1/ Some of you are wondering why $SUSHI has been pumping.

Sushiswap? Wasn't that the dead $UNI fork that got hacked by the founder 2 months ago?

Surprisingly, $SUSHI never left. Instead - it has silently been building in the background.

Let me break it down for you

Sushiswap? Wasn't that the dead $UNI fork that got hacked by the founder 2 months ago?

Surprisingly, $SUSHI never left. Instead - it has silently been building in the background.

Let me break it down for you

2/ $SUSHI's dark horse narrative comprises of 3 main elements:

1. Market proven product yielding stable cashflows

2. Product releases with strong USP factor

3. Near term catalyst

Together, they construct a powerful narrative for Sushiswap's recovery - and why its far from over

1. Market proven product yielding stable cashflows

2. Product releases with strong USP factor

3. Near term catalyst

Together, they construct a powerful narrative for Sushiswap's recovery - and why its far from over

3/ Background

After the initial Sushi hype faded (when 10x rewards expired in mid Sep), TVL and Daily traded volume on Sushiswap collapsed.

Nobody thought a fork with no USP could last.

Throw in a $15m ETH scandal by the founder it looked like the end. https://twitter.com/AdamScochran/status/1302216561269379072?s=20

After the initial Sushi hype faded (when 10x rewards expired in mid Sep), TVL and Daily traded volume on Sushiswap collapsed.

Nobody thought a fork with no USP could last.

Throw in a $15m ETH scandal by the founder it looked like the end. https://twitter.com/AdamScochran/status/1302216561269379072?s=20

4/ Product

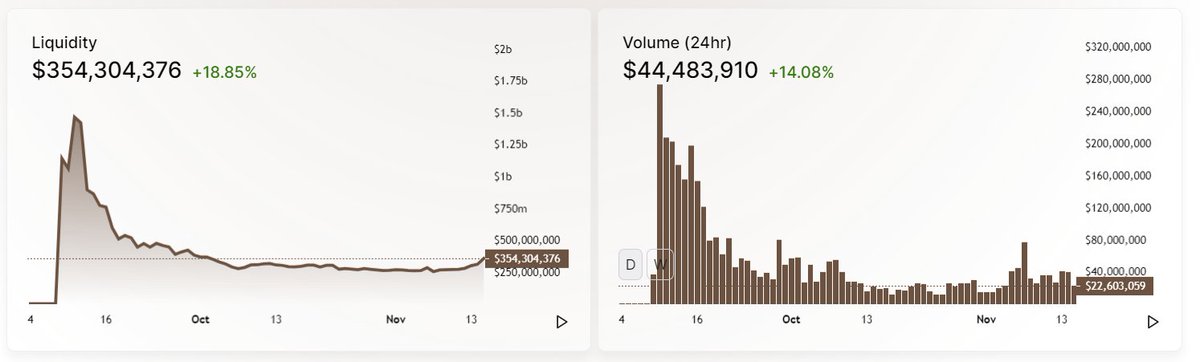

Since then, Sushiswap's numbers have been surprising.

After bottoming out at $250m TVL and $10mm Daily Traded Volume, momentum has picked up once more.

And this is despite emissions being reduced a further 20%

Since then, Sushiswap's numbers have been surprising.

After bottoming out at $250m TVL and $10mm Daily Traded Volume, momentum has picked up once more.

And this is despite emissions being reduced a further 20%

5/ Product

The most astounding thing to me is that Sushiswap has already implemented Uniswap's target business model.

5bps of all traded volume goes to xSushi stakers generating ~14% APY.

This will soon be paid in DAI. https://twitter.com/0xMaki/status/1327082517653041159?s=20

The most astounding thing to me is that Sushiswap has already implemented Uniswap's target business model.

5bps of all traded volume goes to xSushi stakers generating ~14% APY.

