Breaking

Breaking

Letter 125 leading influencers responding to @RishiSunak plans for greening finance.

Spoiler Alert

Spoiler Alert : Incremental "BAU" adjustments that rely purely on the efficiency of markets won't do. We need to reshape finance to support jobs in line with a green recovery.

: Incremental "BAU" adjustments that rely purely on the efficiency of markets won't do. We need to reshape finance to support jobs in line with a green recovery.

TCFD aligned disclosures mandatory across a large part of the UK economy, as well as the Bank of England’s confirmation that it will conduct the postponed climate stress test in June 2021, are laudable. But just these are first steps towards greening Britain’s financial system...

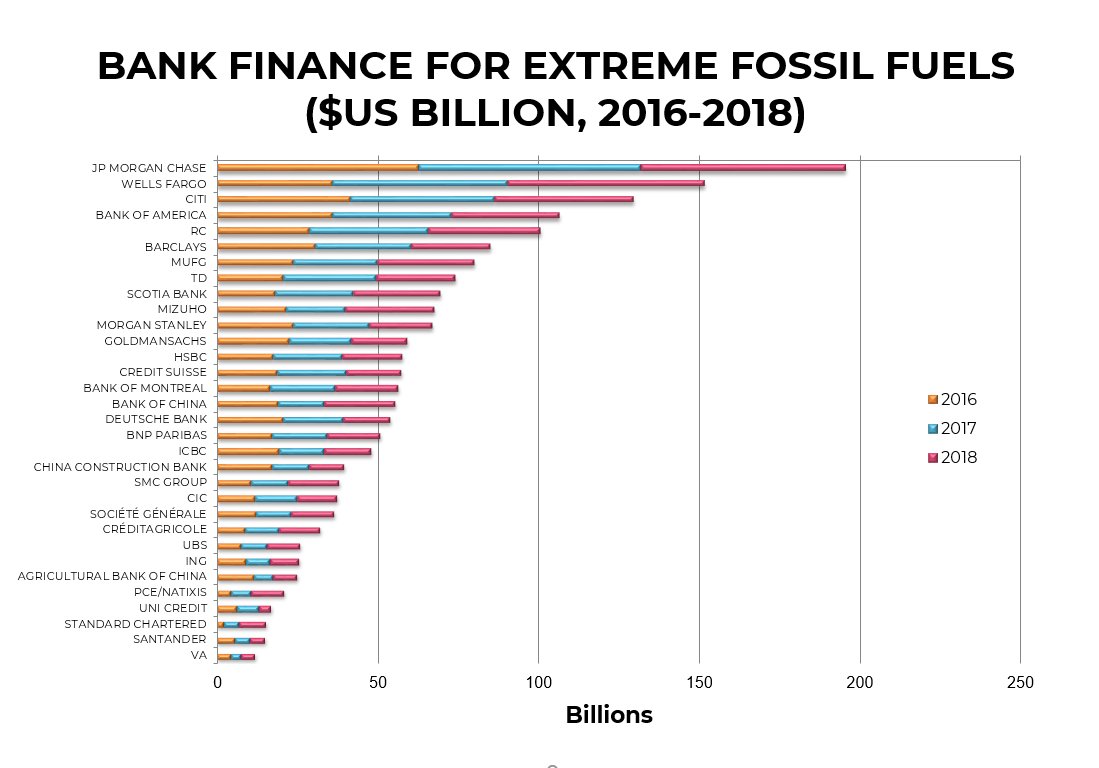

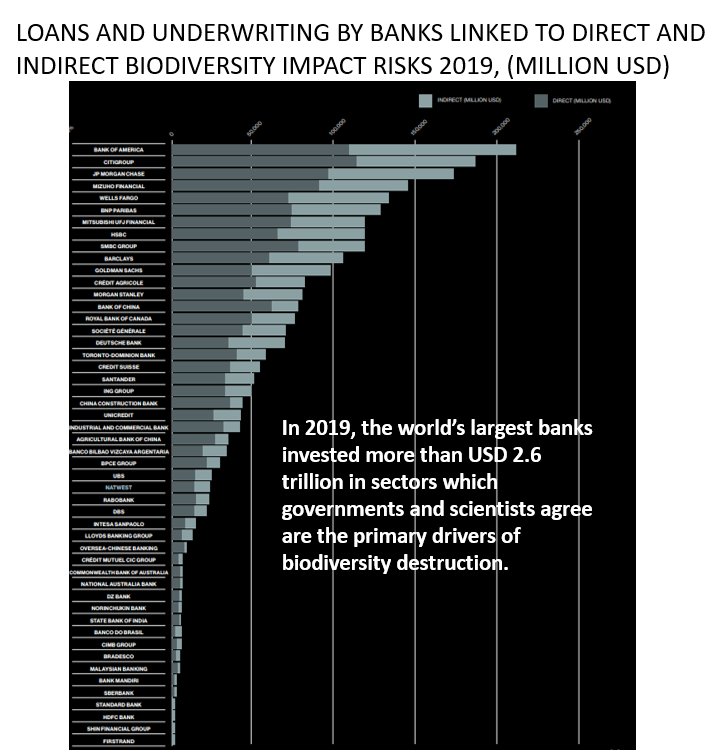

The Paris Climate Agreement and TCFD were established in 2015. From 2016-2018 banks poured $1.9 trillion of financing into fossil fuels. In 2019 alone, $2.6 trillion went into areas governments and scientists agree are the primary drivers of biodiversity destruction.

Disclosures & climate stress testing rely on three flawed assumptions: 1) financial markets are perfectly efficient and can effectively self-regulate. The incalculable human of the 2008 GFC was a crude reminder of what happens when financial markets are left to their own devices.

