1/ Now that we covered BTC price action around all time highs and risk management, let's take a look at what was up with altcoins like $ETH, $XRP, $LTC, $XMR, $DASH and $ETC at that time in 2016 and see if we can draw some conclusions. https://twitter.com/Stillman___/status/1328671591983685632

2/ I'll start off with this chart where I marked the bottoms on BTC-pairings of the alts that would end up shaping the landscape of the 2017 alt bullrun. We'll get back to it later:

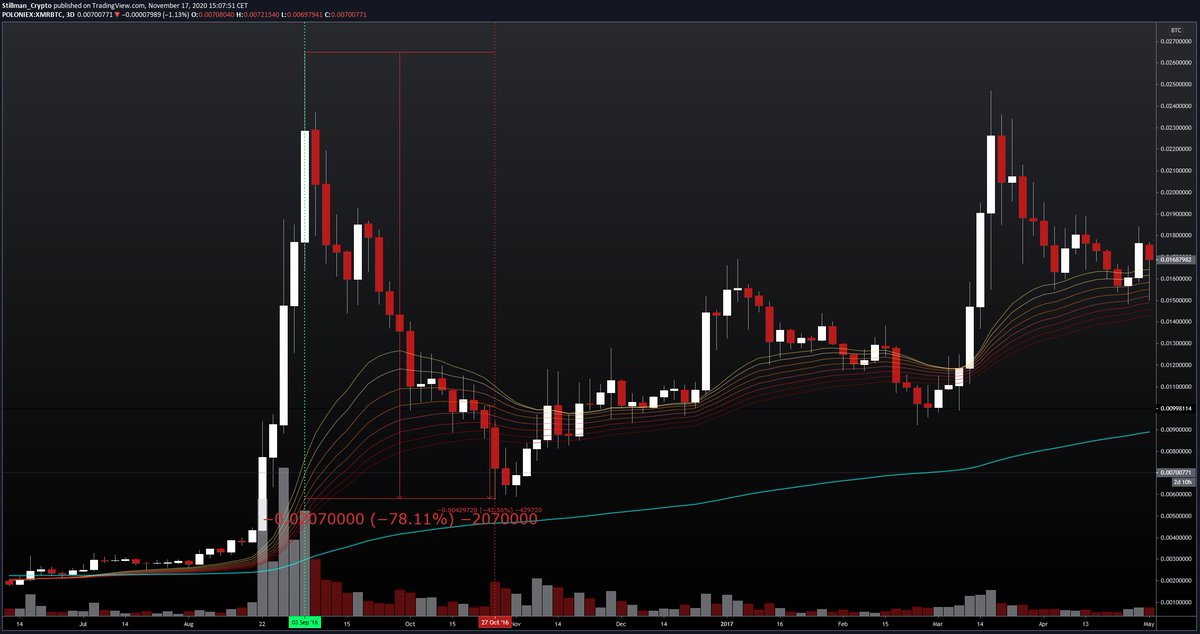

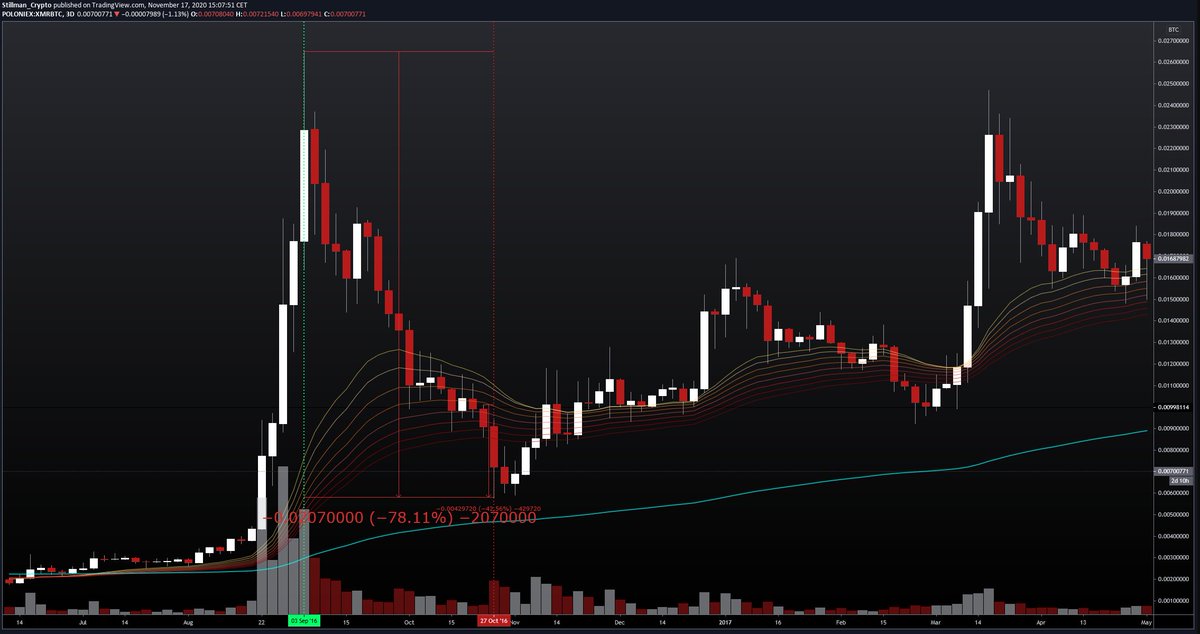

3/ I'm going to look at individual altcoins now and how they behaved during the period we are studying. I'm starting with XMR something that immediately pops out is that its 2016 timeline is very similar to our 2020 DeFi alt run:

4/ It has a huge run and tops out beginning of September, just where our alt run ended this year. The correction also is equally violent with a total drawdown of 78% (defi alts in good company).

