Early impacts of the UK Soft Drinks Industry Levy ('soda tax') on household purchases: 2y after announcement, just before it came into effect, no change in the volume of, or amount of sugar in, soft drinks purchases.

But that's not the whole story... https://journals.plos.org/plosmedicine/article?id=10.1371/journal.pmed.1003269#ack

But that's not the whole story... https://journals.plos.org/plosmedicine/article?id=10.1371/journal.pmed.1003269#ack

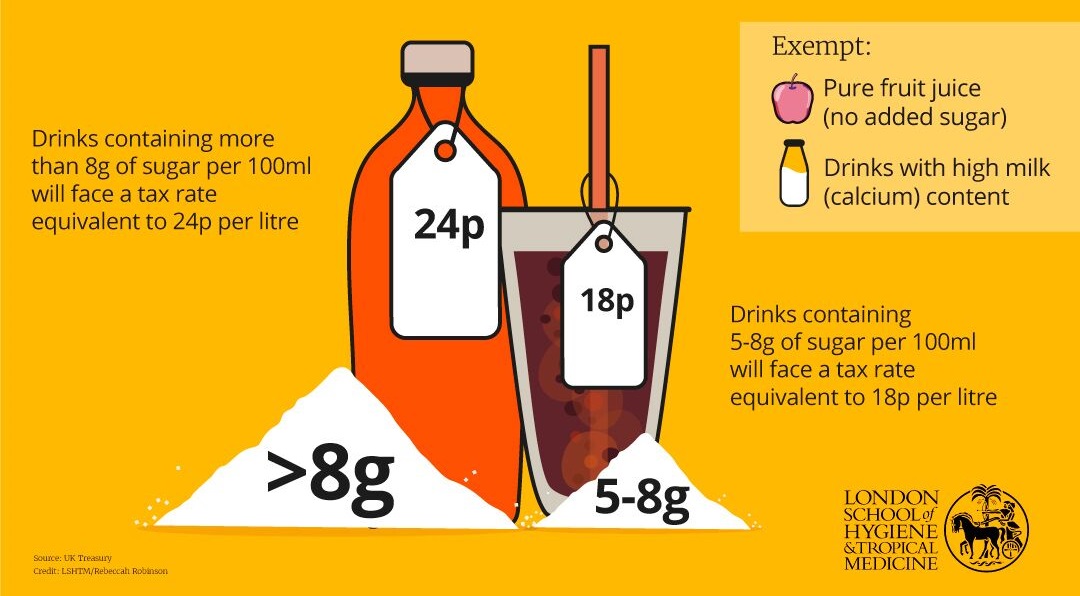

The SDIL is a two tier tax on manufacturers & importers of sugary drinks. Drinks with <5g sugar/100ml aren't charged; those with 5-8g are charged 18p per litre; those with >8g are charged 24p. There are a few exempt drinks categories.

The SDIL was deliberately announced 2y before is was implemented to give industry time to adjust. The tiered nature is also an indication that the SDIL was supposed to incentivise manufacturers to reduce the amount of sugar in their drinks.

