Mr. Market looks at everything Slack does through poo-colored glasses.

It's wrong.

Today, The $WORK Bulls are typing...

It's wrong.

Today, The $WORK Bulls are typing...

I've written about Slack before, but I've never laid out my bull case explicitly. Here it is, in all its 6,900 word glory. Nice! https://notboring.substack.com/p/slack-the-bulls-are-typing

I've been bullish on @SlackHQ since the day it IPO'd in June 2019, and I keep buying the dips.

In the words of Carrie Mathison, "I have never been so sure, and so. wrong." https://twitter.com/packyM/status/1141669805004611590?s=20

In the words of Carrie Mathison, "I have never been so sure, and so. wrong." https://twitter.com/packyM/status/1141669805004611590?s=20

But at some poing, the narrative on $WORK will change, and it will rip. Here's the thesis:

What is Slack?

It's always has a hard time defining itself. As @Stewart put it:

"It’s always been the kind of thing that people don’t know they want, but once they have it, they can’t live without it."

It's always has a hard time defining itself. As @Stewart put it:

"It’s always been the kind of thing that people don’t know they want, but once they have it, they can’t live without it."

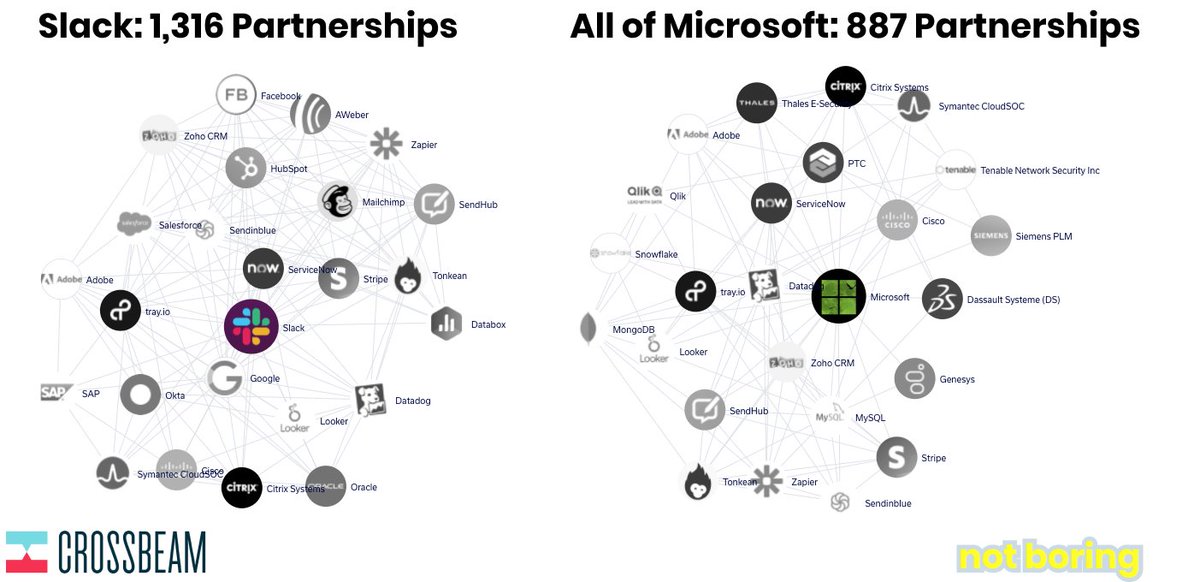

Instead of a bundle, like Teams, Slack is a platform, with 700k integrations, 1,300+ parnterships, and investments in some of the best collaboration tools like @loom @1Password @Crossbeam @hopinofficial and @pitch.

@benthompson called Slack the "enterprise social network." It goes horizontal while $MSFT goes vertical.

