You know, I went in this article expecting not to like it, but it's pretty spot on until...

"Most states will survive the pandemic fine without more federal aid if they don’t reimpose lockdowns."

Let's count the ways... 1/n https://www.wsj.com/articles/state-tax-revenue-rebound-11605568517?st=qyytp97hk37s6kh

"Most states will survive the pandemic fine without more federal aid if they don’t reimpose lockdowns."

Let's count the ways... 1/n https://www.wsj.com/articles/state-tax-revenue-rebound-11605568517?st=qyytp97hk37s6kh

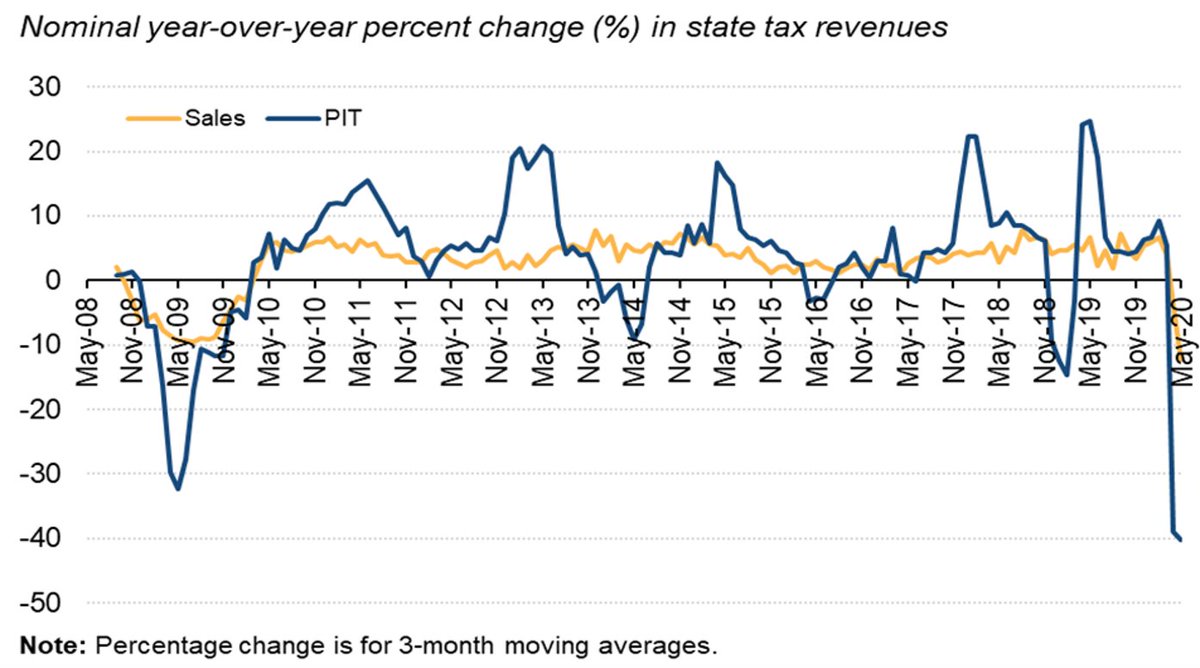

Yes, state revenues are often coming in better than projections… Projections that were developed in April or May, when the economy contracting at a -31% annualized rate and states were experiencing initial shocks worse than the recession formerly known as Great 2/n

And, yes, income taxes are doing sort of ok because the stock market is doing ok (for now), individuals are getting supplemental UI benefits (which are taxable in many states), and businesses got PPP loans (at least until the program ran out of money in August) 3/n

Federal enhanced UI benefits also propped up sales taxes as Texas’ comptroller pointed out over the summer. He also speculated it would not be pretty when said benefits ran out 4/n https://comptroller.texas.gov/about/media-center/news/2020/200803-sales-tax.php

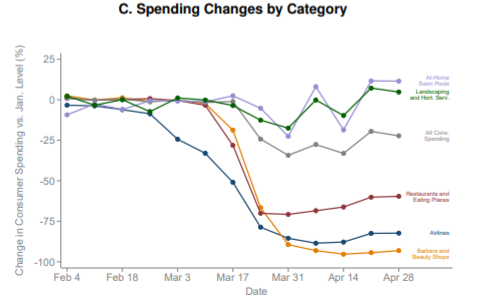

But, as the article points out, while consumption hasn’t dropped people are spending on different things as the @OppInsights team shown 5/n

So, states and localities are helped by the 2018 Wayfair decision, which authorized them to start collecting taxes on online sales 6/n

https://www.urban.org/sites/default/files/publication/98670/quill_to_wayfair_final_0.pdf

https://www.urban.org/sites/default/files/publication/98670/quill_to_wayfair_final_0.pdf

And by their general reluctance to embrace sales taxes on services despite what economists say 7/n https://www.urban.org/policy-centers/cross-center-initiatives/state-and-local-finance-initiative/projects/state-and-local-backgrounders/sales-taxes

But, states and localities are also safety net providers. So guess who will be responsible for spending on all those unemployed workers without employer-provided health insurance whose federal UI benefits are gone at the end of the year? 8/n https://www.urban.org/policy-centers/cross-center-initiatives/state-and-local-finance-initiative/state-and-local-backgrounders/state-and-local-expenditures

What about the state and local fiscal relief appropriated back in March? 90% spent or allocated governors say 9/n https://www.nga.org/advocacy-communications/nearly-90-of-coronavirus-relief-funds-already-allocated/

The Families First Coronavirus Response Act's Medicaid bump has been critical to state and local budgets and will continue as long as the US HHS declared public health emergency remains in effect 10/n https://ccf.georgetown.edu/2020/10/05/secretary-azar-extends-public-health-emergency-medicaid-protections-for-beneficiaries-and-states/

But I'm worried about cities that depend on location-specific sales taxes, fees, and charges 11/n https://www.taxpolicycenter.org/taxvox/covid-19-has-turned-much-what-we-thought-we-knew-about-city-finances-upside-down

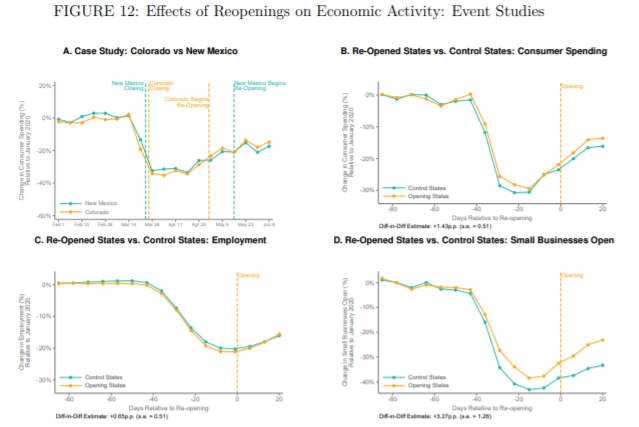

And don't even get me started on the role of lockdowns vs. fear in depressing economic activity and state and local tax revenues 12/n

Or the "self-inflicted" nature of all this - states had saved an average of 8% of annual general expenditures and cities a whopping 30% before COVID struck 13/n

Read on Twitter

Read on Twitter