1. Yesterday, I had the opportunity to present the results of my ongoing research on the effect of US sanctions on the Venezuelan economy at the #EconoMaraton organized by @ceconomiaucv.

Let's highlight the most interesting points:

Let's highlight the most interesting points:

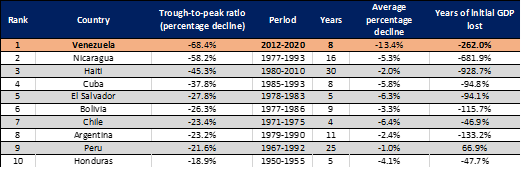

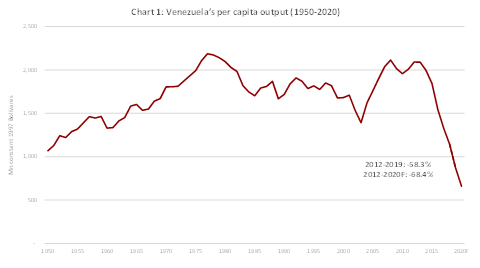

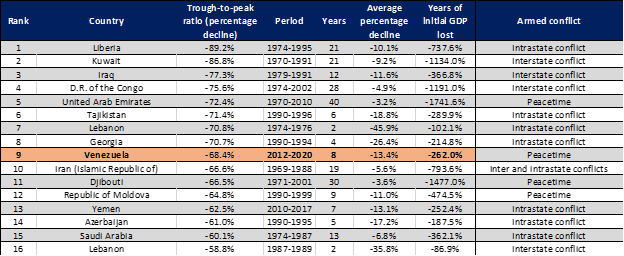

2. Venezuela is going through the largest economic contraction in Latin America's documented history and one of the ten largest in the world. By the end of this year, GDP per capita is expected to have fallen by 68.4%, equivalent to more than 3 Great Depressions.

3. This contraction is even greater than those experienced towards the end of populist cycles in other countries, such as Alán García's Peru (-24.5%) or the Sandinistas in Nicaragua (-32.9%). It is not clear that Venezuelan policies have been much worse than in those cases.

4. The Venezuelan case represents an anomaly in the world growth experience: there seems to be an "excess contraction" over that directly attributable to poor policies. Rather, its performance is comparable to that of some countries experiencing armed conflict.

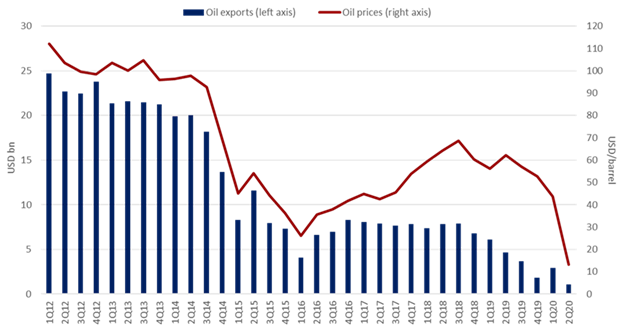

5. One way of explaining the Venezuelan economic collapse is by noting that starting in 2012-13 we see not only the end of a populist economic cycle, but also another phenomenon, which is the virtual disappearance of the country’s oil revenues.

6. In the subperiod 2014-2016, the main cause of the fall in our oil revenues was the drop in oil prices. The growth slump is therefore associated with the end of a populist cycle during which the country did not save enough to prepare for this scenario.

