Was reading through a private group chat yesterday discussing the forward path for market+economy. A lot of much smarter people in that chat than me, but it did get me thinking (I was too busy drinking to engage at the time).

Because of my simple brain, i have simple frameworks.

Because of my simple brain, i have simple frameworks.

And really, i just try to start with the current state of the world and then look at a "N" number of state of the worlds, the lesser the better (but more than 1). So what's the current state? Both in terms of markets and economy.

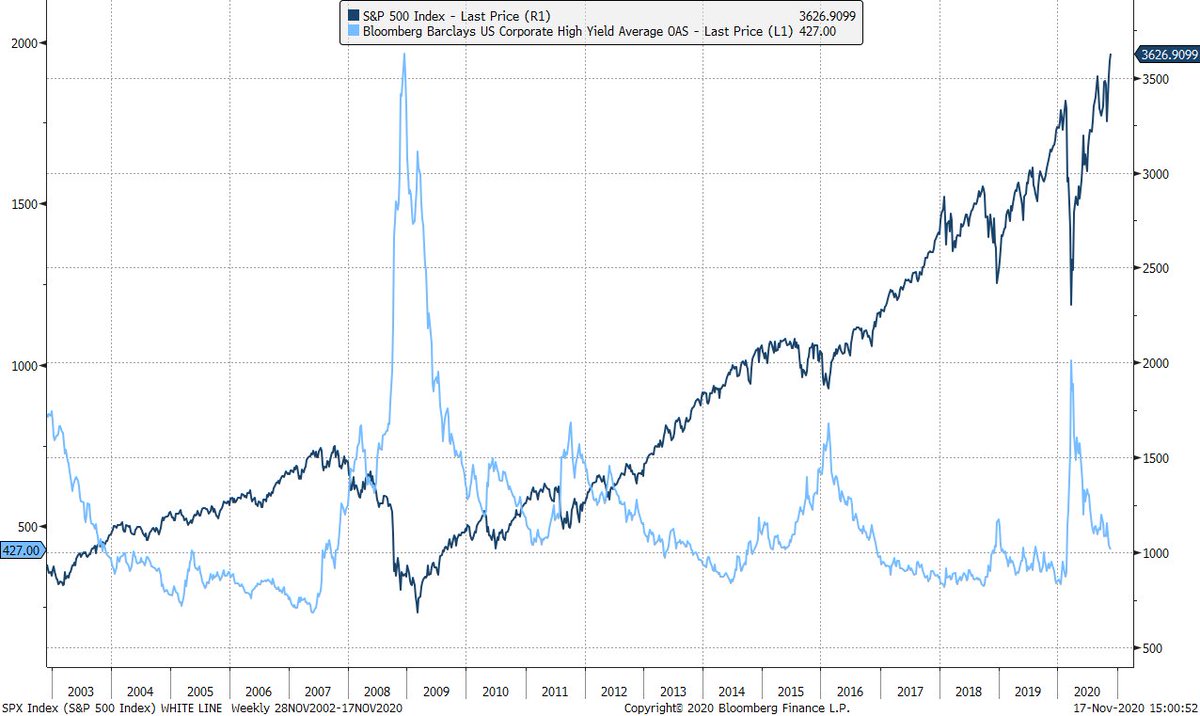

1. Rates are at all time lows while stocks are at all time highs

2. Rate vol is at all time low while vix is still in elevated

3. Credit spreads have tightened considerably (with more room to go) while equities, again, at ATH.

These conditions, to me, have been driven by...

2. Rate vol is at all time low while vix is still in elevated

3. Credit spreads have tightened considerably (with more room to go) while equities, again, at ATH.

These conditions, to me, have been driven by...

...enormous amounts of monetary stimulus and the allure of significant fiscal stimulus. I do feel though, that the margin of safety for equities is diminishing as it moves ahead of all other asset classes (note: not necessarily bearish). This brings me to the new state of worlds.

We are close to a vaccine. Will it get done? Maybe soon, maybe longer. Maybe rapid testing is a more impt solution to reopening than a vaccine (i think yes). But this is clear to me:

CB's cant cut any more. And rate vol is alr smooshed.

CB's cant cut any more. And rate vol is alr smooshed.

State #1: A vaccine comes. We get large stim package.

Large stimulus packages come in, spending goes up, we get some inflation, CBs keep rates low but allow some drift on the long end. The vaccine likely takes quite a few months to roll out, not all will take it.

Large stimulus packages come in, spending goes up, we get some inflation, CBs keep rates low but allow some drift on the long end. The vaccine likely takes quite a few months to roll out, not all will take it.

...Value rotation continues. Tech heavy indices struggle to advance with growth struggling against higher long rates and steeper curves.

Stimulus will only last a quarter at best - the struggling firms now, will still struggle. There is a negative momentum to economic destruction

Stimulus will only last a quarter at best - the struggling firms now, will still struggle. There is a negative momentum to economic destruction

..Do you then see ANOTHER stimulus package? unlikely.

Do you see long end rates get bought as defaults continue to rise and small businesses close? Likely.

Does growth and tech enjoy the dynamic of looser monpol with coporate-darwinism? Probably.

Then maybe indices recover.

Do you see long end rates get bought as defaults continue to rise and small businesses close? Likely.

Does growth and tech enjoy the dynamic of looser monpol with coporate-darwinism? Probably.

Then maybe indices recover.

State #2: Vaccine eventually comes, fiscal stimulus is small. Consumption doesn't pick up nearly as much as wanted while rates moderately rise. Bankruptcies continue and earnings struggle to justify astronomical P/Es.

Rates get bid as growth is scant while prices leak lower.

Rates get bid as growth is scant while prices leak lower.

...do you then see ANOTHER stimulus package? Potentially.

Do you see long end rates bought as growth sputters? Likely.

Does growth and tech enjoy the dynamic of looser monpol with corporate-darwinism? Maybe.

Do you see long end rates bought as growth sputters? Likely.

Does growth and tech enjoy the dynamic of looser monpol with corporate-darwinism? Maybe.

State #3: no vaccine, no package.

What everyone knows/doesn't admit/dgaf is that if anything, equities are a valuation trap. Too expensive at the high end and legitimately shitty at the bottom.

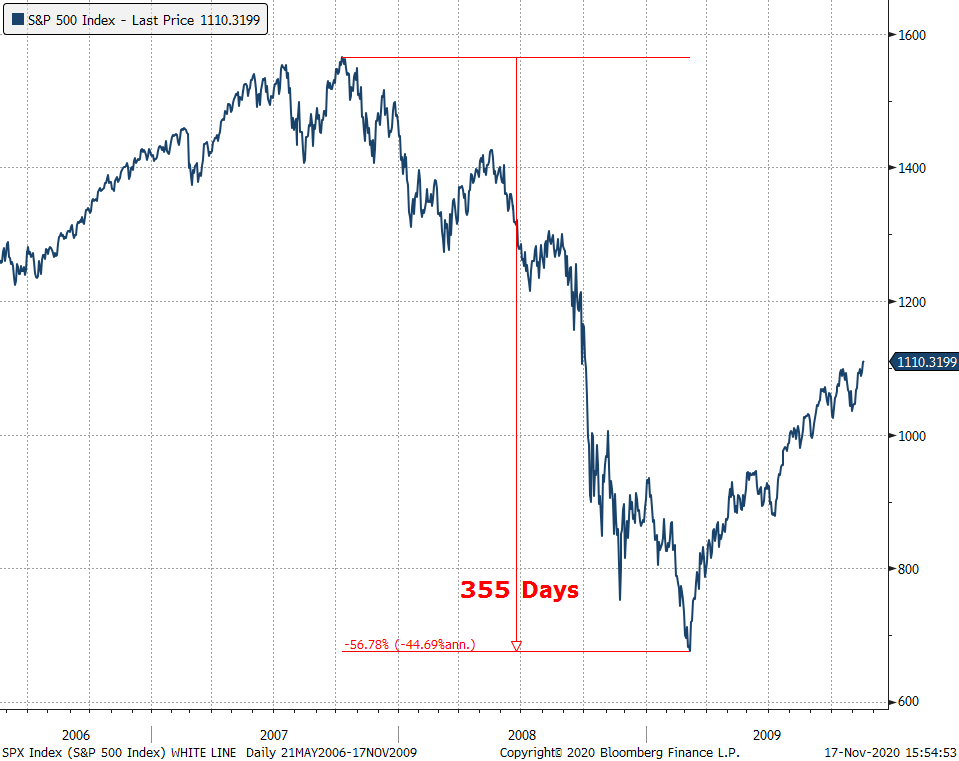

What everyone forgets is that dotcom peak to trough took 600+ TRADING days and 2008 crisis peak to trough took 300+.

What everyone forgets is that dotcom peak to trough took 600+ TRADING days and 2008 crisis peak to trough took 300+.

Readjustments take time, and i wonder if 2021 will be that year. One that normalizes valuations and elevates true value in my eyes - well-run companies with actual growth prospects and a "healthy" balance sheet.

Like i said. simple brain.

Near term:

- neutral rates, selective equity, constructive credit

- bearish eq vol, would hedge w rate vol

Med term:

- bullish rates (yields )

)

- bullish "value+growth"

- selective credit

- daddy what's vol?

Long term:

- Pshhhhhhhh

Near term:

- neutral rates, selective equity, constructive credit

- bearish eq vol, would hedge w rate vol

Med term:

- bullish rates (yields

)

)- bullish "value+growth"

- selective credit

- daddy what's vol?

Long term:

- Pshhhhhhhh

Read on Twitter

Read on Twitter