164% GROWTH ALERT

164% GROWTH ALERT

An online brokerage and trading platform in Hong Kong

& Mainland China

& Mainland China

Taking advantage of the massive influx of Asian IPOs

Taking advantage of the massive influx of Asian IPOsAND from the rise in investable assets in ASIA

Here is an EASY thread

$FUTU was founded in 2011 and provides online brokerage services in Hong Kong  & Mainland China

& Mainland China

Through its investing platform “Futubull” it provides market data, trading services and news feed of HK, Mainland China and US stock markets

it provides market data, trading services and news feed of HK, Mainland China and US stock markets

& Mainland China

& Mainland China

Through its investing platform “Futubull”

it provides market data, trading services and news feed of HK, Mainland China and US stock markets

it provides market data, trading services and news feed of HK, Mainland China and US stock markets

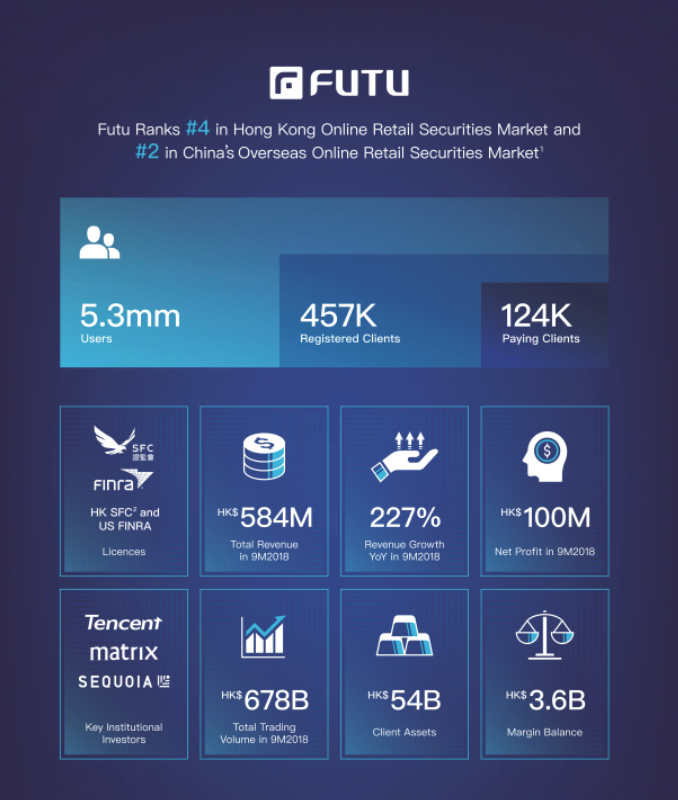

It is backed by Tencent Holdings, Matrix Holdings and Sequoia Capital and it went public on the Nasdaq in March 2019

By the time of its IPO, it counted 5.3m users and had HKS 54B in client assets

and had HKS 54B in client assets

Today, its counts 9.3m users and has HKS 142B in client assets

By the time of its IPO, it counted 5.3m users

and had HKS 54B in client assets

and had HKS 54B in client assets

Today, its counts 9.3m users and has HKS 142B in client assets

Needless to say, the business is growing FAST  In Q2 ’20, its sales increased 164% YoY to $ 89m

In Q2 ’20, its sales increased 164% YoY to $ 89m

Gross profit increased by 172% YoY to $ 69m and Net Income boomed by 327% to $ 30.5m

In Q2 ’20, its sales increased 164% YoY to $ 89m

In Q2 ’20, its sales increased 164% YoY to $ 89mGross profit increased by 172% YoY to $ 69m and Net Income boomed by 327% to $ 30.5m

Ok, so its a business growing at a rapid pace and profitable

Here are some questions

What does it do?

What does it do?

What is its market opportunity

What is its market opportunity

How can it win?

How can it win?

Here are some questions

What does it do?

What does it do? What is its market opportunity

What is its market opportunity How can it win?

How can it win?

What does it do?

What does it do?$FUTU offers a fully digitised brokerage platform

and it makes money mainly from trade executions and margins financing

and it makes money mainly from trade executions and margins financing

Their users consists in the emerging affluent Chinese population, taking advantage of generational shift in wealth management

Besides providing access to trades, it also enable users to get all the latest news on their stocks

