1/ $EDV.TO acquiring $TGZ.TO

Really like this deal as an EDV shareholder

-Massive re-rate pot. w/ future FTSE 100 inclusion, FCF generation, healthy BS and very attractive valuation.

FCF generation, healthy BS and very attractive valuation.

EDV mgmt. are excellent operators, proven integrators and solid capital allocators IMO. https://twitter.com/EndeavourMining/status/1328236629895618560

Really like this deal as an EDV shareholder

-Massive re-rate pot. w/ future FTSE 100 inclusion,

FCF generation, healthy BS and very attractive valuation.

FCF generation, healthy BS and very attractive valuation.EDV mgmt. are excellent operators, proven integrators and solid capital allocators IMO. https://twitter.com/EndeavourMining/status/1328236629895618560

2/

Deal Notes:

-EDV paying C$2.6B (all-share) or ~0.8x cons. P/NAV

-Small premium paid (5% on last price, 9% on 20d VWAP)

-P/NAV accretive (5.7%), CF & EPS accretive in ’23 (’21 and ’22 neutral)

-Closing expected in Q1 2021

-Break-fee: $40M

-Potential for significant synergies

Deal Notes:

-EDV paying C$2.6B (all-share) or ~0.8x cons. P/NAV

-Small premium paid (5% on last price, 9% on 20d VWAP)

-P/NAV accretive (5.7%), CF & EPS accretive in ’23 (’21 and ’22 neutral)

-Closing expected in Q1 2021

-Break-fee: $40M

-Potential for significant synergies

3/ Deal Notes cont'd:

-Condition: EDV granted waiver for change of control of gold purchase and sale agreement w/ $FNV

-Nov. 16: TGZ trading at 1.5% discount to implied acq. price (chance of interloper low IMO)

-Condition: EDV granted waiver for change of control of gold purchase and sale agreement w/ $FNV

-Nov. 16: TGZ trading at 1.5% discount to implied acq. price (chance of interloper low IMO)

4/ Combined company

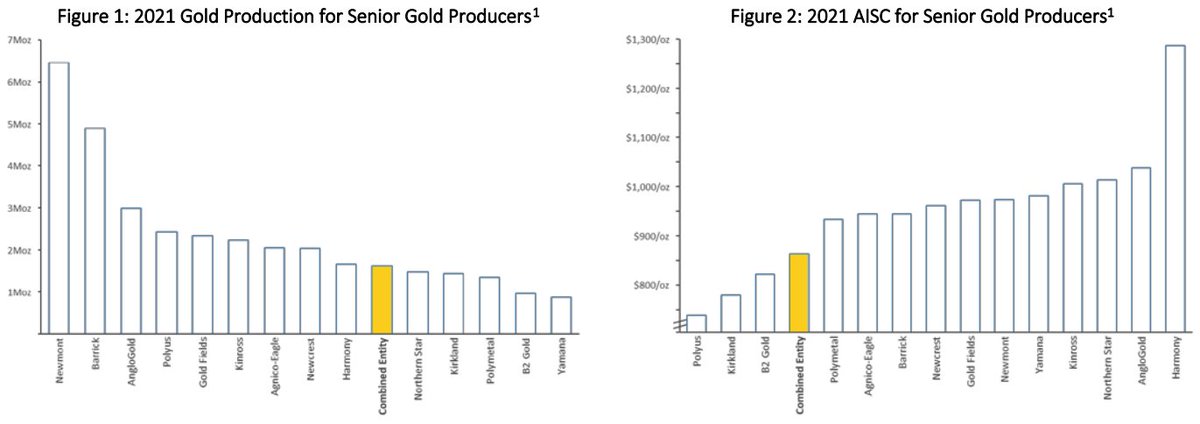

-Creates a top 10 gold producer at 1.5 Moz/yr @ <$900/oz AISC (Cons. ’21: 1.6Moz @ $863/oz AISC)

-Very strong project development pipeline and exploration potential

-No intention to grow past 2Moz/yr pdn

-Seeking LSE Listing and FTSE 100 inclusion post closing

-Creates a top 10 gold producer at 1.5 Moz/yr @ <$900/oz AISC (Cons. ’21: 1.6Moz @ $863/oz AISC)

-Very strong project development pipeline and exploration potential

-No intention to grow past 2Moz/yr pdn

-Seeking LSE Listing and FTSE 100 inclusion post closing

5/

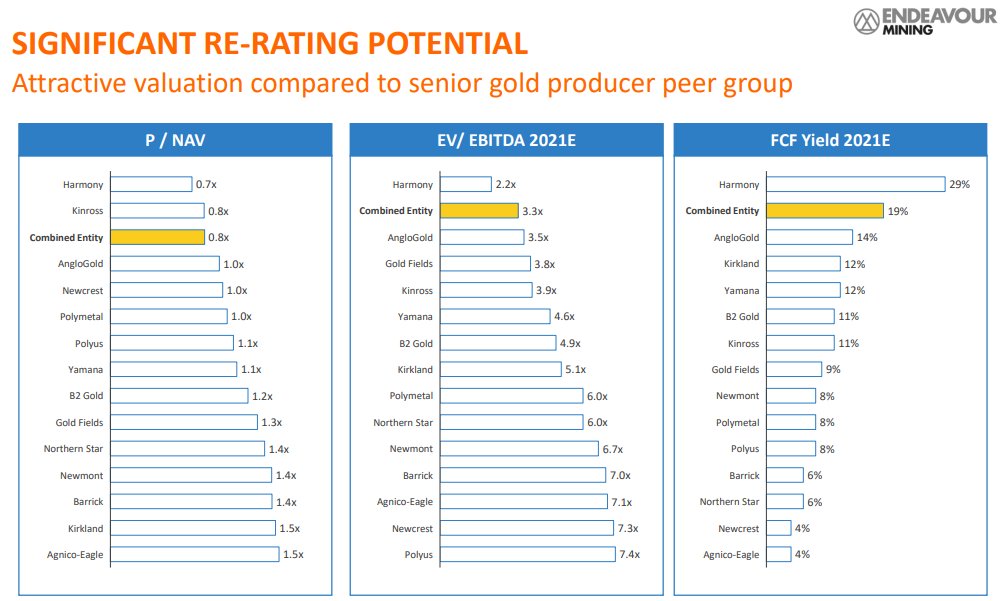

Huge FCF: Cons. ’21 @ $1,222M (~19% FCF Yield) to fund org growth

Balance Sheet (pro-forma): Ample liquidity and low net debt ~$279M (0.3x ND/EBITDA LTM) – net cash by mid-2021 at current gold prices

-Comprehensive debt refinancing up to $800M reduces financing cost ~$40M

Huge FCF: Cons. ’21 @ $1,222M (~19% FCF Yield) to fund org growth

Balance Sheet (pro-forma): Ample liquidity and low net debt ~$279M (0.3x ND/EBITDA LTM) – net cash by mid-2021 at current gold prices

-Comprehensive debt refinancing up to $800M reduces financing cost ~$40M

6/

Capital Allocation

-Maintain dividend at min. yield of 1.6% (avg. yield vs. peers)

-Will revisit dividend policy and capital allocation priorities once net cash >$250M (exp. ~mid-2021)

Valuation – Extremely undervalued vs. peers across P/NAV, EV/EBITDA, FCF Yield

Capital Allocation

-Maintain dividend at min. yield of 1.6% (avg. yield vs. peers)

-Will revisit dividend policy and capital allocation priorities once net cash >$250M (exp. ~mid-2021)

Valuation – Extremely undervalued vs. peers across P/NAV, EV/EBITDA, FCF Yield

Read on Twitter

Read on Twitter