2) The effectiveness of disclosures+climate-stress testing relies climate risks being quantifiable- all that markets need is more transparency and information, and everything will be pareto optimal. Completely neglecting Knightian/fundamental uncertainty. See @BIS_org report.

Big ‘unknown unknowns’ mean financial markets may not be able to accurately ‘price in’ climate risks. Relying solely on market-led approaches therefore risks both failing to manage financial risks and failing to ‘green’ flows within required timeframe. https://www.ucl.ac.uk/bartlett/public-purpose/sites/public-purpose/files/iipp-wp-2019-13-climate-related-financial-policy-in-a-world-of-radical-undertainty-web.pdf

3) The set-up of the current financial system is not geared towards providing the vital patient strategic finance needed to support jobs, businesses and local communities in line with a green recovery.

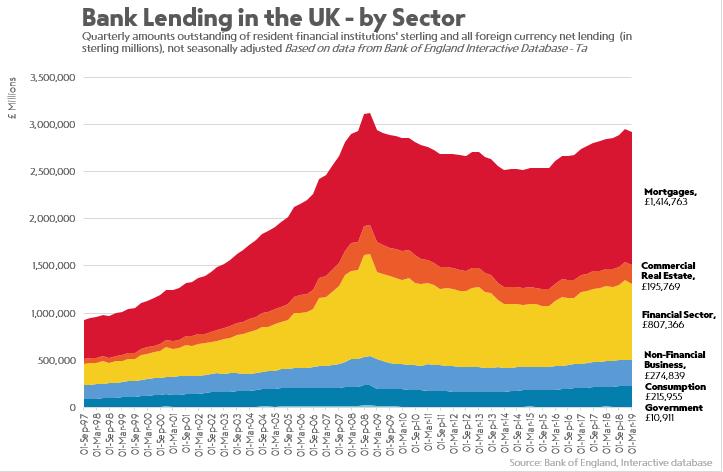

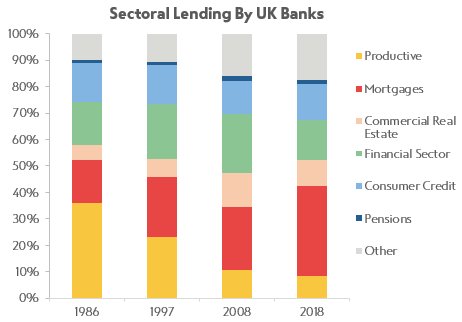

Prior to the crisis, a significant share of bank credit was directed towards property and real estate (55%) and the financial sector (26%) with very little lending (8.5%) for non-financial businesses.