This will soon be paid in DAI. https://twitter.com/0xMaki/status/1327082517653041159?s=20

6/ Product

This is important because:

A) There is a clear link between platform value capture and token value accrual

B) This is non-subsidized (no ponzinomics here)

C) Actual dividends in stablecoins reduce volatility of returns (you don't need to form a view on Sushi's price)

This is important because:

A) There is a clear link between platform value capture and token value accrual

B) This is non-subsidized (no ponzinomics here)

C) Actual dividends in stablecoins reduce volatility of returns (you don't need to form a view on Sushi's price)

7/ USP

On top of an exchange that has found product-market fit, new follow-on products are about to be released:

1. Bentobox (Margin trading any alt pairs)

2. Gusoku (IL protection)

3. MISO (Sushi Launchpad)

Of the 3, Bentobox has to be the one I'm looking out for.

On top of an exchange that has found product-market fit, new follow-on products are about to be released:

1. Bentobox (Margin trading any alt pairs)

2. Gusoku (IL protection)

3. MISO (Sushi Launchpad)

Of the 3, Bentobox has to be the one I'm looking out for.

8/ Bentobox

Leveraged trading altpairs (on Sushiswap) are something degens will appreciate.

Thankfully 90% of crypto are complete degens so this will fit right in. This will boost fees earnt on Sushiswap tremendously.

Currently in final stages of development + pending audit

Leveraged trading altpairs (on Sushiswap) are something degens will appreciate.

Thankfully 90% of crypto are complete degens so this will fit right in. This will boost fees earnt on Sushiswap tremendously.

Currently in final stages of development + pending audit

9/ Catalyst

Obviously everyone is anticipating $UNI farming ending.

In my earlier thread I explored reasons why funds may leave Uniswap.

I think its very likely a large chunk moves to Sushiswap. https://twitter.com/Wangarian1/status/1326413955204591618?s=20

Obviously everyone is anticipating $UNI farming ending.

In my earlier thread I explored reasons why funds may leave Uniswap.

I think its very likely a large chunk moves to Sushiswap. https://twitter.com/Wangarian1/status/1326413955204591618?s=20

10/ Catalyst

Current APY yields for the 4 ETH pairs on Sushiswap:

wBTC: 22% (13% on Uni)

USDT: 31% (23% on Uni)

USDC: 36% (21% on Uni)

DAI: 29% (32% on Uni)

And 2/3 rewards are locked for 6 months to reduce Sushi dumping.

Where do you think funds will go?

Current APY yields for the 4 ETH pairs on Sushiswap:

wBTC: 22% (13% on Uni)

USDT: 31% (23% on Uni)

USDC: 36% (21% on Uni)

DAI: 29% (32% on Uni)

And 2/3 rewards are locked for 6 months to reduce Sushi dumping.

Where do you think funds will go?

11/ Team

@0xMaki and team have done a phenomenal job since assuming control of Sushi in Sep. They have been building in silence and the fruits of their labor are about to show.

@FUTURE_FUND_ captures this well here: https://twitter.com/FUTURE_FUND_/status/1327801477545533441?s=20

@0xMaki and team have done a phenomenal job since assuming control of Sushi in Sep. They have been building in silence and the fruits of their labor are about to show.

@FUTURE_FUND_ captures this well here: https://twitter.com/FUTURE_FUND_/status/1327801477545533441?s=20

12/ Conclusion

Everything comes together in a perfect storm for $SUSHI.

They are proving that community driven forks can successfully compete vs incumbents through carving out their own separate niches in the space.

I can't wait to see how they continue to grow in the future.

Everything comes together in a perfect storm for $SUSHI.

They are proving that community driven forks can successfully compete vs incumbents through carving out their own separate niches in the space.

I can't wait to see how they continue to grow in the future.

13/ Disclaimer

Author is long $SUSHI. Tweets are not financial advice. Please DYOR.

Author is long $SUSHI. Tweets are not financial advice. Please DYOR.

Read on Twitter

Read on Twitter