income” section of line 21 of Schedule 1 - Additional Income and Adjustments

21/25

21/25

A lot of traders are convinced that because of the anonymous, #decentralized nature of #Blockchain and #crypto transactions, that there is no way for the government to see or know that they are making money trading/buying/selling #cryptocurrency. This is not true.

22/25

22/25

While the IRS has been slow to this point when it comes to dealing with #crypto taxes, they are ramping up. The IRS win against #Coinbase, which required the popular exchange to turn over records for individuals who have $20,000 or more in any transaction

23/25

23/25

The #Blockchain is a distributed public ledger, meaning anyone can view the #ledger at anytime. Figuring out an individual’s activities on that #ledger essentially comes down to associating a wallet address with a name.

24/25

24/25

Choosing not to report your #crypto transactions is a risky decision that exposes you to tax fraud to which the IRS can enforce a number of penalties, including criminal prosecution, five years in prison, along with a fine of up to $250,000.

25/25

25/25

Read on Twitter

Read on Twitter