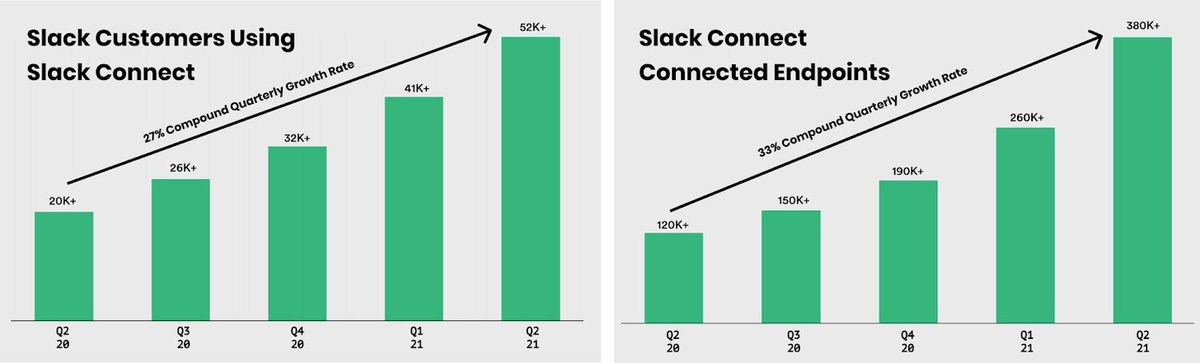

Slack Connect, which lets companies collaborate cross-org in Slack, is blowing up, with more customers using it and connecting to more partners.

Slack Connect, which lets companies collaborate cross-org in Slack, is blowing up, with more customers using it and connecting to more partners.

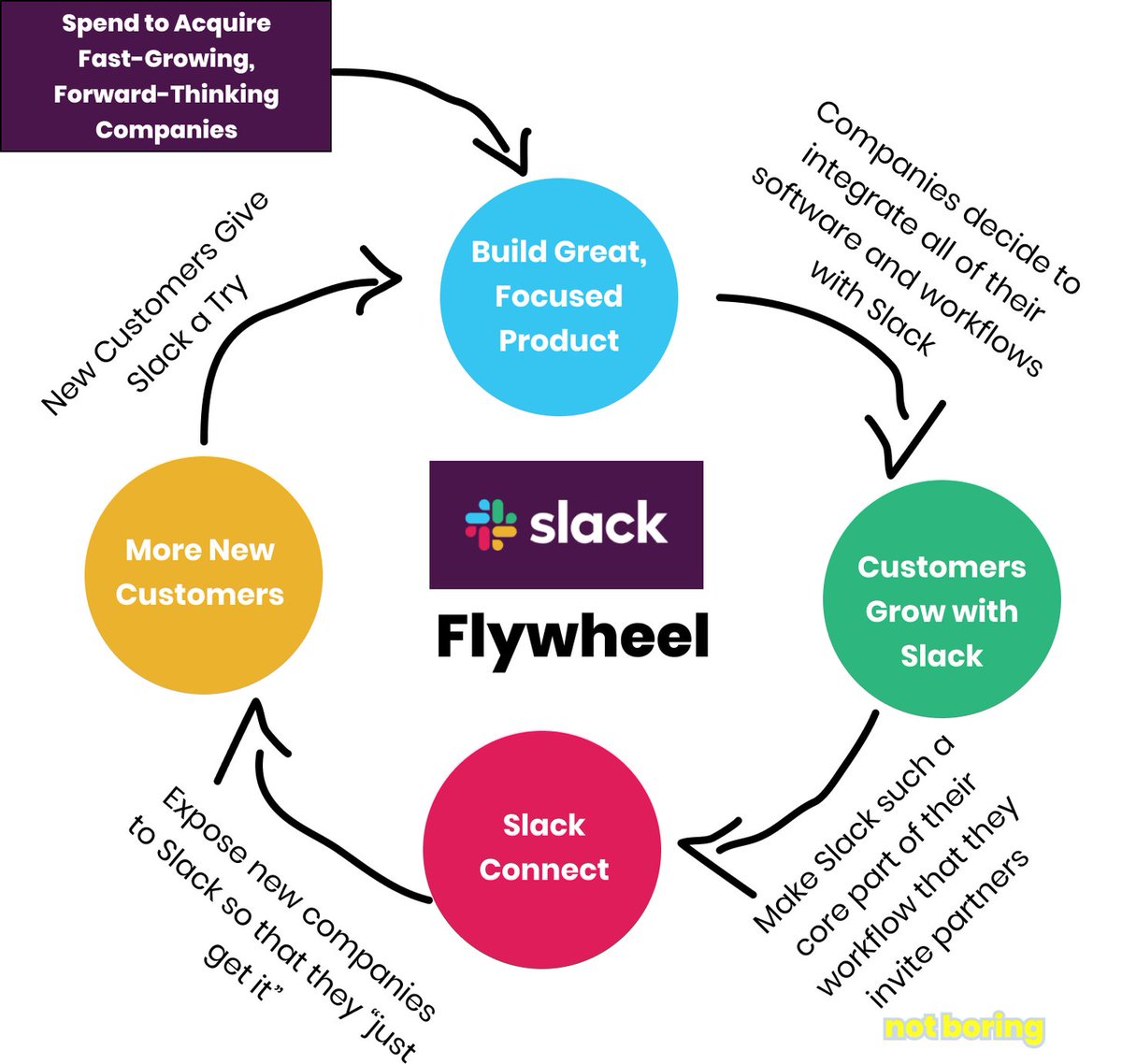

Slack Connect is crucial to Slack's Flywheel:

