Good decisions do not always lead to good outcomes!

Why do I feel like I lost €1,800 on a transaction today, when, in fact, I gained €4,495?

#AThread

Why do I feel like I lost €1,800 on a transaction today, when, in fact, I gained €4,495?

#AThread

In August 2020, I built up a small position in 22nd Century Group - a biotechnology company focused on tech that alter the level of nicotine in tobacco plants and the level of cannabinoids in hemp / cannabis plants through genetic engineering.

I had been following the company for some time and at the beginning of August, I bought 4,078 units of its shares at €0.63 per share.

The Company released it’s earnings report and the market (over)reacted negatively to this report.

The Company released it’s earnings report and the market (over)reacted negatively to this report.

I saw this as an opportunity to some buy more shares, at an even lower valuation. By the end of August, I had bought a total of 15,872 units, and my average unit price had fallen to €0.5754. See above screenshot for details.

My goal was to hold around 4,000 units in my portfolio - long term.

All additional purchases were to take advantage of my view that the market had overreacted to the earnings report.

So I decided that I would sell off the extra (~12k) as soon prices reached a certain level.

All additional purchases were to take advantage of my view that the market had overreacted to the earnings report.

So I decided that I would sell off the extra (~12k) as soon prices reached a certain level.

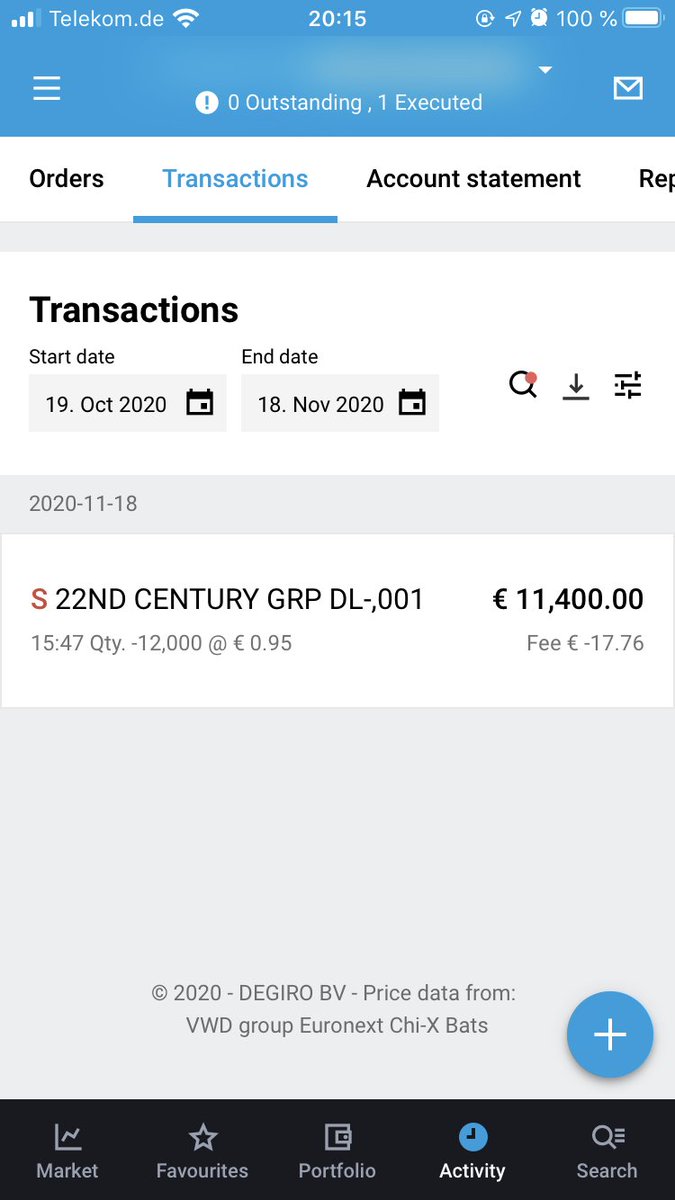

Accordingly, I set a limit order to sell 12,000 units at €0.95 per share.

I also wanted to limit my exposure to a single security so I wouldn’t have more than xx% of my entire portfolio in a single security. especially not in another Biotech „Start-up“.

I also wanted to limit my exposure to a single security so I wouldn’t have more than xx% of my entire portfolio in a single security. especially not in another Biotech „Start-up“.

Yesterday, markets closed at €0.766 per share.

Today, prices crossed €0.95 and my order to sell 12,000 units was executed, realizing a return of 65.1%.

The catch? The Market closed at €1.1 today, so that’s €0.15 that I left on the table - for each unit of stock that I sold

Today, prices crossed €0.95 and my order to sell 12,000 units was executed, realizing a return of 65.1%.

The catch? The Market closed at €1.1 today, so that’s €0.15 that I left on the table - for each unit of stock that I sold

€0.15 * 12.000 = €1,800

For context, Apple’s new MacBook Pro with 16GB RAM 512GB SSD, with the M1 processor costs around €1,800. I know because I ordered one on Sunday and I haven’t recovered from the chest pain

For context, Apple’s new MacBook Pro with 16GB RAM 512GB SSD, with the M1 processor costs around €1,800. I know because I ordered one on Sunday and I haven’t recovered from the chest pain

I had a really busy day at work, skipped lunch, so I didn’t have time to check movements and perhaps adjust my price up based on the price changes during the day.

So, the big question - should I have waited a bit longer before I sold those 12,000 units?

- Yes?

- No?

- Maybe?

So, the big question - should I have waited a bit longer before I sold those 12,000 units?

- Yes?

- No?

- Maybe?

Let‘s analyze this:

1). What was my motive for buying additional shares after the initial purchase of around 4k units?

- to take advantage of the perceived undervaluation due to market overreaction

1). What was my motive for buying additional shares after the initial purchase of around 4k units?

- to take advantage of the perceived undervaluation due to market overreaction

2). Why did I give an order to sell the shares if I thought prices were going to rise up to €0.95. Why not hold until they got up to €0.96 or €0.99... or €69.69?

- I wanted my exposure to this Biotech security to be limited to xx% (given my other heals and biotech holdings)

- I wanted my exposure to this Biotech security to be limited to xx% (given my other heals and biotech holdings)

- I also wanted to realize the gains from my view that the market overreacted to below-expectations earnings report, as well as the impact of Covid on share prices.

3). Since I had a valid, logical and well-thought-out plan for this stock, why do I feel bad about the...

3). Since I had a valid, logical and well-thought-out plan for this stock, why do I feel bad about the...

...price appreciation that I didn’t capture?

- Hindsight bias. Because in hindsight, I have now seen that if I had held on for a few more hours, I would have made more money (€1,800, to be exact).

I wrote this thread about how to detect and deal with hindsight bias https://twitter.com/nosamugiagbe/status/1279097308672675847

https://twitter.com/nosamugiagbe/status/1279097308672675847

- Hindsight bias. Because in hindsight, I have now seen that if I had held on for a few more hours, I would have made more money (€1,800, to be exact).

I wrote this thread about how to detect and deal with hindsight bias

https://twitter.com/nosamugiagbe/status/1279097308672675847

https://twitter.com/nosamugiagbe/status/1279097308672675847

My decision did not lead to the best outcome today, but that does not make it a bad decision. In fact, it was a good decision.

However, as I noted before, good decisions do not always lead to good outcomes.

However, as I noted before, good decisions do not always lead to good outcomes.

In the short / medium term, the share price of 22nd Century Group may go even higher (in which case, my remaining holdings will benefit), or it could go down. No one knows for sure.

Read on Twitter

Read on Twitter