Seth Klarman in 1991: "I traded my first stock when I was 10."

"We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners."

"We started out with three families. Each of these had had [a liquidity event.]"

"We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners."

"We started out with three families. Each of these had had [a liquidity event.]"

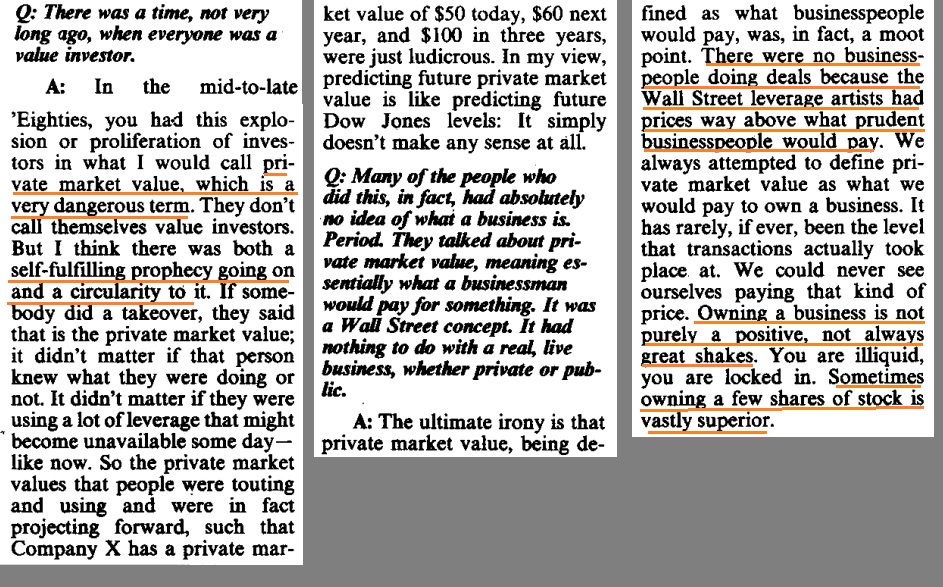

Barron's: "There was a time when everyone was a value investor." (plus ca change)

"Private market value - self-fulfilling prophecy and circularity" as takeovers set the new reference price.

"The ultimate irony... no business-people were doing deals" because prices were too high

"Private market value - self-fulfilling prophecy and circularity" as takeovers set the new reference price.

"The ultimate irony... no business-people were doing deals" because prices were too high

"Owning a business is not purely a pure positive. Sometimes owning a few shares of stock is vastly superior."

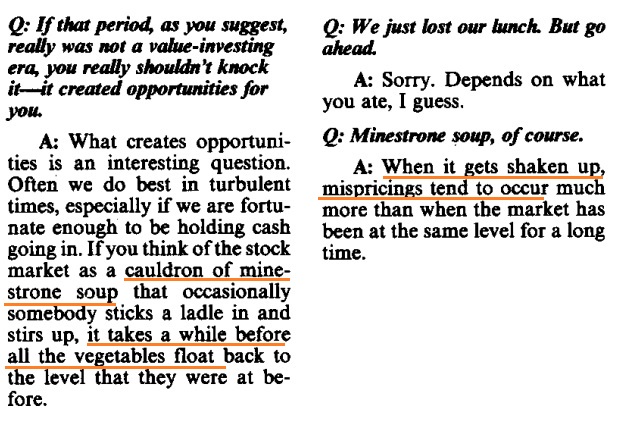

"What creates opportunity is an interesting question."

"Think of the stock market as a cauldron of minestrone soup. When it gets shaken up, mispricings tend to occur.

It takes a while before all the vegetables float back."

"Think of the stock market as a cauldron of minestrone soup. When it gets shaken up, mispricings tend to occur.

It takes a while before all the vegetables float back."

