THREAD: How to track $RUNE liquidity pools and when is a good time to take profits?

Tracking LPs is tricky because there are a lot of moving parts. We have two coins, with constant ratio and price changes. On top of that, we have rewards and those pesky impermanent losses (IL).

Tracking LPs is tricky because there are a lot of moving parts. We have two coins, with constant ratio and price changes. On top of that, we have rewards and those pesky impermanent losses (IL).

Luckily, the @thorchain_org community is incredibly engaged, they came up with many useful tools.

Here is an example with RUNE/BTCB pool. In the last few days, IL (orange line) was below -3% (circled in red), but there was a moment when IL was only -1% (blue circle).

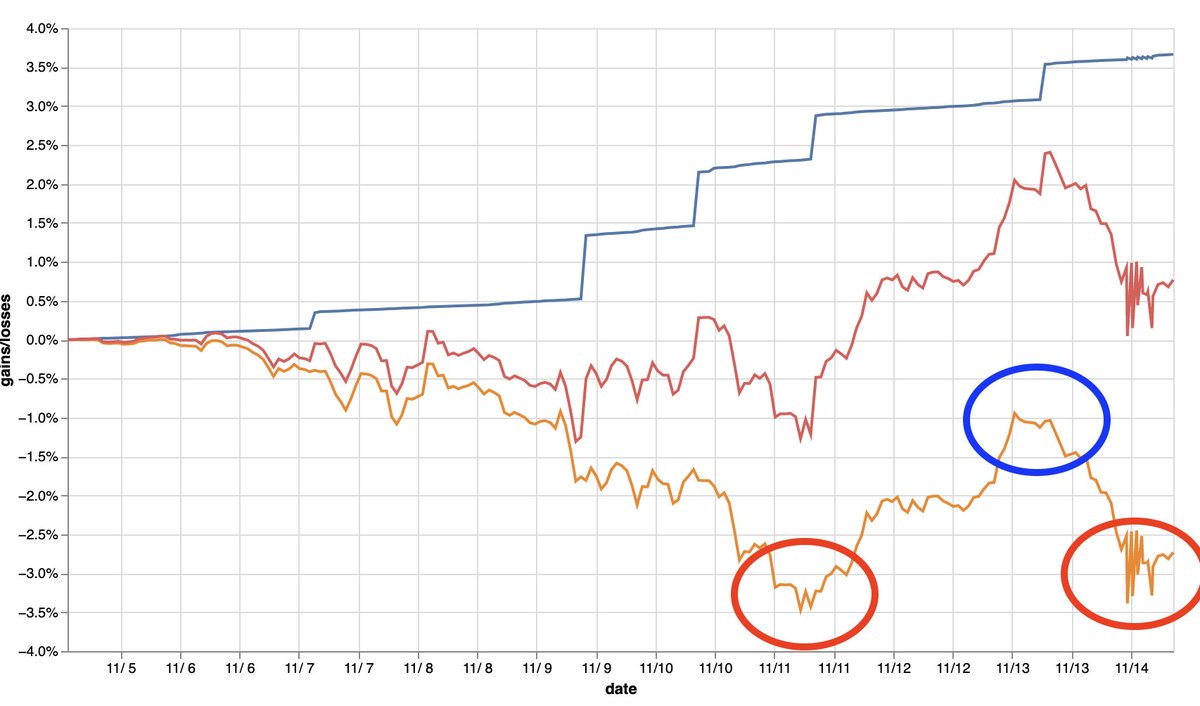

Here is an example with RUNE/BTCB pool. In the last few days, IL (orange line) was below -3% (circled in red), but there was a moment when IL was only -1% (blue circle).

If we look at the $Rune price action, the high IL corresponds with the Rune price pumping. The blue circle corresponds with Rune going through a correction.

So if you want to take profits out, you would wait in this particular case for Rune price correction to get IL near 0%.

So if you want to take profits out, you would wait in this particular case for Rune price correction to get IL near 0%.

So even if you have already collected a lot of fees, it's critical to wait for that IL correction, which is inevitable, if both coins are healthy. If one side is in constant decline, IL might not recover at all, be aware of that.

Generally, high liquidity pools are less risky.

Generally, high liquidity pools are less risky.

These are the tools which you can use in order to track @thorchain_org liquidity pools:

http://www.runedata.info/ by @Larrypcdotcom

and

https://runestake.info/ by @Four4Newt

http://www.runedata.info/ by @Larrypcdotcom

and

https://runestake.info/ by @Four4Newt

Read on Twitter

Read on Twitter