7. In 2017-2020, the collapse in oil exports is due to a drop in production. As I highlighted in an article published by @WOLA_org in 2018, to understand the Venezuelan collapse, we have to understand the causes of the drop in oil production. https://www.venezuelablog.org/crude-realities-understanding-venezuelas-economic-collapse/

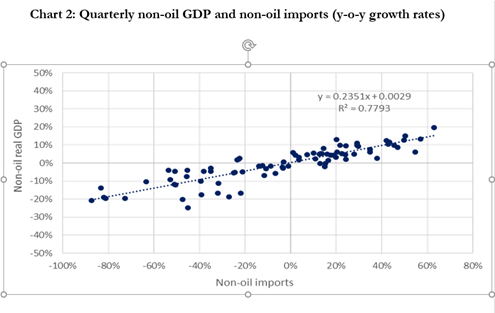

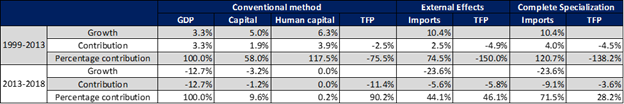

8. The Venezuelan economy is highly dependent on imports. When import capacity falls, the economy contracts. Therefore, it is not difficult to explain our collapse if we know why our oil revenues are plummeting.

9. The growth decomposition method finds that approximately ¾ of the GDP drop since 2013 is due to lower imports. It also finds a drop in productivity of approx 4% per year from 2013, reflecting the impact of poor economic policies.

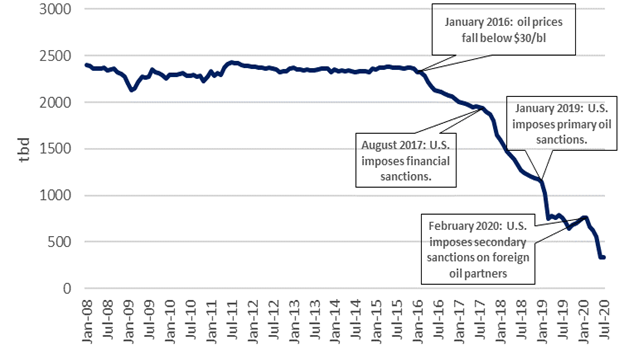

10. Venezuela’s oil production series shows stability between 2008 and 2015. The drop in production begins when oil prices plummet in 2016 and accelerates with each round of economic sanctions.

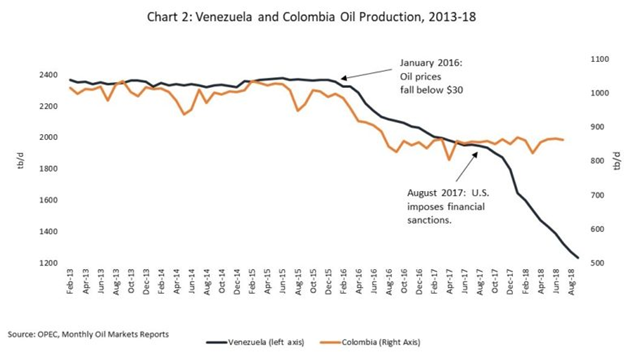

11. In my article for WOLA in 2018, I observed that Colombia, whose oil sector - like Venezuela's - operates with high production costs, displays similar behavior in its oil production series until August 2017. The series begin to diverge after financial sanctions.

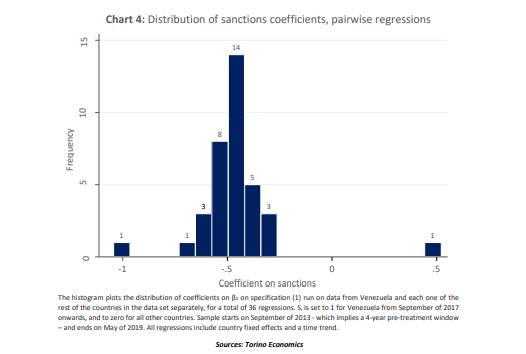

12. In response to an article by Weisbrot and Sachs that cited my graph, Hausmann, and Muci (2019), Bahar et al. (2019), and Morales (2019) argued that Colombia does not provide an adequate comparison given that the pre-2013 trends diverge significantly. https://www.brookings.edu/research/revisiting-the-evidence-impact-of-the-2017-sanctions-on-venezuela/

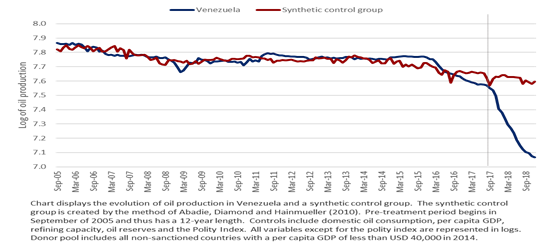

13. In an article from July 2019, I show that the results of the comparison with Colombia extend to pairwise comparisons pairs with 35 oil-producing countries and that the comparison window suggested by these authors was excessively in comparison to those used in the literature.