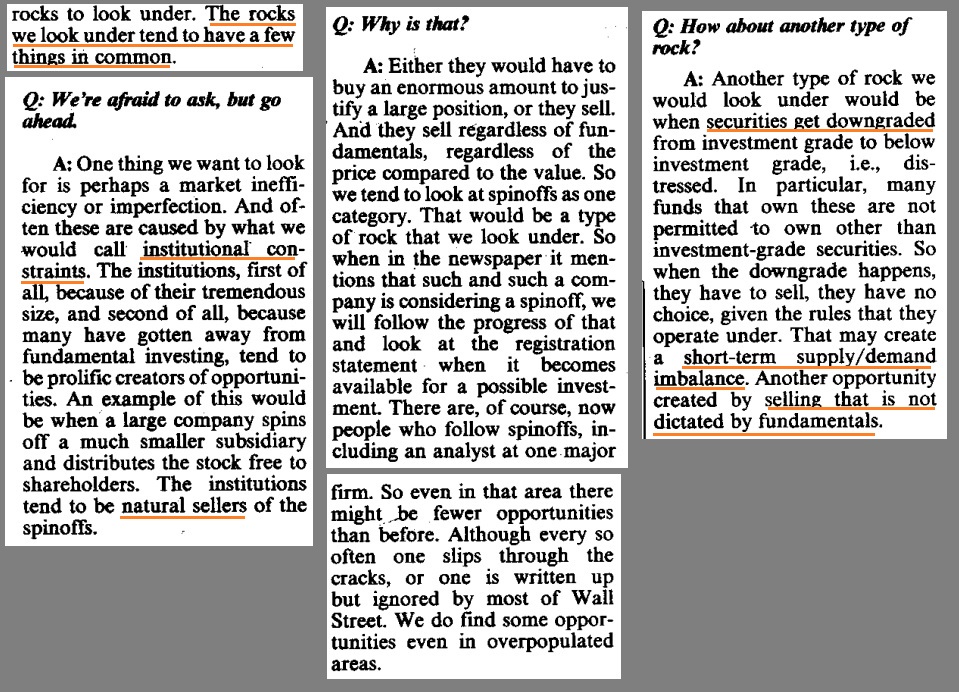

"The rocks we look under tend to have a few things in common."

> Institutional constraints

> Selling that is not dictated by fundamentals creating a short-term supply/demand imbalance

Not "spinoffs!" but situations where institutions turn into "natural sellers."

> Institutional constraints

> Selling that is not dictated by fundamentals creating a short-term supply/demand imbalance

Not "spinoffs!" but situations where institutions turn into "natural sellers."

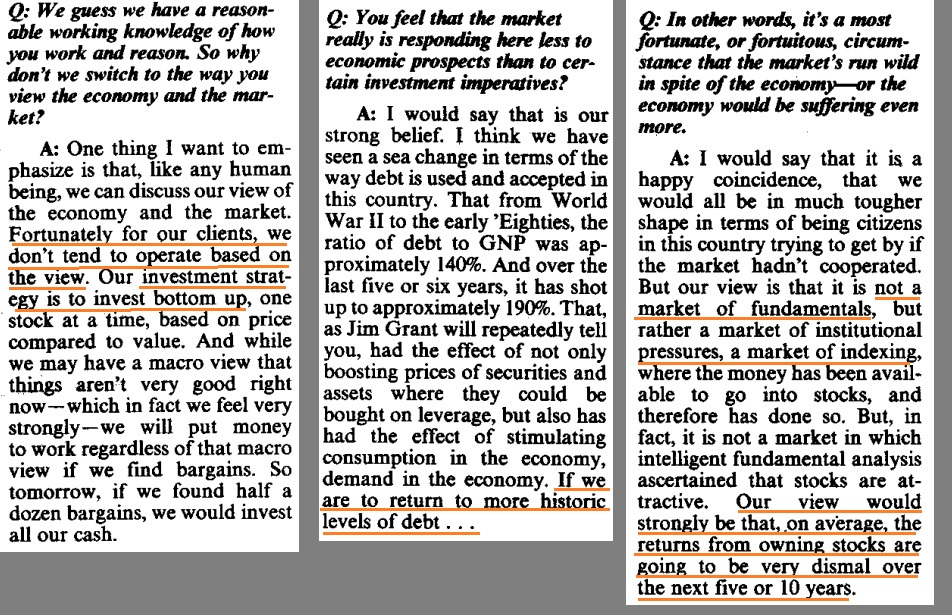

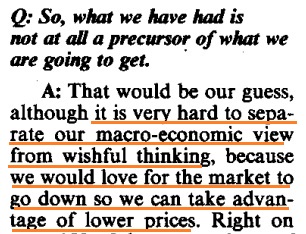

Predictions are difficult, especially about the future:

"Our view would strongly be that the returns from owning stocks are going to be dismal over the next 5-10 years."

(Dow up 3x within the decade)

"Fortunately we don't operate based on the view. Our strategy is bottom up."

"Our view would strongly be that the returns from owning stocks are going to be dismal over the next 5-10 years."

(Dow up 3x within the decade)

"Fortunately we don't operate based on the view. Our strategy is bottom up."

Read on Twitter

Read on Twitter![Seth Klarman in 1991: "I traded my first stock when I was 10.""We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners.""We started out with three families. Each of these had had [a liquidity event.]" Seth Klarman in 1991: "I traded my first stock when I was 10.""We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners.""We started out with three families. Each of these had had [a liquidity event.]"](https://pbs.twimg.com/media/Em9piytXMAYIcP3.jpg)

![Seth Klarman in 1991: "I traded my first stock when I was 10.""We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners.""We started out with three families. Each of these had had [a liquidity event.]" Seth Klarman in 1991: "I traded my first stock when I was 10.""We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners.""We started out with three families. Each of these had had [a liquidity event.]"](https://pbs.twimg.com/media/Em9plhJWEAIZM67.jpg)

![Seth Klarman in 1991: "I traded my first stock when I was 10.""We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners.""We started out with three families. Each of these had had [a liquidity event.]" Seth Klarman in 1991: "I traded my first stock when I was 10.""We set out at the beginning to be somewhat unconventional, with our clients acting as board members and as part owners.""We started out with three families. Each of these had had [a liquidity event.]"](https://pbs.twimg.com/media/Em9p2QdXUAoDOHG.jpg)