The EBA has just published one of its most interesting report ever: a benchmarking of EU bankruptcy procedures and the impact on recovery rates on defaulted loan.

I could tweet the whole report but the most important is this chart.

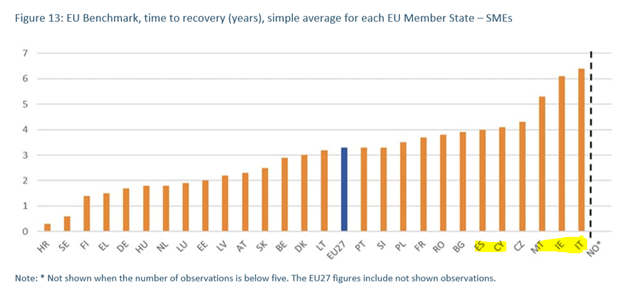

Time to recovery is v long in Italy, Ireland

I could tweet the whole report but the most important is this chart.

Time to recovery is v long in Italy, Ireland

This has two major consequences.

1) is well known: NPLs are a STOCK not a FLOW. So banks with high NPLs are banks in slow recovery countries.

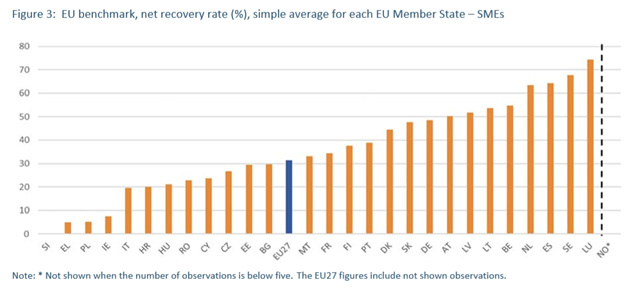

2) is less well known: under IFRS, recovery is a NPV, so there's a time effect. Unsurprisingly, recovery is very low in Italy, Ireland

1) is well known: NPLs are a STOCK not a FLOW. So banks with high NPLs are banks in slow recovery countries.

2) is less well known: under IFRS, recovery is a NPV, so there's a time effect. Unsurprisingly, recovery is very low in Italy, Ireland

Bottom line: the single most important policy measure to improve the lending channel, financial stability, etc. is this: IMPROVE BANKRUPTCY PROCEDURES.

The EC is working on it, but has been for decades. It is time to finally make it work. Post Covid the stakes are very high

The EC is working on it, but has been for decades. It is time to finally make it work. Post Covid the stakes are very high

Read on Twitter

Read on Twitter