5/ The bottom occurs relatively early compared to the three majors we are going to look at later: 27 October. The final dump it takes off the base it formed takes 6 days and adds up to another -42%.

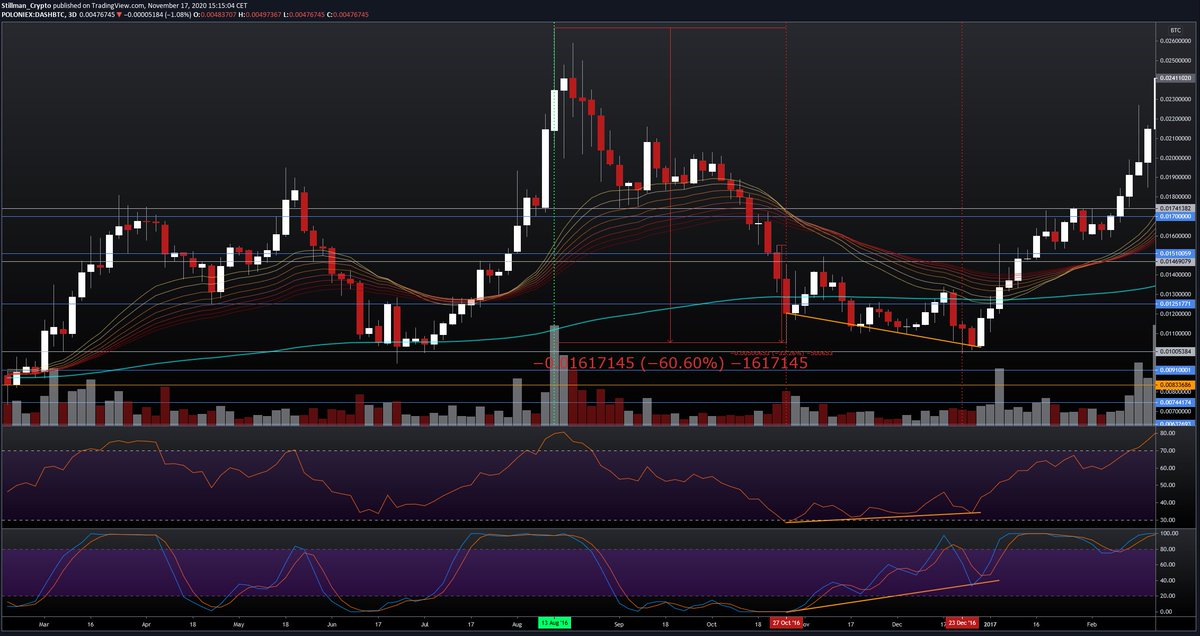

6/ DASH tops out a little earlier in August and suffers a total retrace of 60% hitting that same October 27th low. It falls 32% over the course of the final 6 days:

7/ Unlike XMR, DASH then dead cat bounces and makes another, final, low in December, forming the bullish divergence of a life time where I bet more than one masternode was acquired at a discount:

8/ ETC entered the stage just at the right time to catch some of that August/September 2016 alt show. It topped out beginning of August and then slow-bled 85% to find it's low on December 2. There is no final acceleration happening in this case over the last two 3D candles:

9/ After underperforming the alt market at the beginning of 2017, ETC comes close to making a double bottom in March and takes off from there.

