1. Given we are ~20% away from ATH in #BTC  , it's worth worth mentioning that actively trading crypto isn't meant for everyone and sometimes buying and holding is the most viable approach.

, it's worth worth mentioning that actively trading crypto isn't meant for everyone and sometimes buying and holding is the most viable approach.

, it's worth worth mentioning that actively trading crypto isn't meant for everyone and sometimes buying and holding is the most viable approach.

, it's worth worth mentioning that actively trading crypto isn't meant for everyone and sometimes buying and holding is the most viable approach.

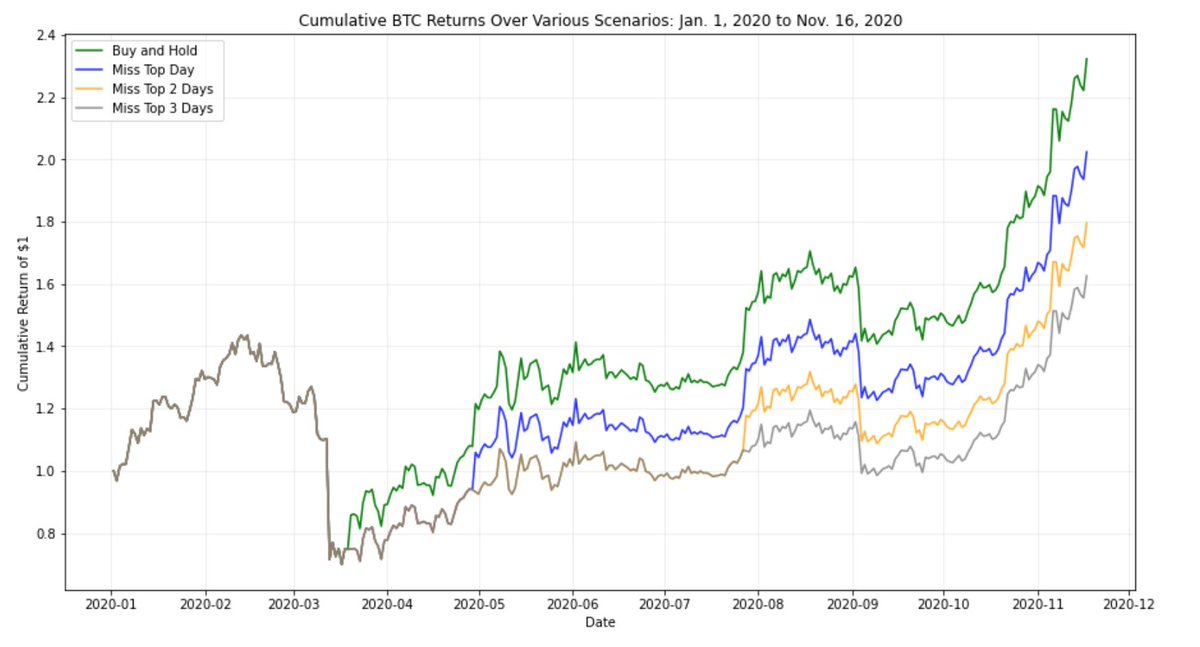

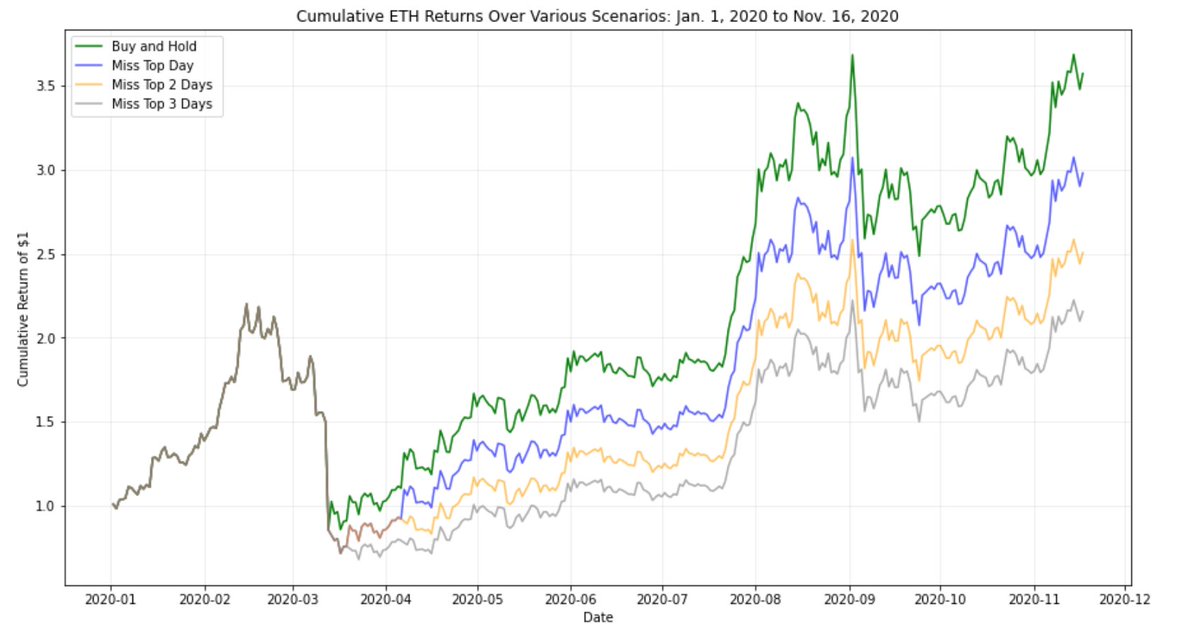

2. Let's consider the YTD cumulative returns of buy and hold for BTC and ETH.

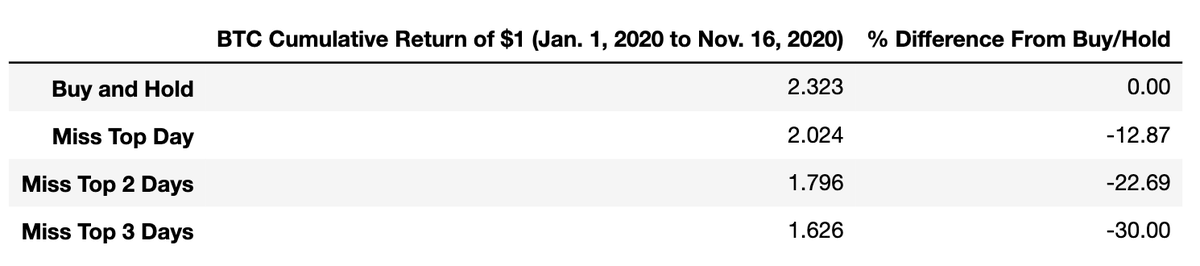

BTC YTD Cumulative Return: 2.323x

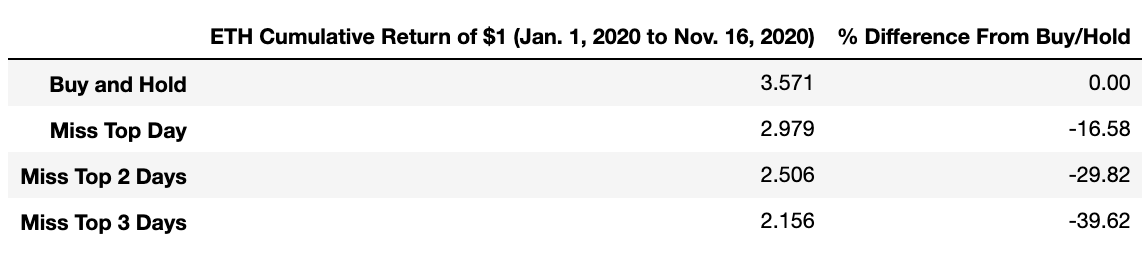

ETH YTD Cumulative Return: 3.571x

This means a $1 investment in BTC on Jan. 1, 2020 would be worth $2.323 today assuming we buy and hold.

BTC YTD Cumulative Return: 2.323x

ETH YTD Cumulative Return: 3.571x

This means a $1 investment in BTC on Jan. 1, 2020 would be worth $2.323 today assuming we buy and hold.

3. Now suppose we are actively trading/timing the market. If we missed the top three days which had the largest BTC or ETH return YTD, the cumulative end returns would be massively lower as shown in the plots below.

4. The top 3 daily returns for BTC and ETH during 2020 have made up nearly 40% and 50% respectively of the total cumulative return YTD.

In other words, 1% of the trading days since the start of this year are responsible for **nearly half** of the BTC and ETH cumulative returns.

In other words, 1% of the trading days since the start of this year are responsible for **nearly half** of the BTC and ETH cumulative returns.

5. Simply missing out on the top 3 days for BTC and ETH would underperform the buy and hold approach by 30% and 40% respectively (the rest of the time we're still buying and holding).

6. The point here is to help people think about whether their trading strategy has enough edge to beat buy/hold. This humble approach may not be fancy, but it'll generally be a better approach for most folks to grow and compound their wealth.

Read on Twitter

Read on Twitter