14. In that article, I also show estimates based on the synthetic control method, a quasi-experimental method designed to estimate the effect of interventions by building an approximation to a comparison or control group. https://franciscorodriguez.net/2020/01/11/sanctions-and-the-venezuelan-economy-what-the-data-say/

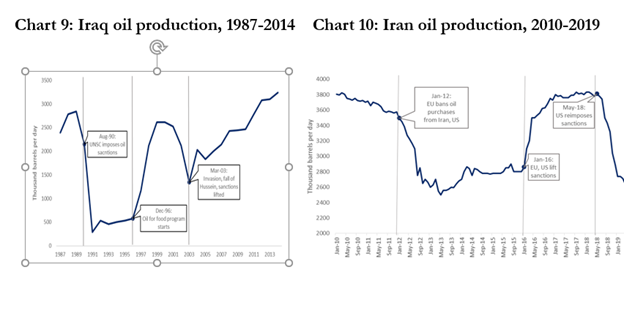

15. By applying the synthetic control method, I find that 797 thousand barrels per day of the drop in oil production after August 2017 can be explained as a result of financial sanctions.

16. The evidence shows sharp drops in production immediately after the oil sanctions (Jan 19) and the secondary sanctions on Rosneft (Feb / Mar 20). This is consistent with the effects of similar measures in other countries and results from panel regressions.

17. The effect of secondary sanctions on Rosneft appears to have been very significant. In 2019, Rosneft handled 75% of Venezuelan oil sales. Rosneft also delivered almost all the gasoline that was imported by Venezuela in 2019. https://www.argusmedia.com/en/news/2033597-scant-imports-leave-venezuela-bereft-of-motor-fuel

18. It is not surprising, therefore, that Venezuela's gasoline shortages intensified approximately one month after the Rosneft sanctions and eased on the occasions when gasoline was imported from Iran. https://lta.reuters.com/article/eeuu-venezuela-gasolina-idLTAKBN21Q27O

19. Less than a month ago, the United States announced that it would suspend the exception to its rules for imposing secondary sanctions that allowed some foreign companies to still bring diesel to Venezuela. https://www.argusmedia.com/en/news/2155041-us-turns-screws-on-venezuela-as-florida-beckons

20. In the public discussion on sanctions, two problematic arguments are often made: "Sanctions are not the cause of the crisis because the crisis started before the sanctions" and "sanctions are not the cause of the crisis, but they have aggravated it. "

21. Both arguments are flawed because they assume that only one factor can cause the crisis. This argumentative flaw is known as the fallacy of causal oversimplification. https://www.logicallyfallacious.com/logicalfallacies/Causal-Reductionism

22. In other words, there is no reason why poor economic policies and sanctions cannot both have contributed - jointly or separately - to the Venezuelan economic collapse.

23. The Venezuelan economy was poorly managed for years. The Chávez and Maduro governments squandered an oil boom. Consequently, the country was not prepared for the drop in oil prices that began in 2014. That is the cause of the 2014-16 contraction.

24. Beginning in 2017, there is an explicit attempt to disinsert Venezuela from the world economy in order to dissuade Maduro from advancing in his authoritarian project. This disinsertion led to the collapse in oil production that caused the second wave of the collapse.

25. Understanding that economic sanctions have contributed to the crisis does not mean that we should advocate for their lifting. Our position at @oilforvenezuela is to promote reforms that protect Venezuelans from their collateral effects. https://oilforvenezuela.org/

Read on Twitter

Read on Twitter