- Acquire forward-thinking cos

- Make them love the product so much that they build integrations and invite partners to Slack

- Convert those companies to Slack customers

- Get them to love the product and invite more

- Acquire forward-thinking cos

- Make them love the product so much that they build integrations and invite partners to Slack

- Convert those companies to Slack customers

- Get them to love the product and invite more

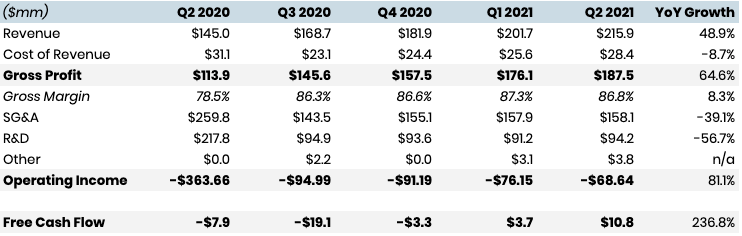

# by the #'s

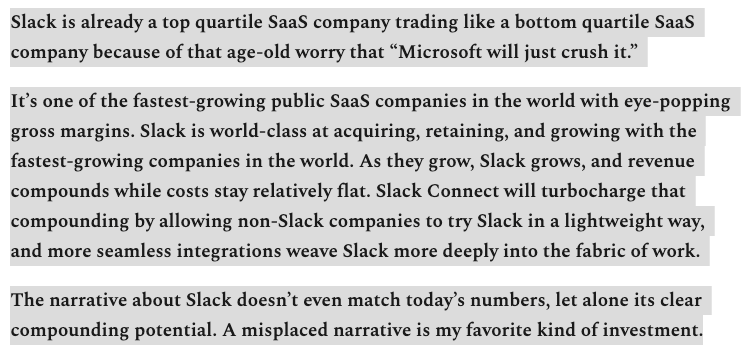

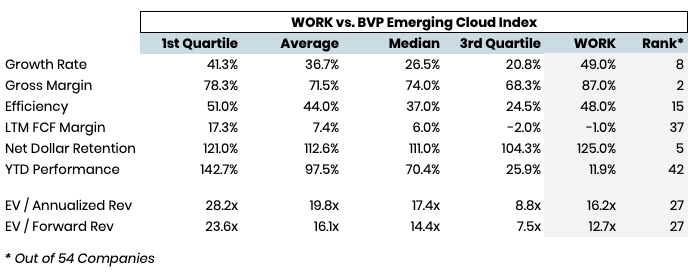

Based on analysis by @JohnStCapital, Slack is a top quartile @BessemerVP Emerging Cloud Index company trading like a bottom quartile one.

