1 CIBC: #Covid19 has triggered the largest cash accumulation in recorded history. We estimate households & businesses are currently sitting on no < C$170B of excess cash. Redeployment of that will have a notable impact on the future trajectory of consumer spending & #cdnecon

2 CIBC: In Q2, labor income plummeted by just over C$100B saar, while government #transfers grew

by close to C$225B saar, with “other” benefits including the #pandemic emergency programs growing by C$151B saar. #cdnecon

by close to C$225B saar, with “other” benefits including the #pandemic emergency programs growing by C$151B saar. #cdnecon

3 CIBC: That spike in disposable incomes coincided with a

notable decline in spending, which pushed #savings rate from 3.6% to 28.2% as of June. Since then, government support has become increasingly more tailored to those who need it the most

#cdnecon

notable decline in spending, which pushed #savings rate from 3.6% to 28.2% as of June. Since then, government support has become increasingly more tailored to those who need it the most

#cdnecon

4 CIBC: Using US data for Q3 as a guidepost, the Canadian #savings rate likely fell to 13% in Q3—still miles above the

3.6% level seen prior to the pandemic. With the second wave of infection upon us, that rate is likely to remain elevated during the winter.

#cdnecon

3.6% level seen prior to the pandemic. With the second wave of infection upon us, that rate is likely to remain elevated during the winter.

#cdnecon

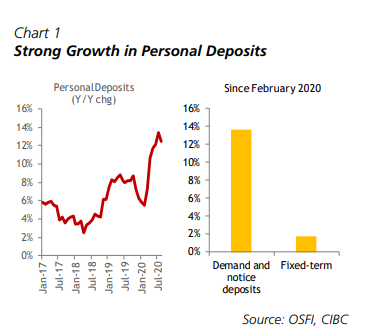

5 CIBC: Those new savings are quickly finding their way into #households’ checking and #savings accounts. On a year-over-year basis, #Bconsumer deposit balances are currently rising by an estimated 12%.

#cdnecon

#cdnecon

5 CIBC: And with current interest rates not so inviting, nearly all of that new cash is parked in notice and demand accounts, as opposed to term-deposits (right on chart above)—ready to be redeployed in short order.

#cdnecon

#cdnecon

Read on Twitter

Read on Twitter