Biden could provide business and household relief by eliminating Trump tariffs: https://tax.foundation/32OBAR8

Relying on rarely used sections of trade law, President Trump used executive authority to impose tariffs on the import of solar panels, washing machines, steel and aluminum, Chinese products, and other types of goods. These tariffs invited retaliation from other countries.

Tariffs raise prices and reduce the quantity of goods available to U.S. businesses and consumers, which results in lower incomes, reduced employment, and lower economic output.

Tariffs are regressive, meaning their tax burden falls hardest on lower- and middle-income households.

Tariffs are regressive, meaning their tax burden falls hardest on lower- and middle-income households.

We estimate that the Trump administration tariffs amount to an annual tax increase of $80 billion.

If left in place permanently, we estimate that the tariffs would reduce long-term output by 0.23% (~13.5% of the long-run impact of the TCJA) and eliminate nearly 180k FTE jobs.

If left in place permanently, we estimate that the tariffs would reduce long-term output by 0.23% (~13.5% of the long-run impact of the TCJA) and eliminate nearly 180k FTE jobs.

Reducing or eliminating the Trump tariffs, which a Biden administration could do without congressional authorization, would be a relatively quick form of relief to businesses and households, with outsized benefits to lower- and middle-income households (tariffs are regressive).

Some might argue that even though tariffs are damaging, the Trump administration had good reason to impose them.

However, the evidence on tariffs shows that the negative effects outweigh any small, temporary protection that may be afforded to specific industries.

However, the evidence on tariffs shows that the negative effects outweigh any small, temporary protection that may be afforded to specific industries.

A recent study, “Macroeconomic Consequences of Tariffs,” reviews tariff changes across 151 countries from 1963-2014 and finds that tariff increases lead to less output and more unemployment and inequality. Negative effects are magnified during expansions and in advanced economies

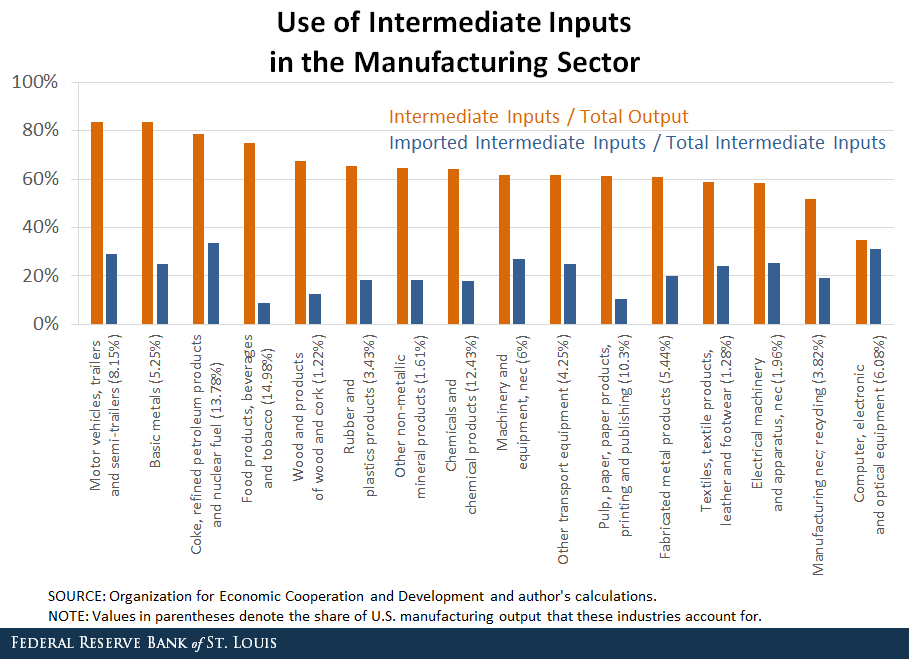

A St. Louis Fed study analyzed how tariffs on Chinese imports impact the US manufacturing sector, supporting the idea that raising tariffs on intermediate goods hurt manufacturers more than it helps since tariffs significantly increase costs of production across US manufacturing.

Another St. Louis Fed study analyzed the correlation between trade exposure and economic activity, finding “states that were very exposed to trade at the onset of the trade war experienced worse outcomes in terms of employment and output growth.”

The Cato Institute’s @scottlincicome notes this St. Louis Fed study also pokes a hole in the idea that protectionist policies are politically helpful. https://bit.ly/36Kw2Za

Recent @federalreserve study: positive effects of import protection for US manufacturing are "offset by larger negative effects from rising input costs and retaliatory tariffs. Higher tariffs are also associated with relative increases in producer prices via rising input costs.”

. @scottlincicome on the failure of steel tariffs: “After two-plus years of ‘national security’ tariffs and quotas on a wide range of steel imports from almost all major sources, Big Steel is once again hurting and going back to the government for help...

...What they don’t mention, however, is what might actually work: eliminating the tariffs, which have been shown to hurt US manufacturing and several domestic steelmakers, and imposing long‐term market discipline on Big Steel—a discipline it hasn’t faced in decades (if ever).”

While there is wide agreement that concerns over unfair trading practices ought to be addressed, the tariffs imposed by Trump are not the appropriate policy tool.

Ultimately, tariffs result in net decreases in productivity, output, and income.

Consumers lose more than producers gain from tariffs, resulting in a net loss to the economy.

Tariffs also have a negative effect on America’s global relationships.

Consumers lose more than producers gain from tariffs, resulting in a net loss to the economy.

Tariffs also have a negative effect on America’s global relationships.

President-elect Biden reducing or eliminating the Trump administration tariffs would provide immediate relief to U.S. businesses and households as imports would no longer face those taxes, though business adjustments may take some time.

It would also signal the end of the era of trade uncertainty caused by the Trump administration and would be a positive move toward rebuilding damaged trading relationships while working with allies to address unfair trading practices.

Read on Twitter

Read on Twitter