- 2nd highest gross margins

- 8th fastest growth

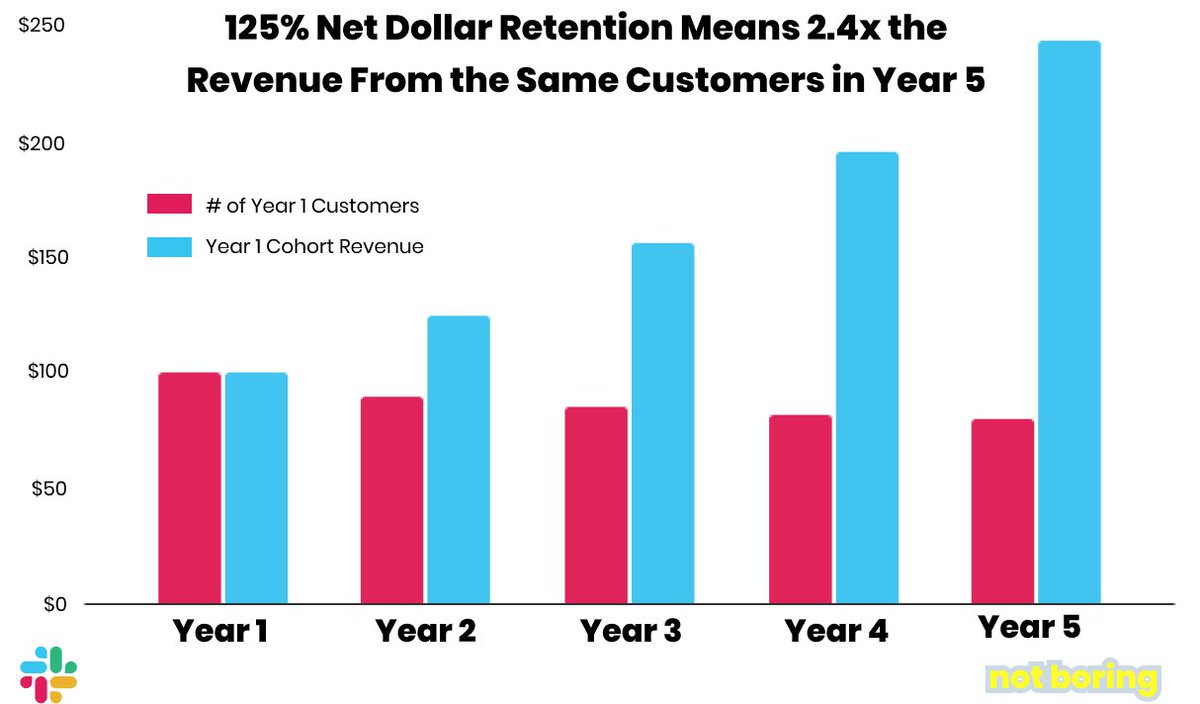

- 5th best Net Dollar Retention

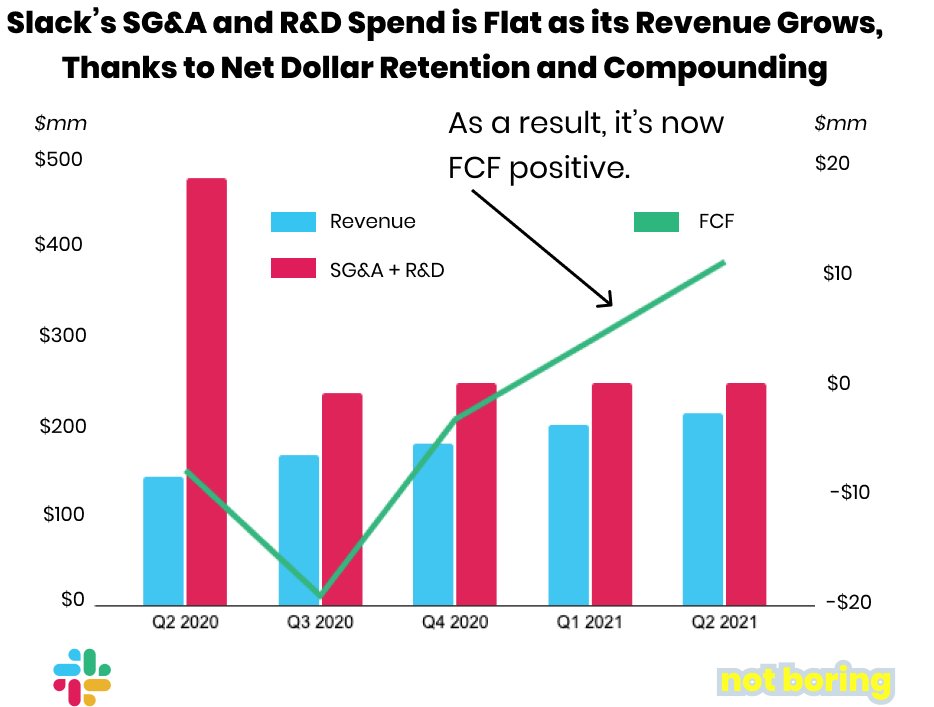

It's biggest knock, FCF, is improving.

Based on analysis by @JohnStCapital, Slack is a top quartile @BessemerVP Emerging Cloud Index company trading like a bottom quartile one.

- 2nd highest gross margins

- 8th fastest growth

- 5th best Net Dollar Retention

It's biggest knock, FCF, is improving.

$WORK bears see those numbers and ignore them. They're all like... so far, they're winning.