10/ LTC is a different case altogether. It just skipped 2016 completely after it topped out from its big run in July 2015. Over the course of 2016/into 2017, it suffered a drawdown of 90%. It found a late bottom beginning of March 2017 in a glorious 3D inverted hammer candle:

11/ XRP falls into the same category with a top of its second, lower pump in June 15 and a total retrace of 95%. Bottom found in Jan and double bottom in March 17 with LTC. This could give the "an old coin can never pump again, too many bagholders" crowd some food for thought.

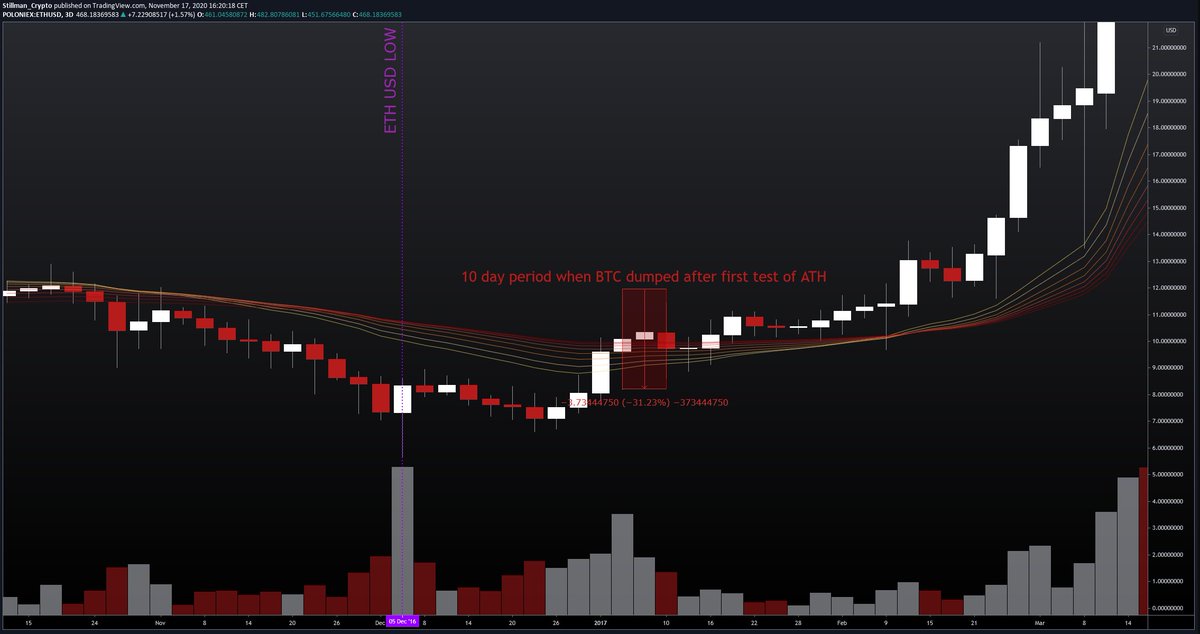

13/ Ethereum topped out from its first run in March 2016 but had an ok bear market performance during that August-September Phase when the privacy coins did well.

14/ In total it fell 80% and 70% from its September 2016 bounce high. ETH found its low beginning of December to then perform a final stop run at the end of that month. A very slight divergence and/or a good amount of courage made the difference between rekt and hilariously rich.

15/ Last thing we gotta do is check our overview BTC chart with the additional data we gathered and see if we can draw some conclusions:

16/ At a quick glance we can see a cluster forming here that is located in the month of December. Now what certainly is a surprise is that these alt bottoms happened before BTC tested its all time highs, not during that time or when it broke it.

17/ Additionally, an alt like ETH did not make new USD lows during the steep retrace and general volatility surrounding the break of BTC's all time high. For reference:

18/ Things got very volatile but price didn't come close to breaking the uptrend.

In order to not have too small of a sample size, we'll include XMR too which suffered a bit more (-48%) and also needed a longer time to recover:

In order to not have too small of a sample size, we'll include XMR too which suffered a bit more (-48%) and also needed a longer time to recover:

19/ In summary:

If the alt action were to resemble 2016,

- then alt lows on strong ALT-BTC-pairings are likely in or close to in. I am emphasizing the word strong here because our samples from 2016 all ended up being top performers.

- USD lows are even more likely already in

If the alt action were to resemble 2016,

- then alt lows on strong ALT-BTC-pairings are likely in or close to in. I am emphasizing the word strong here because our samples from 2016 all ended up being top performers.

- USD lows are even more likely already in

20/ - the turbulence around the all time high test/break and potential dump still offered the opportunity to compound alt positions with strong volatility over days and dumps/swings up to 50% in USD

Read on Twitter

Read on Twitter