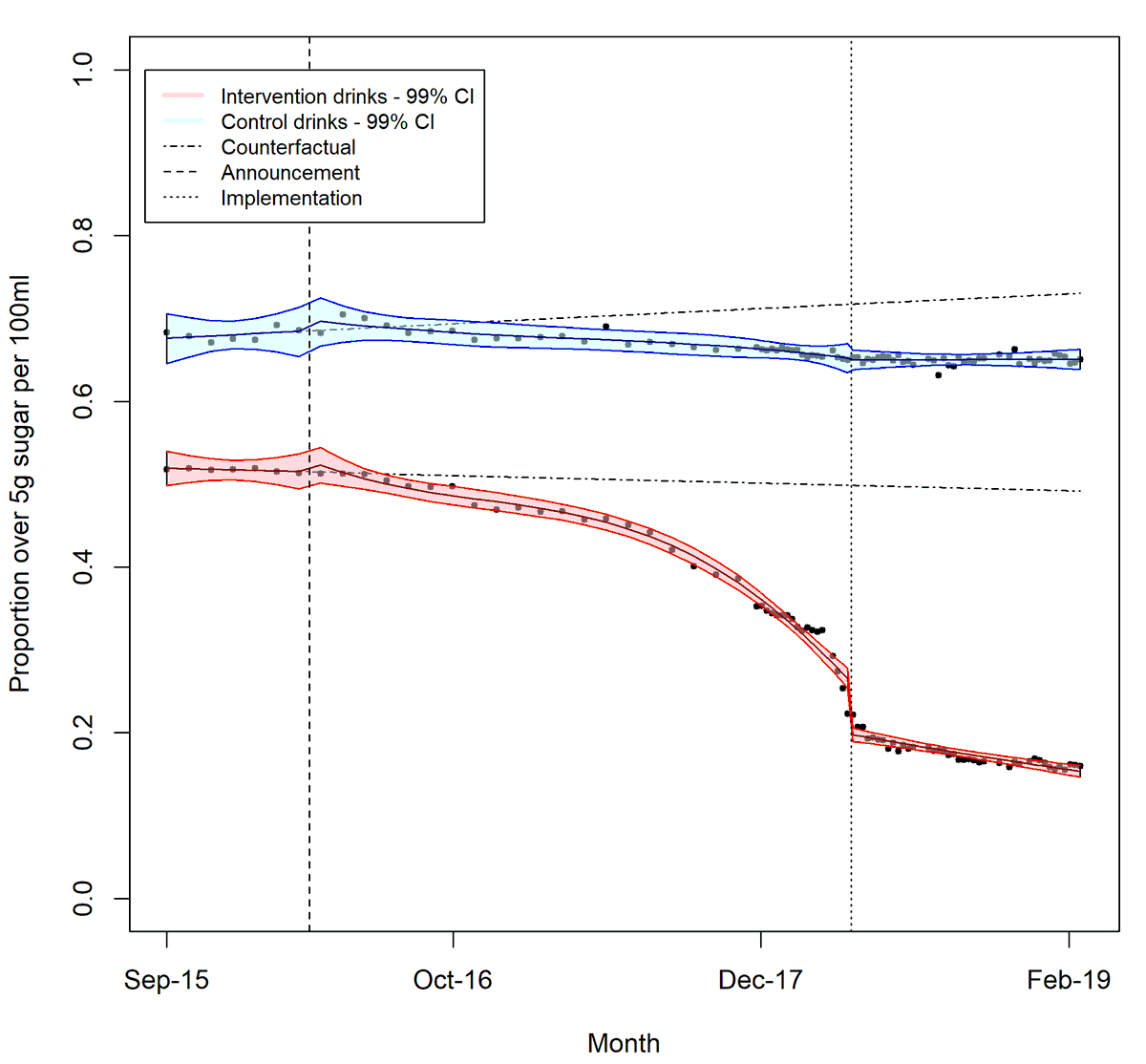

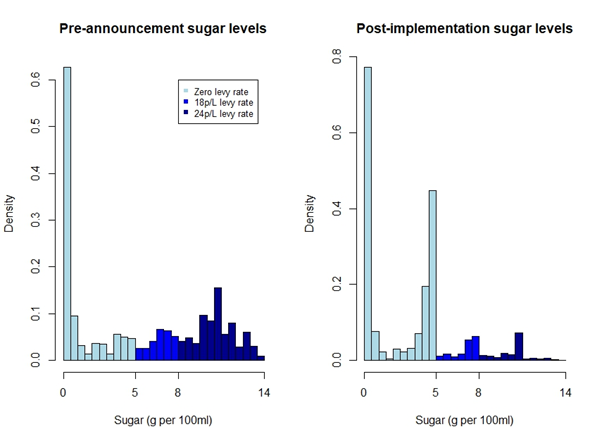

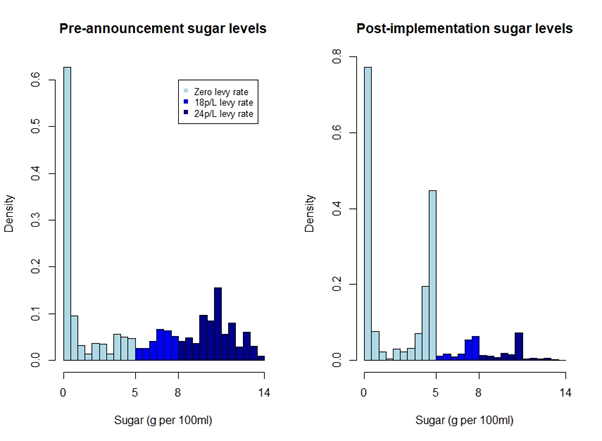

In previous work led by @Pete_Scarbs there was evidence of substantial reformulation of the UK soft drinks market in the months before the levy came into effect. The proportion of drinks with >5g sugar/100ml decreased by 33 percentage points. https://journals.plos.org/plosmedicine/article?id=10.1371/journal.pmed.1003025

This graph shows the distribution of sugar concentration in the soft drinks market pre-announcement & pre-implementation. Pre-implemenation there are fewer drinks with >5g sugar/100ml. But LOTS more drinks with just less than 5g/100ml. Manufacturers are reformulating 'to target'?

In our new paper, we used household scanner data to track purchases of soft drinks by UK households over time - from 2y before to 2y after the SDIL was announced. We studied volume purchased and the sugar in those purchases. Our analysis stops just before the levy was implemented

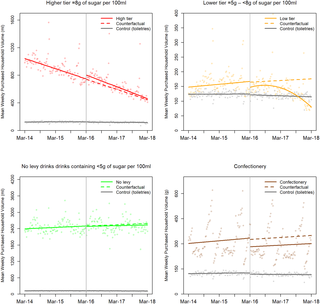

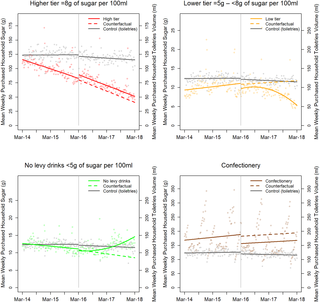

Looking at volume first, 2 things stand out. 1. there's a big drop off in volume of low levy tier drinks purchased following announcement. 2. there's a strong downward existing trend in purchases of high levy tier drinks that didn't change much. Consumers are changing anyway?

When we combined all drinks (including exempt categories), there was no overall change in total volume of soft drinks purchased 2y after announcement compared to the trends expected from 2y before.

