Dan Gertler bought royalties to ERG's copper-cobalt Metalkol tailings in 2017 from Gecamines. We're just finding out now. Gertler says he paid $55m+$28m debt. Gecamines says nothing. ERG says they'll follow sanctions rules if they pay him. https://www.bloomberg.com/news/articles/2020-11-16/gertler-bought-gecamines-royalties-in-erg-congo-cobalt-project?sref=rfb3qa2N @business

We asked Mr Gertler about the transaction & he responded with a video saying he'd share the revenue with all the Congolese people. He didn't say how. There are about 100 million Congolese people. https://twitter.com/soniarolley/status/1328372074084175878?s=20

Presumably an individual would buy shares in his company, Multree, then get dividends from the royalties. Depending on terms, it could be a good deal, or not. It's likely that the better the deal for the investor, the worse the deal was for Gecamines. Excited to see prospectus

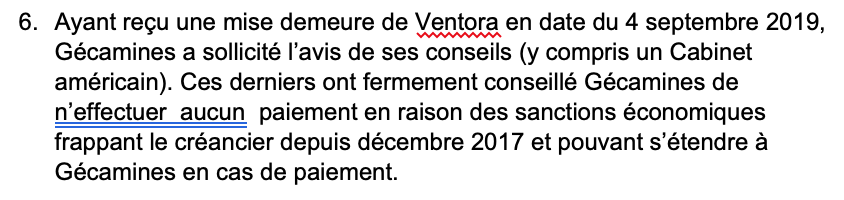

Even if it's a good deal, problem remains: Dan Gertler & his majority-owned companies are under U.S. sanction, so investing in his projects is complicated. Even Gecamines' lawyers told them not to pay $ they owe his company, Ventora. (Ventora sued.)

Dan Gertler has been at the center of Congolese politics and business for more than 20 years, and to see him speak publicly on film for essentially the first time was extraordinary.

Above all, Gecamines isn't answering so many questions. Why did they sell the royalties? Why did they think that was the right price? What did they do with the money--both from the debt and the sale? Why did they wait 3 years to publish the contract?

Read on Twitter

Read on Twitter