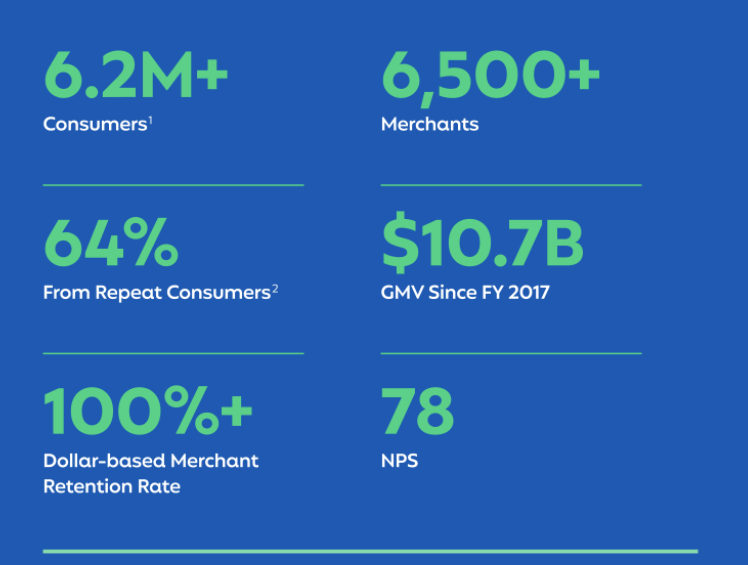

0/ @Affirm filed their S1 after the close today. They highlight 6.2M+ customers, 17.2M transactions, 6,500+ merchants, $10.7B GMV since FY17, 100%+ dollar-based merchant retention rate, 64% repeat customers & 78 NPS. https://www.sec.gov/Archives/edgar/data/1820953/000110465920126927/tm2026663-4_s1.htm

1/ They highlight some interesting macro data. Gen Z & Millennials spending power is expected to be over $2.5T in ’20. Global online sales grew ~20% to $3.4T in ‘19 & are expected to grow to ~$5.8T by ‘23; however, e-commerce still only accounts for 14% of total retail sales.

2/ 70% of Millennials prefer shopping online; e-commerce sales as a % of total sales jumped from 11.8% to over 16.1% between 1Q & 2Q20.

3/ In NA, “buy now pay later” market share is expected to triple to 3% of the e-commerce payments market by ‘23. In other regions, such as EMEA, “buy now pay later” already accounts for almost ~6% of the e-commerce payment market, & is expected to grow to almost 10% by ‘23.

4/ Approximately 25% of Millennials do not carry credit card. 64% of Americans would consider purchasing or applying for financial products through a technology company’s platform instead of a traditional financial services provider. This is 81% for ages 18-34.

5/ In ’19 consumers paid ~$121B in credit card interest, $11B in overdraft fees, and $3B in late fees. As of June ’20 Americans owed nearly $1 trillion in credit card debt

6/ Their underwriting models have been built on more than a billion data points, including data from over 7.5 million loans and over six years of repayments.

As we continue to see maturation of FinTech companies expect these types of metrics to garner further attention.

As we continue to see maturation of FinTech companies expect these types of metrics to garner further attention.

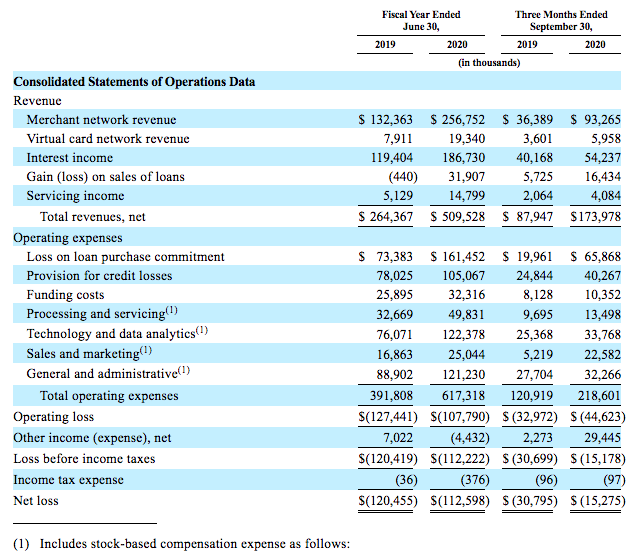

7/ From merchants, they earn a fee when they help them convert a sale & power a payment; they generally earn larger merchant fees on 0% APR financing products. For the FY ended June 30th & three months ended Sept 30th, 0% APR financing represented 43% & 46%, of total GMV

8/ From consumers, they earn interest income on the simple interest loans that they purchase from their originating bank partners.

Consumers are never charged deferred or compounding interest, late fees, or penalties on the loans.

Consumers are never charged deferred or compounding interest, late fees, or penalties on the loans.

9/ As of Sept ‘20, they had over $4.2B in funding capacity from a diverse set of capital partners, & they have funded approximately $10.7B of purchases since July 1, 2016.

10/ Looking at their financials total revenue is +106.8% YoY ($509.5M vs. $264.47M) for the FY ended 6/30. The Sept quarter is +97.8% YoY ($174M vs. $87.9M) and is at $695M run-rate

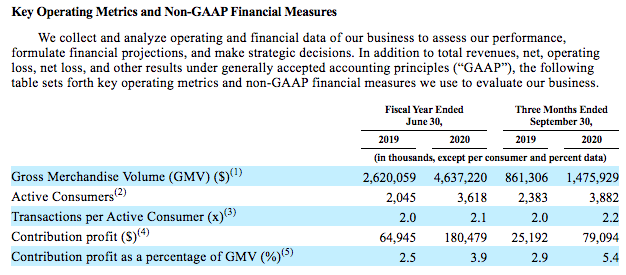

11/ They highlight Key Operating Metrics including GMV, Active Consumers, Tx / active consumer, contribution profit ($), and % of GMV all of which are trending strongly + YoY.

12/ It’ll be important to watch the loss on loan purchase commitments / provision for credit losses & interesting to see how the market looks to value this type of business (e.g., as a B/S lending business or an embedded finance co or something in between).

Read on Twitter

Read on Twitter