For years I've been convinced we are heading for a global debt deflation event caused by the steady decline of real wages, rocketing inequality, & excessive debt, and that the scale of the collapse would lead to massive government and CB intervention

1/9 https://twitter.com/guyinaredtie1/status/1290674659109765121?s=20

1/9 https://twitter.com/guyinaredtie1/status/1290674659109765121?s=20

..not rescuing banks like in 2008, but by monetising most of the debt, & direct injection into the economy with helicopter money, UBI & massive infrastructure investment

It would be the end of the 40 year neoliberal experiment and the start of a reflationary economic cycle

2/9

It would be the end of the 40 year neoliberal experiment and the start of a reflationary economic cycle

2/9

Well here's the thing: I was convinced a full collapse would be necessary before the cycle change, as it could only happen when governments were terrified. But what if the coronavirus threat is enough?

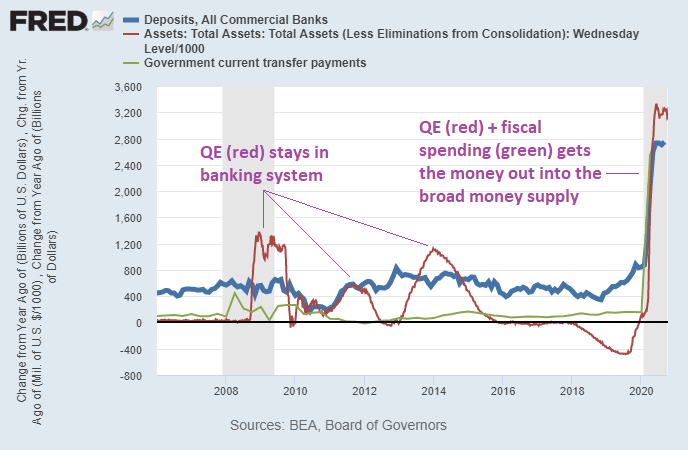

The chart below is pretty staggering:

3/9

The chart below is pretty staggering:

3/9

So far this year the Fed has printed about $3trillion, the ECB almost the same; the BoE about $1 trillion

This time around the money isn't going to banks, but as transfer payments: mostly to businesses so far

@DiMartinoBooth calls it #PrintingScared, which is pretty apt

4/9

This time around the money isn't going to banks, but as transfer payments: mostly to businesses so far

@DiMartinoBooth calls it #PrintingScared, which is pretty apt

4/9

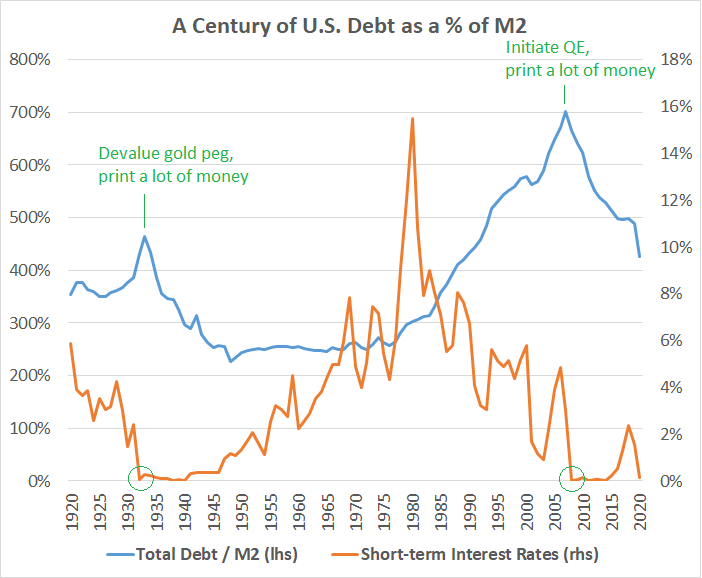

And although gov debt is rocketing, debt in relation to M2 is continuing to fall

Which begs the question: where is all that cash?

5/9

Which begs the question: where is all that cash?

5/9

Maybe the neoliberal cheerleaders have realised that this is really it, and the long cycle since 1980 is finally over, and the reflation has already started

6/9 https://edition.cnn.com/2020/11/12/economy/economy-after-covid-powell/index.html

6/9 https://edition.cnn.com/2020/11/12/economy/economy-after-covid-powell/index.html

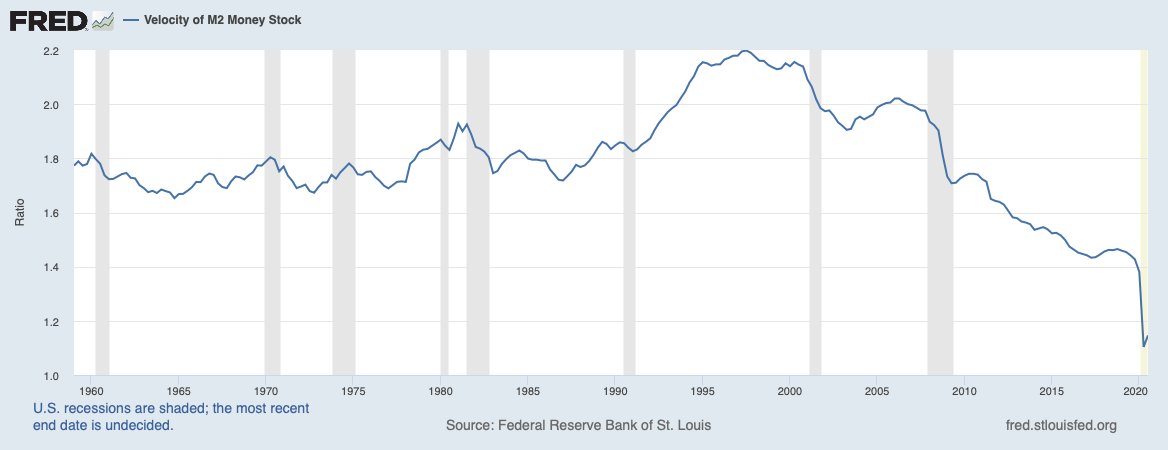

I'm still not convinced though. It would be such a massive change of direction: surely it can't happen this easily

I'm going to stick with @DaveHcontrarian : a melt up, followed by a stock market crash, then a collapse in corporate bonds and a banking crash

THEN reflation

7/9

I'm going to stick with @DaveHcontrarian : a melt up, followed by a stock market crash, then a collapse in corporate bonds and a banking crash

THEN reflation

7/9

And I'll be watching M2 velocity to see if I'm right

Disclaimer: I'm not a professional economist (but perhaps that's been an advantage in the last 40 years)

..but I am lucky enough to be followed by some very good economists

8/9

Disclaimer: I'm not a professional economist (but perhaps that's been an advantage in the last 40 years)

..but I am lucky enough to be followed by some very good economists

8/9

@ArashKolahi

@shreyagnanda

@asatarbair

@drsparwaga

I know you are all busy, but if you get time please could you read this short thread and tell me if you agree

9/9

@shreyagnanda

@asatarbair

@drsparwaga

I know you are all busy, but if you get time please could you read this short thread and tell me if you agree

9/9

Read on Twitter

Read on Twitter