The Bear Narrative

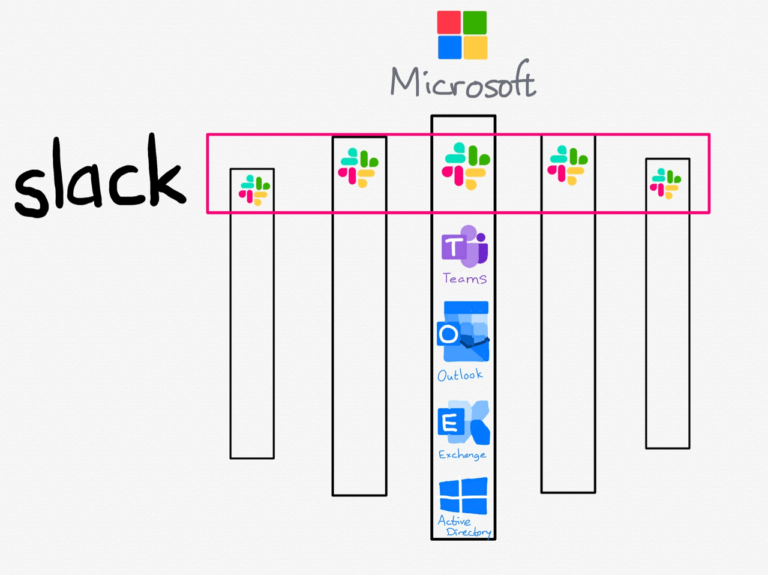

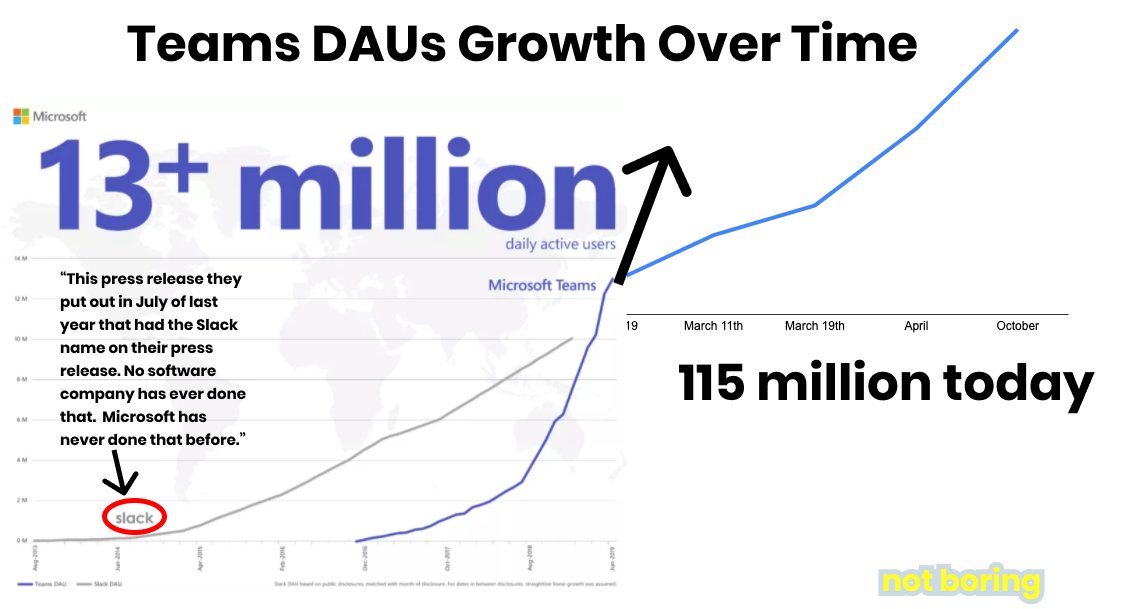

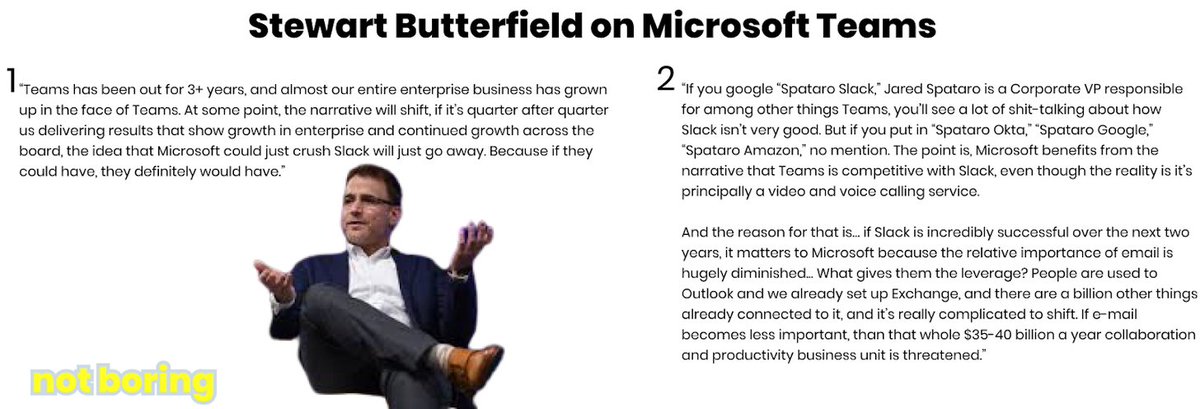

$MSFT Teams is growing so much faster than $WORK and it's going to crush them.

They miss that they're different products, Teams is more focused on video, and it's just converting companies who already pay for Teams with Office365.

$MSFT Teams is growing so much faster than $WORK and it's going to crush them.

They miss that they're different products, Teams is more focused on video, and it's just converting companies who already pay for Teams with Office365.

Teams makes them look at $WORK through shit-colored glasses.

- Operating losses = just another structurally unprofitable co

- Compare 49% YoY growth to $ZM's 355% instead of the BVP Index's median 27%

- 125% Net Dollar Retention as a sign that cos leaving Slack.

- Operating losses = just another structurally unprofitable co

- Compare 49% YoY growth to $ZM's 355% instead of the BVP Index's median 27%

- 125% Net Dollar Retention as a sign that cos leaving Slack.