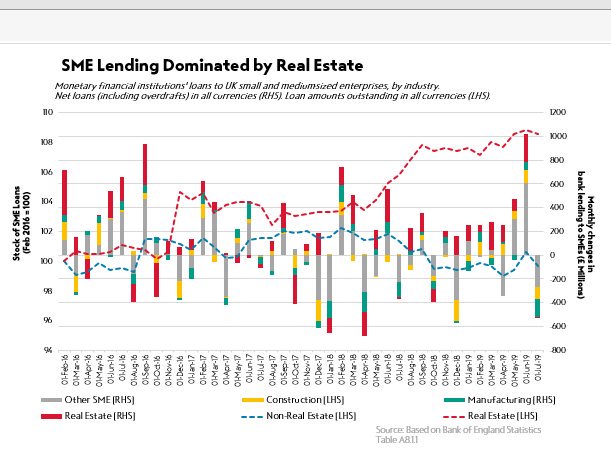

Of the business loans, only 2-3% of all bank lending was for SMEs that form the backbone of our economy – 99.9% of UK businesses are SMEs, 60% of private sector jobs come from SMEs, while 40% of GDP is derived from SMEs. Most of this SME lending was for real estate!

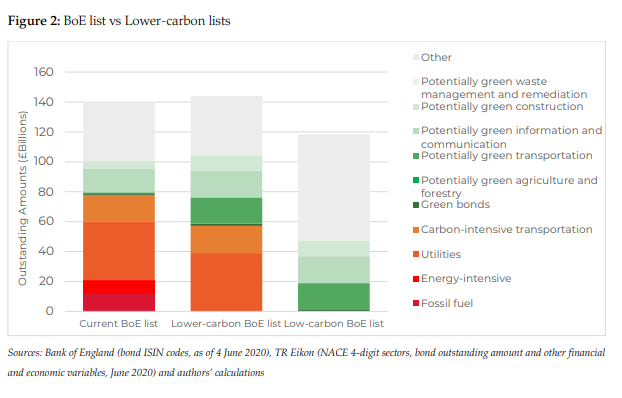

According to the @BankofEngland, the City of London is complicit in setting us on the path for more than 3.5 degrees. The Bank’s own corporate bond portfolio is currently aligned with this 3.5 degrees pathway. See https://neweconomics.org/uploads/files/NEF-Decarbonise-BoE-report.pdf

This mismatch between rhetoric and action on the part of the Bank is not only undermining the UK government’s climate targets, but also the high risk standards to which it is supposed to hold private financial institutions to account. See

https://neweconomics.org/2020/08/decarbonising-the-bank-of-englands-pandemic-qe

https://neweconomics.org/2020/08/decarbonising-the-bank-of-englands-pandemic-qe

https://neweconomics.org/2020/08/decarbonising-the-bank-of-englands-pandemic-qe

https://neweconomics.org/2020/08/decarbonising-the-bank-of-englands-pandemic-qe

Instead of being led by markets, the @hmtreasury and @bankofengland need to take a proactive approach. For this to happen the Treasury needs to equip the Bank with an updated mandate that clearly outlines its role in supporting the green recovery. The Bank could then:

1) Encourage private financial flows towards green, job-creating projects. This can be achieved by including climate-related criteria in the Term Funding Scheme to provide cheaper funding for sustainable investments. Like greening @ECB TLTROs https://www.positivemoney.eu/2020/09/green-tltros/

2) Integrate climate-related financial risks into its collateral framework and asset purchases. Governor Andrew Bailey has already said this is ‘perfectly sensible’, but since March the Bank has been waiting for the Treasury to adjust its mandate. https://neweconomics.org/2020/08/road-to-recovery

