Thread: I disagree with a lot of my friends on the student loan issue. First, the “how about you don’t take a loan you can’t pay?” line feels very shallow and obtuse. I’ll use myself as an example. When I was a senior in high school it was made to seem there was no

other option in life other than going to college. If I didn’t, I had no future and couldn’t provide for myself. Now, this is not actually true, nonetheless, our public education system is designed as a pipeline to college. That needs to be fixed. Preparing

students for a trade is just as viable and worthy of respect as college, and our current system doesn’t even mention it. So when I took my loan, it could’ve been for $500,000 and I would’ve taken it, how could I not when I was so ignorant? My parents

likely didn’t know better as they, too, had been propagandized into thinking I had to be in college. That’s first off, but more importantly, the cost of college has far outpaced wage growth. In 1987, the cost of a 4 year undergraduate degree was $12,760.

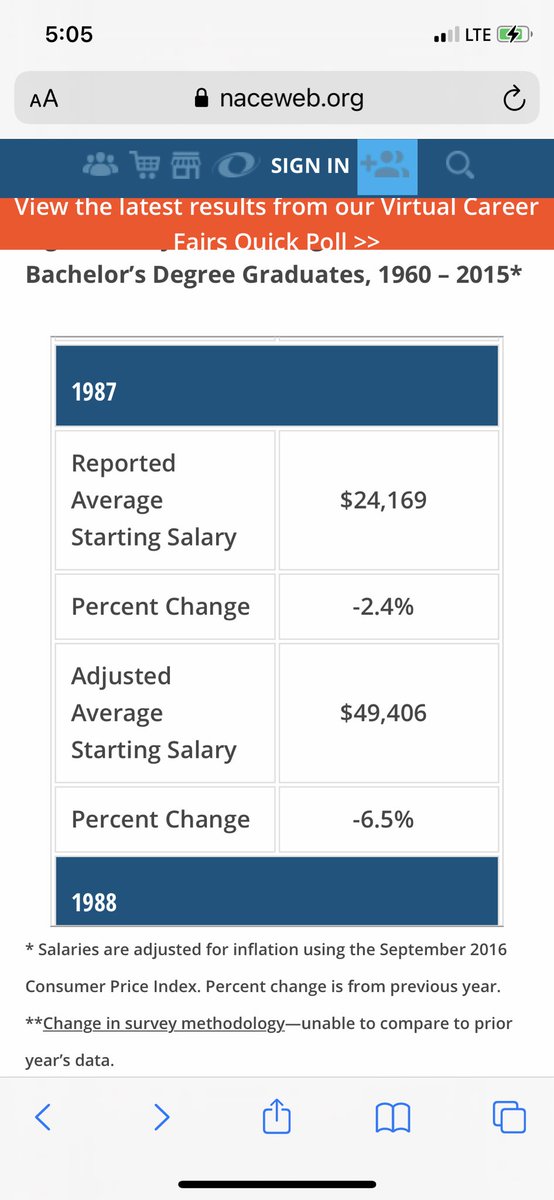

In 1987, the average first year salary for a business degree was $49,406. One could comfortably pay off an entire student loan debt in their first 2 years after graduation with little effort.

However, in 2015 ( approximating for 2017-18 since I couldn’t get that data) the average first year graduate earned $50,219. That’s a 1.6% increase in inflation adjusted wages for 212% increase in tuition. It’s absurd. Here’s where libs are wrong:

The student loan debt should be written down, not eliminated, so that it more closely reflects earning potential and the universities should take the losses. This is the universities’ responsibility to provide value and they failed. This will teach them a lesson.

Read on Twitter

Read on Twitter