When we look at sugar the trends in individual categories are a bit different. There's the same existing downward trend in high tier drinks. The big drop off in low tier drinks is seen again. But there's also an increase in sugar purchased from drinks in the no levy category.

The increase in sugar purchased from drinks in the no levy category reflects the changes in the market we saw above - more drinks have just less than 5g sugar/100ml after announcement than before. Here's that graph again to remind you.

If we put the increase in sugar purchased from no levy drinks together with the decrease from low levy tier drinks, the result is no overall change in sugar purchased from all soft drinks by UK households at 2 years post announcement compared to trends expected from 2y before.

Confectionery is included in our analyses (in brown in the figures above) to check whether people just got their sugar fix from sweets rather than soft drinks! No evidence of that. Or that they moved over to alcohol instead.

Together with the previous paper on the drinks market, this new paper indicates that even before the levy was implemented it seemed to be achieving substantial changes in what soft drinks UK households buy.

The announcement alone wasn't enough to achieve changes that might impact on public health. But it was never expected to. In the previous paper, implementation led to further changes in sugar and price.

Stayed tuned for impacts of implementation on purchases.....

Stayed tuned for impacts of implementation on purchases.....

This analysis was led by David Pell, and the work included a superstar team that I'm v grateful to be part of @TarraPenney @olimytton @ADMBriggs @stevencjcummins @MikeRayner @harryrutter @Pete_Scarbs @ProfRichSmith @martinwhite33

Read on Twitter

Read on Twitter