Today: Tesla will join the S&P 500

Few days ago: Cathie Wood’s Ark Invest Rocked as Shareholder Seeks Control https://www.bloomberg.com/news/articles/2020-11-16/takeover-battle-emerges-for-cathie-wood-s-ark-in-stellar-year https://twitter.com/cnbc/status/1328464667358990337

Few days ago: Cathie Wood’s Ark Invest Rocked as Shareholder Seeks Control https://www.bloomberg.com/news/articles/2020-11-16/takeover-battle-emerges-for-cathie-wood-s-ark-in-stellar-year https://twitter.com/cnbc/status/1328464667358990337

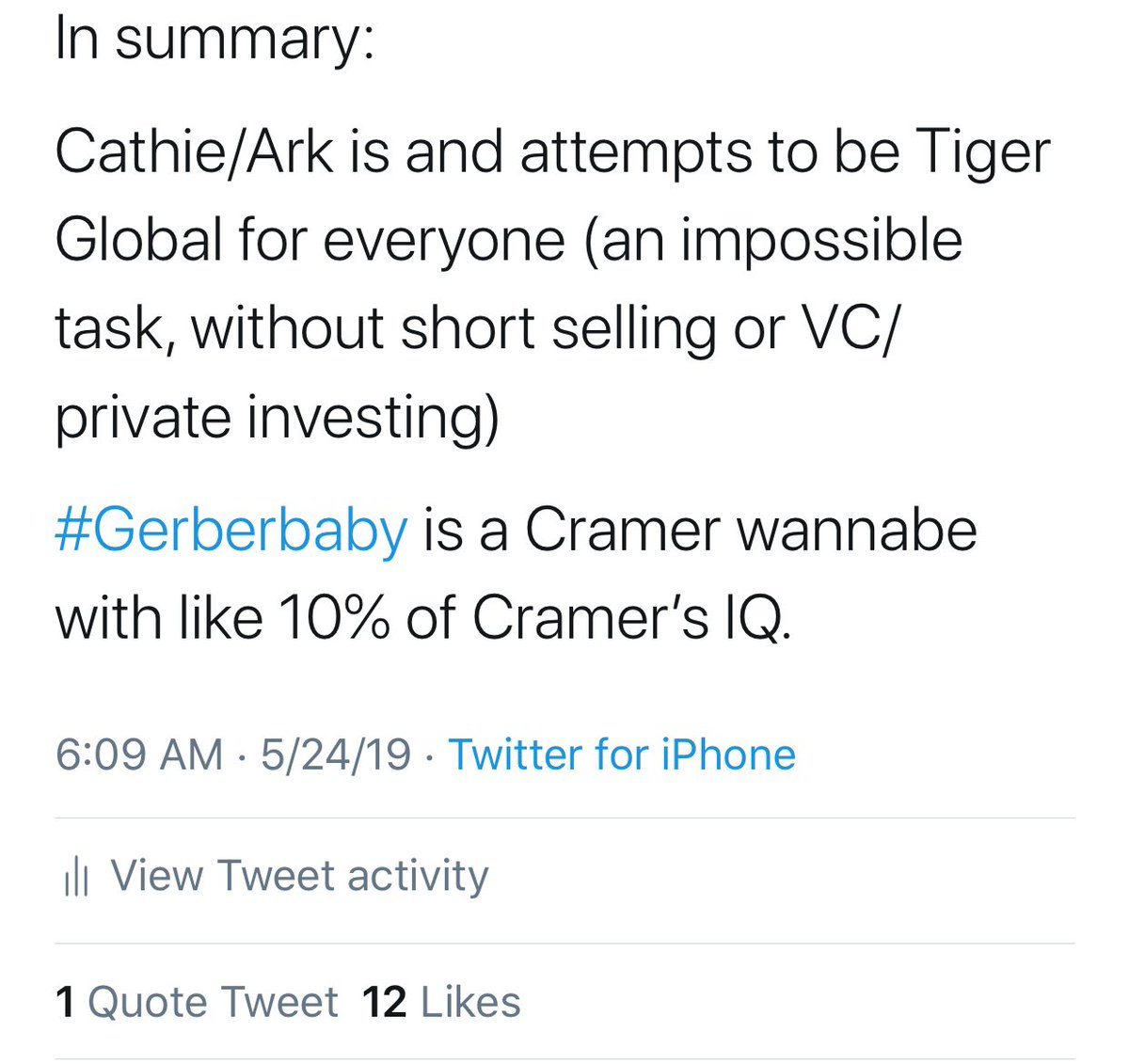

I was bullish Ark / Cathie Wood but not enough: https://twitter.com/longshorttrader/status/1131683682178228224

Dunking on cathie / ark has been a great way to boost engagement (likes/RTs) over the last few years... but it’s also been an incredibly costly endeavor.

I think this is correct. I interacted with @CathieDWood before she launched ARK. She dunked on Buffett/value way before it was trendy and consensus. In fact, her idea to launch was partially motivated by the fact she believed growth was under appreciated. Right for right reasons: https://twitter.com/ryansoh/status/1328483774527627264

One of the weirdest cognitive dissonances among some loud mouthed fintwit: hate on value/Buffett and hate on Cathie Wood/ARK. Funny, because that was her MO - putting $, time, where her mouth was - all in - not to mention bearing entrepreneurial risk.

Thing is even if the Qqqs, tech, startups etc were all to come crashing down, in my eyes, Cathie Wood/ARK still won.  right for reasons. Beginning, bearing entrepreneurial risk when it was contrarian and riding the wave to date.

right for reasons. Beginning, bearing entrepreneurial risk when it was contrarian and riding the wave to date.

right for reasons. Beginning, bearing entrepreneurial risk when it was contrarian and riding the wave to date.

right for reasons. Beginning, bearing entrepreneurial risk when it was contrarian and riding the wave to date.

Read my thread. This is incorrect IMO. Cathie was dunking on value and buffett before it was fashionable and consensus. Years before. In fact, she put her own $ to bet against that, and bet on growth. Skin In the game https://twitter.com/johnlawsite/status/1328489693185503234

I can't vouch for the validity of EVERY SINGLE position ARK, nor the analysis (or lack thereof) for every single position. But here is what I can attest to: I interacted with Cathie 5ish years ago. Her vision + thesis were proven correct ever since: https://twitter.com/blane9171/status/1328490975782707200

and what was that vision + thesis? To articulate with a bit more clairvoyance (paraphrasing):

"I am super bullish disruption + innovation. I am very bearish stagnation/status quo. I also find disruption/innovation to be cheap relative to stagnation/status quo." - 5 years ago

"I am super bullish disruption + innovation. I am very bearish stagnation/status quo. I also find disruption/innovation to be cheap relative to stagnation/status quo." - 5 years ago

"oh wow druckenmiller is god, and tiger global is god emperor... haha ark is a contradicator, bunch of stupid positions"

these have not been consistent takes.. but they've been abundant in this platform.

these have not been consistent takes.. but they've been abundant in this platform.

in my interaction 5 years ago, half of the thesis was fundamental - opportunity in disruptive/tech industries. The other half of the thesis was belief the market underinvested/underappreciated these. So there was a fundamental + market component: https://twitter.com/GumdropCap/status/1328494182751670272

we are in a bubble induced by the central banks for the last 5 years, and that's why value names have been sucking so much? So central banks are the reason long disruption/innovation , short stagnation/status quo has been doing so well over last 5 years? https://twitter.com/JohnLawSite/status/1328495311539609600

Read on Twitter

Read on Twitter