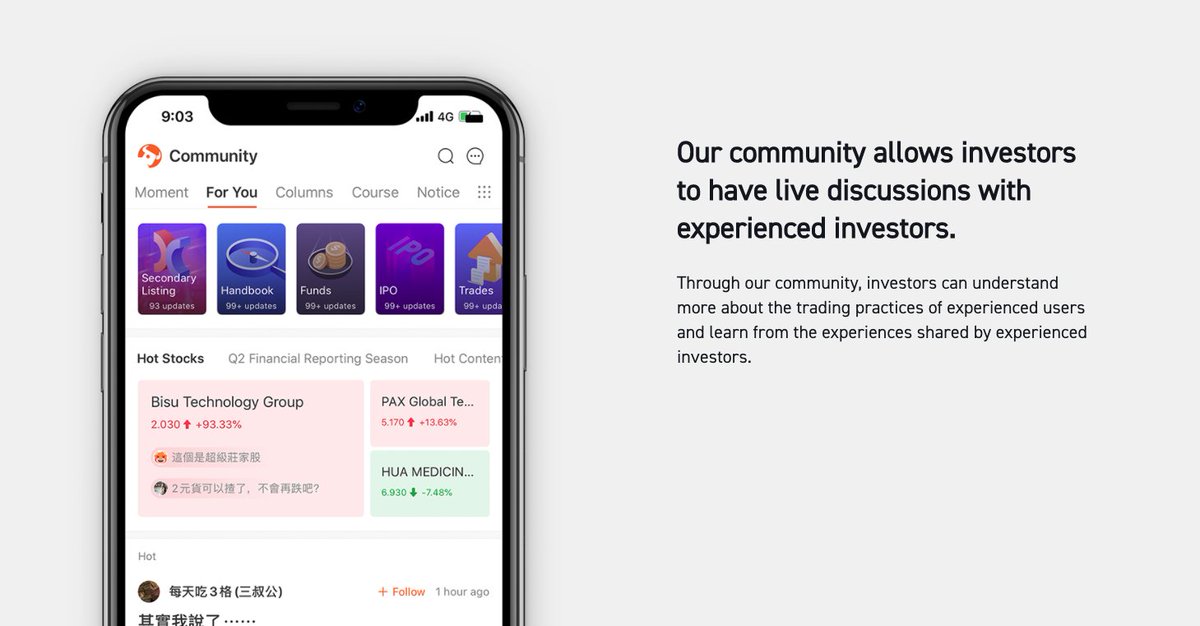

It also provides an immersive social platform for investors through the Futubull platform From their S1 filling

From their S1 filling

It also provides an immersive social platform for investors through the Futubull platform

From their S1 filling

From their S1 filling

“We have embedded social media tools to create a network centered around our users and provide connectivity to users”

As of Dec. 2019, the daily active users for the social community reached 208k users and these users spent on average 24.5 minutes each day on the platform

reached 208k users and these users spent on average 24.5 minutes each day on the platform

As of Dec. 2019, the daily active users for the social community

reached 208k users and these users spent on average 24.5 minutes each day on the platform

reached 208k users and these users spent on average 24.5 minutes each day on the platform

What is its market opportunity?

What is its market opportunity?According to BCG, China’s household wealth

is set to increase by about $ 14T by 2023 and reach $ 35T

is set to increase by about $ 14T by 2023 and reach $ 35TThe number of High Net Worth Individuals (investable assets of $ 850k) will surge by 44%

and currently stands at 1,7m individuals

and currently stands at 1,7m individuals

Sill according to BCG, the Assets Under Management (AUM) in China is set to grow by 11% to 15% per year over the 2018 - 2025 period

Watch out: on this graph values are indexed to 2016

Watch out: on this graph values are indexed to 2016

This is further supported by data from the UBS and the Financial Times

China’s asset management industry is set to reach around RMB 47T by 2025 Up from RMB 11T in 2017

Up from RMB 11T in 2017

China’s asset management industry is set to reach around RMB 47T by 2025

Up from RMB 11T in 2017

Up from RMB 11T in 2017

How can it win?

How can it win?They are doing it right! Growing at a rapid pace, taking advantage of social features and active in a market that is set to boom in coming years

But what about their competition? How are they doing?

A look at the Android marketplace for mobile trading apps reveals that

A look at the Android marketplace for mobile trading apps reveals that

Futubull has 4.5 stars

Futubull has 4.5 stars  and 4,700 ratings

and 4,700 ratings Huasheng Securities has 3.8 stars

Huasheng Securities has 3.8 stars  and 199 ratings

and 199 ratings

StockViva has 4.3 stars

StockViva has 4.3 stars  and 1,655 ratings

and 1,655 ratingsOf course, there are other very large players such as AntGroup ($BABA)

$FUTU is showing that it can deliver on its vision  and take advantage of the growing investment landscape in China

and take advantage of the growing investment landscape in China

At this point in time the market growth can absorb more than one player and $FUTU is ideally placed

can absorb more than one player and $FUTU is ideally placed

and take advantage of the growing investment landscape in China

and take advantage of the growing investment landscape in China

At this point in time the market growth

can absorb more than one player and $FUTU is ideally placed

can absorb more than one player and $FUTU is ideally placed

The key element that one should still monitor is the regulatory environment for investments in China

Overall, the regulatory environment in China is becoming more open as access to markets is being provided to foreign institutions and investors

Overall, the regulatory environment in China is becoming more open as access to markets is being provided to foreign institutions and investors

“If you’re any financial institution, a fund manager big or small, CHina is now an open market to you […] It is really a high point of openness and capital market development for China” - Fraser Howie, taken from Financial Times https://www.ft.com/content/a5392f07-9deb-4573-beb1-88a946f00df5

Of course, one should not forget that under certain events, the governing bodies might take restrictive actions

As this has been the case with the AntGroup IPO

https://www.wsj.com/articles/ant-group-ipo-postponed-by-shanghai-stock-exchange-11604409597

As this has been the case with the AntGroup IPO

https://www.wsj.com/articles/ant-group-ipo-postponed-by-shanghai-stock-exchange-11604409597

THE BOTTOM LINE

THE BOTTOM LINE

$FUTU is growing at a fast clip as it provides the trading tools a new generation of investors require

$FUTU is growing at a fast clip as it provides the trading tools a new generation of investors require It is taking advantage of the “community” building effect of investing, increasing the time spent on app and the number of trades per day

It is taking advantage of the “community” building effect of investing, increasing the time spent on app and the number of trades per day

The trading market is set to boom in China as wealth is being built up and the amount if investable assets increases dramatically

The trading market is set to boom in China as wealth is being built up and the amount if investable assets increases dramatically Regulation is an element to watch for sure and competition from top players such as $BABA should be monitored

Regulation is an element to watch for sure and competition from top players such as $BABA should be monitored

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Google Play Store

✑ Financial Times

✑ Wall Street Journal

Sources

✑ Investor presentation

✑ Company website

✑ Google Play Store

✑ Financial Times

✑ Wall Street Journal

✑ Boston Consulting Group

✑ Bain & Company

✑ UBS

✑ Global Times

✑ Bain & Company

✑ UBS

✑ Global Times

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter