Shivalik Rasayan Ltd -

Are all negative or less cash flow making companies are red flags?

A thread

Are all negative or less cash flow making companies are red flags?

A thread

Some important questions (Shivalik Rasayan)

1) Is the company unable to convert it's profit into CFO?

2) Is there a huge working capital mismanagement?

Well, let's dig deeper and see what investors should look for in the numbers..

1) Is the company unable to convert it's profit into CFO?

2) Is there a huge working capital mismanagement?

Well, let's dig deeper and see what investors should look for in the numbers..

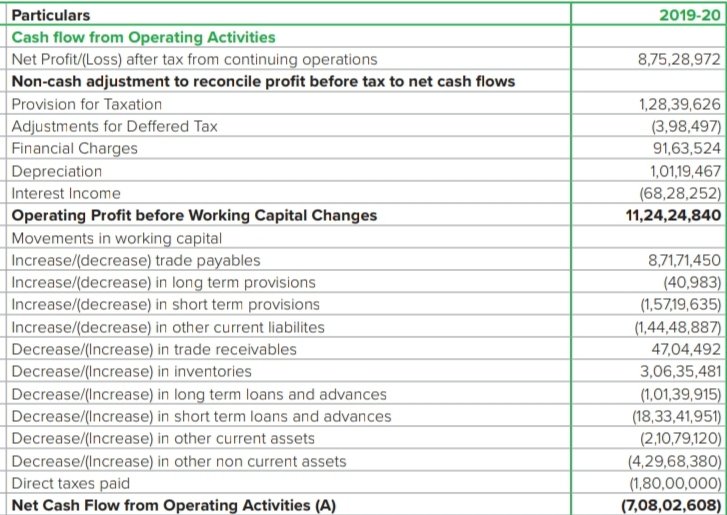

Financials (FY 2019-20 - Standalone)

Sales - 61 crs

Profit - 8.7 crs

Inventories - 3.16 crs

T/ Receivables - 8.21 crs

T/ Payables - 15.75 crs

CFO - (7.08) crs

P. S. - oops!! CFO is in negative then it must be a bad company? Isn't it?

Not at all

Sales - 61 crs

Profit - 8.7 crs

Inventories - 3.16 crs

T/ Receivables - 8.21 crs

T/ Payables - 15.75 crs

CFO - (7.08) crs

P. S. - oops!! CFO is in negative then it must be a bad company? Isn't it?

Not at all

Working capital Days

From the above (financials) figures we can easily calculate the working capital days.

Days of Receivables - 49 days

Days of Inventories - 19 days

Days of payables - 94 days

= Working capital days - (26) days

Negative working capital

From the above (financials) figures we can easily calculate the working capital days.

Days of Receivables - 49 days

Days of Inventories - 19 days

Days of payables - 94 days

= Working capital days - (26) days

Negative working capital

Contd.

Now the question is that how CFO is in negative if the company doesn't require working capital to do it's business?

Now the question is that how CFO is in negative if the company doesn't require working capital to do it's business?

Well, let's understand it in simple words..

There's a short term loans and advances of 18 crs and other non current assests of 4 crs in CFO activities. These are the one time expenses towards advances to capital suppliers and Dahej revenue expenditure for CAPEX purpose.

There's a short term loans and advances of 18 crs and other non current assests of 4 crs in CFO activities. These are the one time expenses towards advances to capital suppliers and Dahej revenue expenditure for CAPEX purpose.

CFO should improve from hereon!

Now the company has completed the CAPEX plan and CFO is going to improve from hereon. It's already reflected in this quarter numbers. CFO is in positive.

Now the company has completed the CAPEX plan and CFO is going to improve from hereon. It's already reflected in this quarter numbers. CFO is in positive.

Conclusion

If still someone talks about receivables they should understand its never to be seen in isolation. Payables should be checked along with it.

Its very important to understand the basics of cash flows. Be a baniya or businessmen while analysing a co & not an accountant

If still someone talks about receivables they should understand its never to be seen in isolation. Payables should be checked along with it.

Its very important to understand the basics of cash flows. Be a baniya or businessmen while analysing a co & not an accountant

Read on Twitter

Read on Twitter