Factor Diversification is Dead:

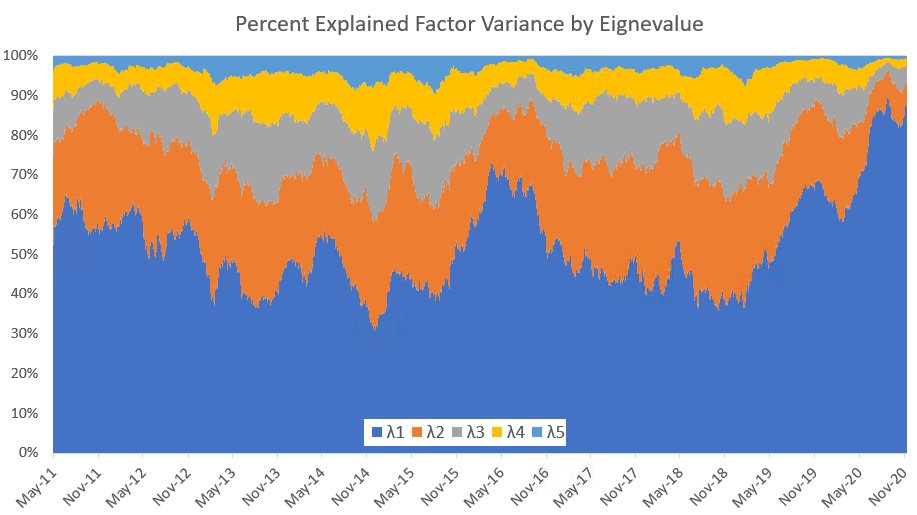

The chart below shows explained variance of eigenvalues from the rank correlation for 5 long-short factors: Value, Quality, Momentum, Size (SMB), and Low Beta.

It typically takes 3 dimensions to explain 90% of noise, this has collapsed to 1-d!

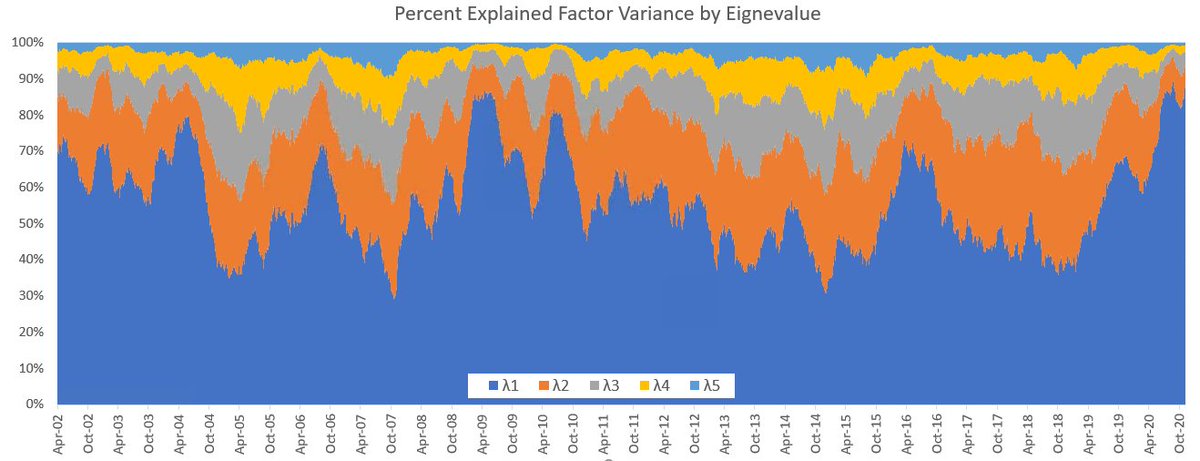

The chart below shows explained variance of eigenvalues from the rank correlation for 5 long-short factors: Value, Quality, Momentum, Size (SMB), and Low Beta.

It typically takes 3 dimensions to explain 90% of noise, this has collapsed to 1-d!