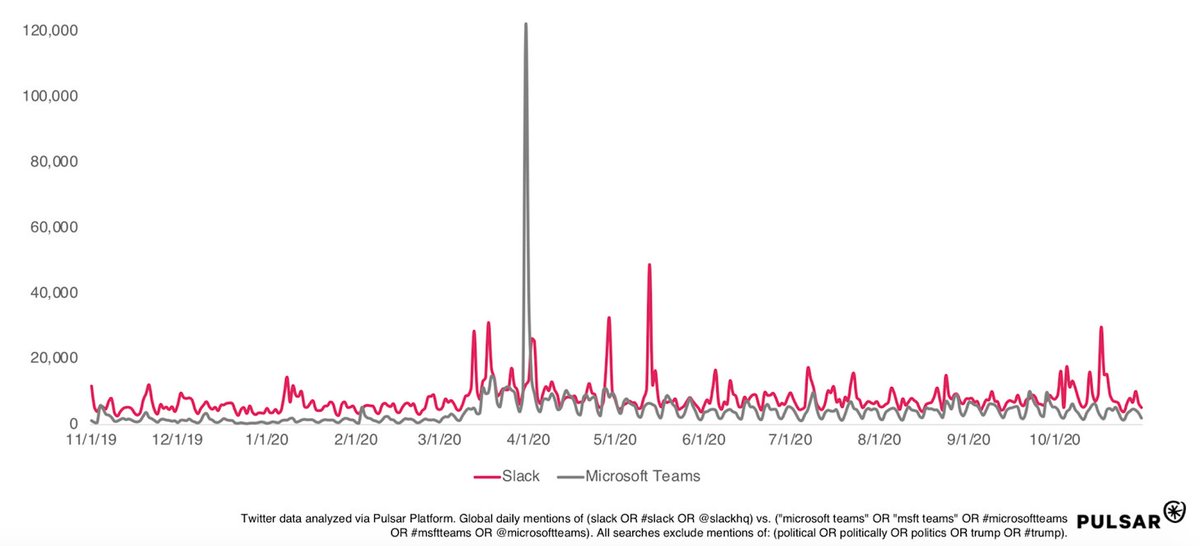

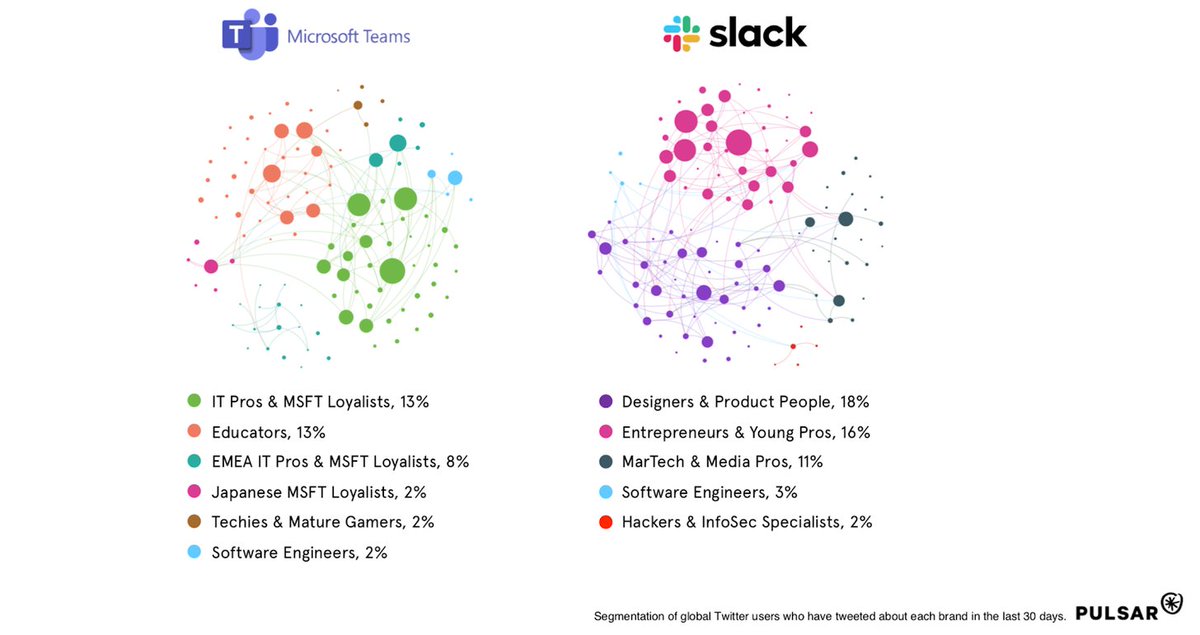

According to @PulsarPlatform, the people who talk