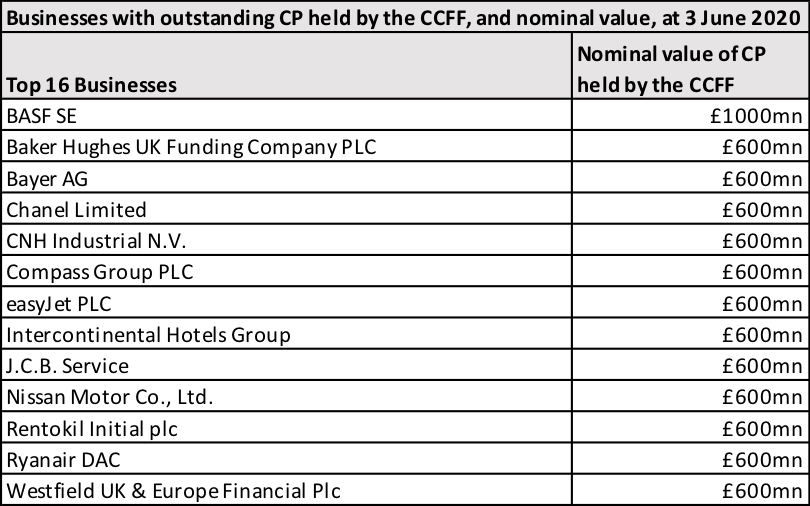

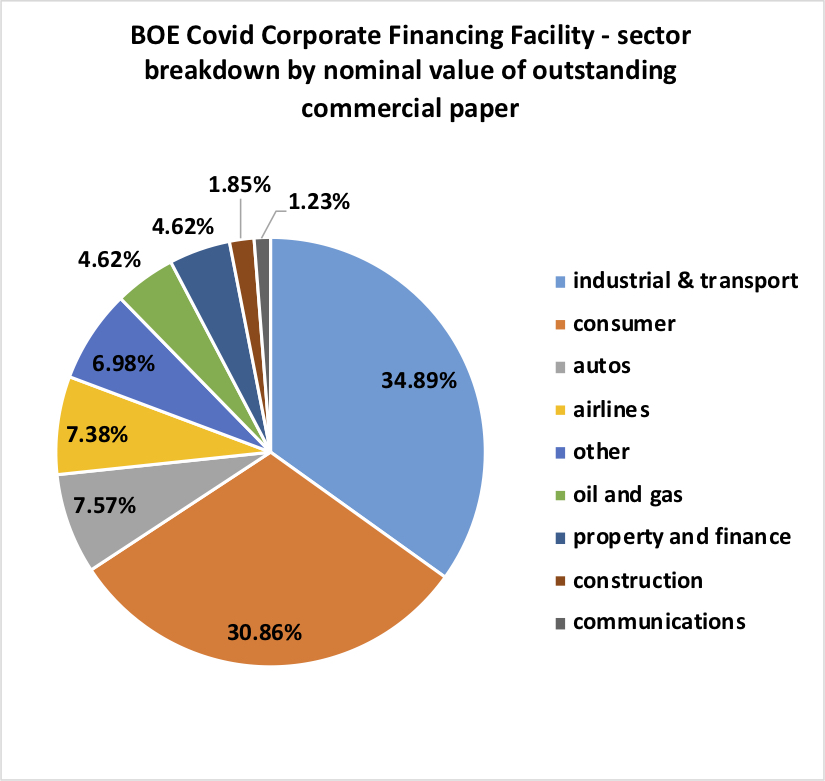

3) Permit the Bank capitalise a new Green Investment Bank to support lending to businesses for green activities. It could reinvest the maturing (dirty) proceeds of the Covid Corporate Financing Facility into a GIB, which would not increase the net debt burden of the government.

We @jryancollins show similar policies have been extremely successful throughout history - including by Roosevelt to support the New Deal. Why cant we do the same for a green and just recovery in the face of world's worst recession and climate crisis? https://www.ucl.ac.uk/bartlett/public-purpose/publications/2018/aug/bringing-helicopter-ground

Finally, the establishment of a green taxonomyis commendable. But limiting the taxonomy to green activities will not necessarily encourage a move away from financing activities that undermine climate goals. We need a dirty taxonomy as well! https://www.theguardian.com/business/2020/nov/16/bank-of-england-needs-more-powers-to-decarbonise-economy-say-experts

You find a full copy of the letter here - with list of 125 signatories. Which includes @willem_buiter @StephanieKelton @Nouriel @yanisvaroufakis @adam_tooze and so many more amazing people. Thanks so much! https://docs.google.com/document/d/1JO8yCV_TAtzA17cBn7Bbv7SdV_ikZVtxBXifBSI_ph8/edit

Read on Twitter

Read on Twitter