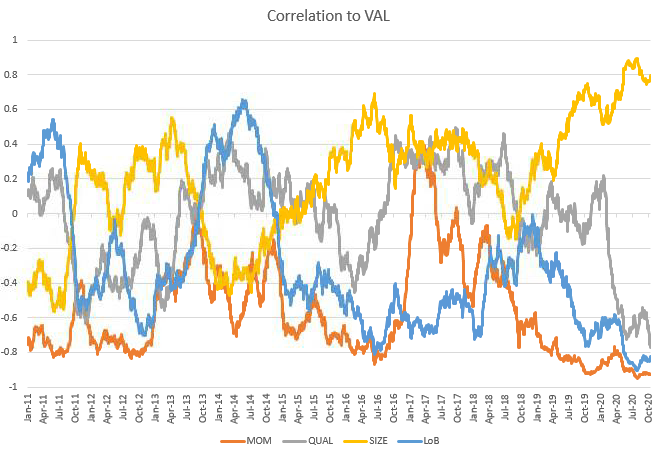

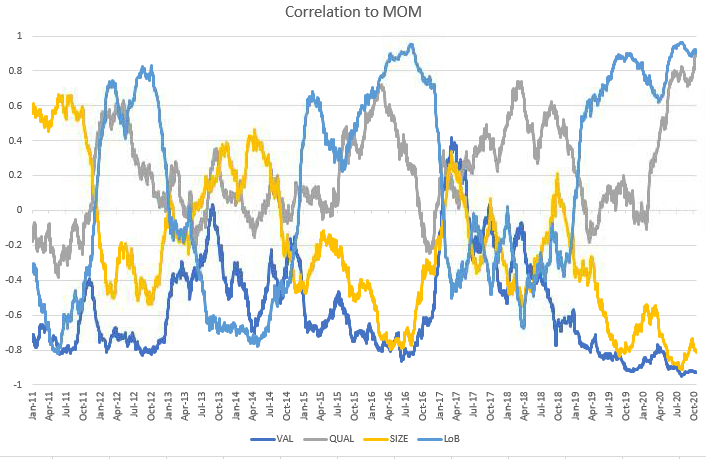

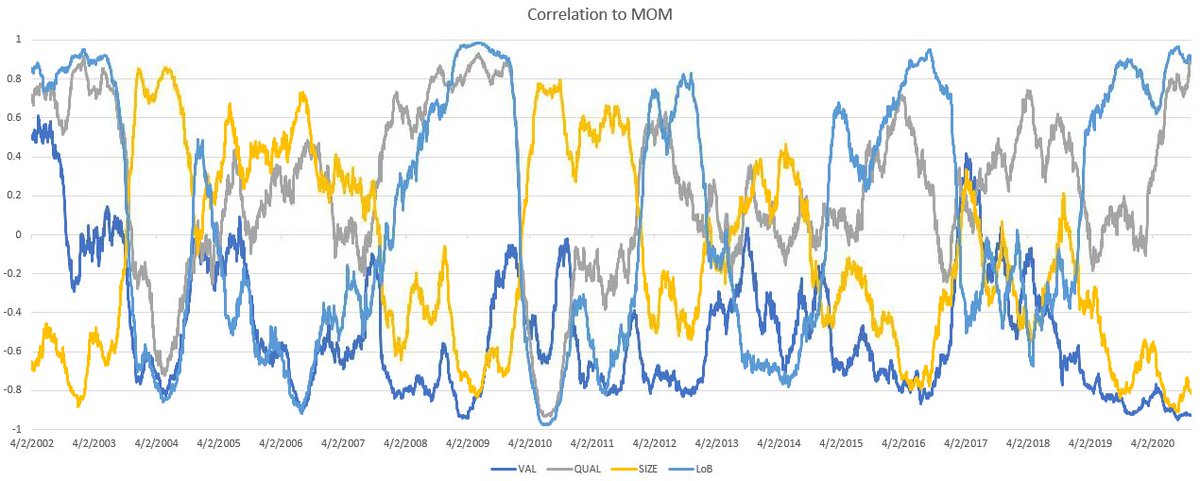

We can also see this from the rank correlations themselves. VAL/MOM is always the biggest bet. You used to get diversification from SIZE, QUAL, and Loβ.

Now SIZE is VAL and MOM is Loβ!!!

This started in Q4 and was cemented by c-19. Factor investors already know this though.

Now SIZE is VAL and MOM is Loβ!!!

This started in Q4 and was cemented by c-19. Factor investors already know this though.

This analysis based on Dow Jones Thematic Long short indices which are sector neutral.

Used Spearman Correlation on trailing 3-month returns. This keeps things a little more sane when we get the blowout moves like last week.

Used Spearman Correlation on trailing 3-month returns. This keeps things a little more sane when we get the blowout moves like last week.

Extended this back as far as the indices will allow. We similar spikes in factor correlation a couple of times.

Notably, this set up looks eerily similar to the MOM crash of March 2009. Basically, the market was volatile so people piled into quality and low vol. Momentum started tracking these, setting up a 1-d market.

A little good news and short momentum (value) rallied hard.

A little good news and short momentum (value) rallied hard.

Read on Twitter

Read on Twitter