about Teams are already $MSFT Loyalists.

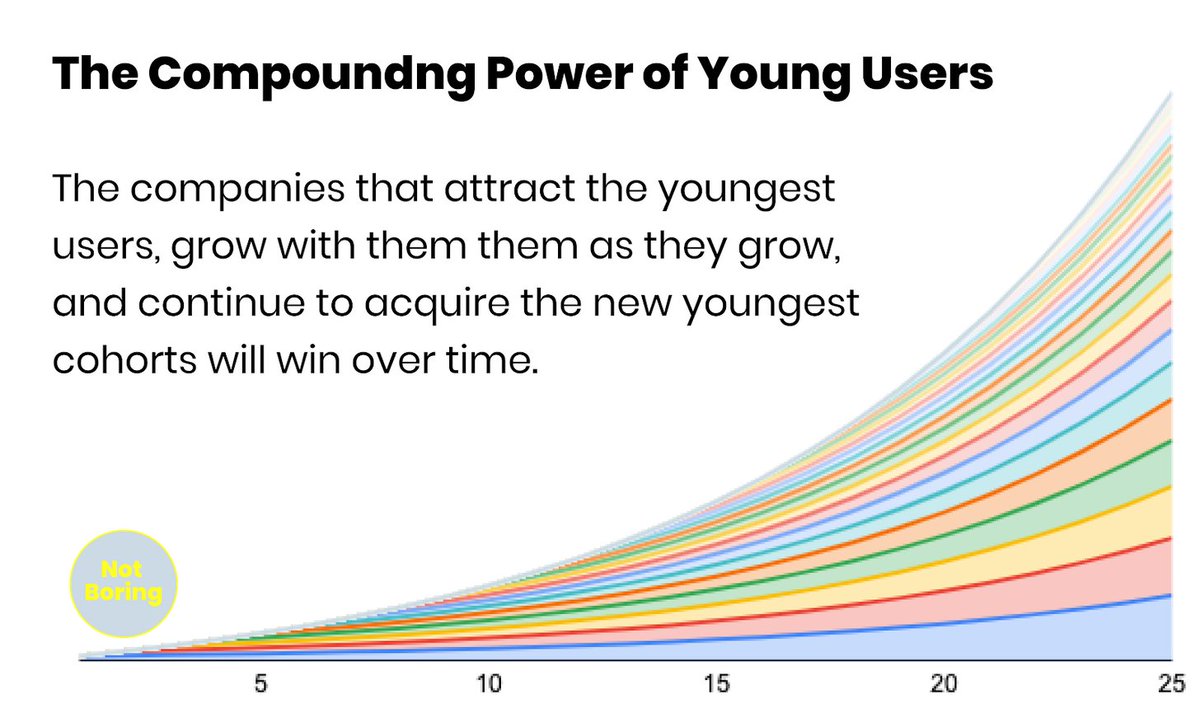

Slack gets the younger, faster-growing companies.

Slack gets the younger, faster-growing companies.

@stewart does a great job breaking it all down on the @verge podcast:

https://open.spotify.com/episode/4ceM9YTWviqsBBYrXueZFJ

https://open.spotify.com/episode/4ceM9YTWviqsBBYrXueZFJ

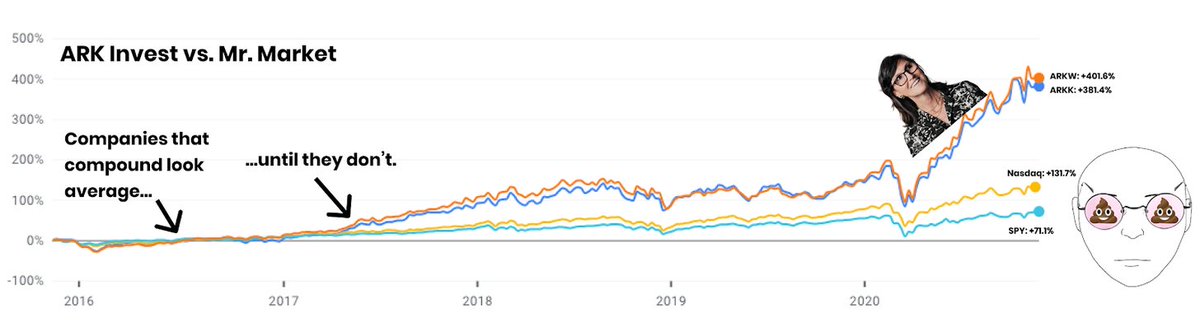

Bears are missing the power of compounding. That's why @CathieDWood & @ARKInvest have crushed the market.

$WORK is the 9th biggest holding in ARKK and 11th in ARKW.

"The power of compounding over time is massive."

$WORK is the 9th biggest holding in ARKK and 11th in ARKW.

"The power of compounding over time is massive."

@AznWeng's great analysis paints a picture of who uses Slack vs. Teams.

Slack gets more engineering-focused and faster-growing companies. https://twitter.com/AznWeng/status/1314212670438928384?s=20

Slack gets more engineering-focused and faster-growing companies. https://twitter.com/AznWeng/status/1314212670438928384?s=20

Check out just a sampling of Slack's customers. They will continue to grow and compound Slacks' growth.

Stickiness, Net Dollar Retention, and FCF

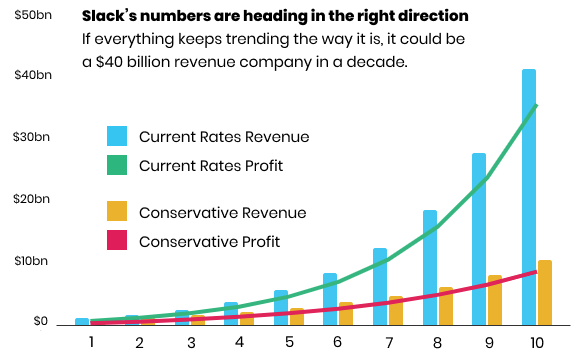

At current growth rates and multiples, $WORK could be a $200-800 billion market cap company in a decade.

At current growth rates and multiples, $WORK could be a $200-800 billion market cap company in a decade.

The Real Bear Case

I don't trust the Wall Street bears. I do trust @kevinakwok.

He wrote that Slack is actually the “911 for whatever isn’t possible natively in a company’s productivity apps.”

And thinks that companies will skip Slack more and more. https://kwokchain.com/2019/08/16/the-arc-of-collaboration/

I don't trust the Wall Street bears. I do trust @kevinakwok.

He wrote that Slack is actually the “911 for whatever isn’t possible natively in a company’s productivity apps.”

And thinks that companies will skip Slack more and more. https://kwokchain.com/2019/08/16/the-arc-of-collaboration/

@discord might actually be the bigger threat, and Slack should steal some of its tricks.

@stewart laid out some of the pipeline on today's awesome interview with @HarryStebbings, including:

- Huddle (audio)

- Stories

- Becoming the integration fabric

- More and more Slack Connect

- Huddle (audio)

- Stories

- Becoming the integration fabric

- More and more Slack Connect

Read on Twitter

Read on Twitter