~$1 billion of $ETH is likely to be deployed into DeFi and the market in the coming days as Unsiwap's first UNI yield farming scheme comes to an end.

Let's look over a few places where you could put that Ethereum to work and their risks. https://twitter.com/Wangarian1/status/1326413955204591618

https://twitter.com/Wangarian1/status/1326413955204591618

Let's look over a few places where you could put that Ethereum to work and their risks.

https://twitter.com/Wangarian1/status/1326413955204591618

https://twitter.com/Wangarian1/status/1326413955204591618

1/ ETH 2.0

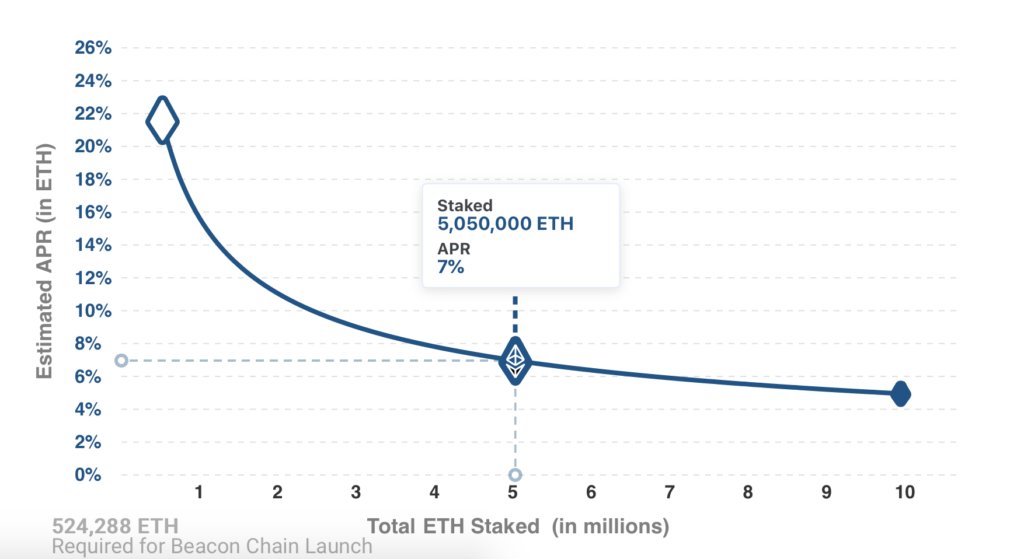

If the bare minimum ETH gets staked in the Beacon Chain, validators will get paid 22% APR.

Risks:

- ETH2 will b untradable

- Slashing if you don't run your validator properly

- Extreme opportunity cost; can't bring ETH back from Beacon Chain

If the bare minimum ETH gets staked in the Beacon Chain, validators will get paid 22% APR.

Risks:

- ETH2 will b untradable

- Slashing if you don't run your validator properly

- Extreme opportunity cost; can't bring ETH back from Beacon Chain

2/ Alpha Homora Pools

Alpha Homora allows ETH holders to easily farm yield farming pools (SushiSwap, Uniswap, Index, Mstable, etc.) and LP on AMMs with leverage.

Yields are quite high (15-100%+) due to IL.

Risks:

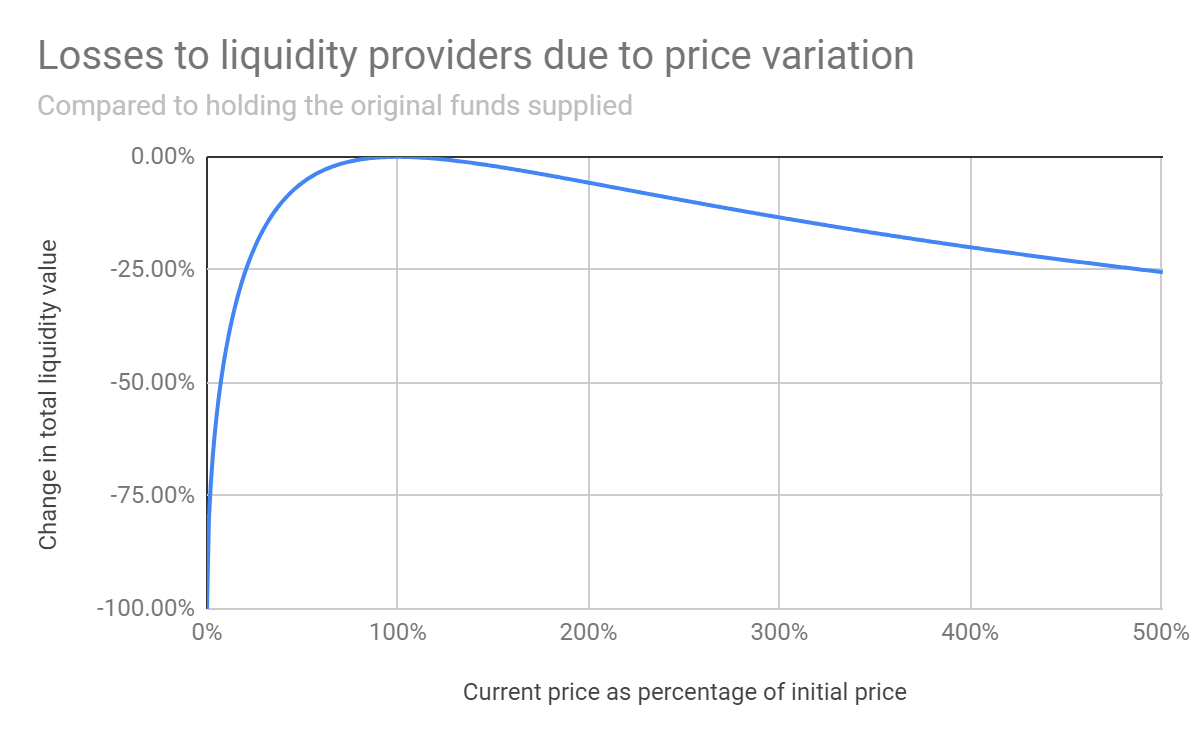

- Impermanent loss. IL risk is magnified if you take on leverage

Alpha Homora allows ETH holders to easily farm yield farming pools (SushiSwap, Uniswap, Index, Mstable, etc.) and LP on AMMs with leverage.

Yields are quite high (15-100%+) due to IL.

Risks:

- Impermanent loss. IL risk is magnified if you take on leverage

3/ Alpha Homora ETH Vault

To allow users to obtain leverage on pools, AH requires a pool of ETH to be drawn from.

Liquidity providers are paid out a steady return in ETH of 3-20%.

Risks:

- Debtors getting liquidated incorrectly

- Cannot withdraw due to high utilization rate

To allow users to obtain leverage on pools, AH requires a pool of ETH to be drawn from.

Liquidity providers are paid out a steady return in ETH of 3-20%.

Risks:

- Debtors getting liquidated incorrectly

- Cannot withdraw due to high utilization rate

4/ Rari

Rari offers an ETH yield pool that utilizes money markets to obtain yields on ETH. Rari is also offering RGT on all deposits until mid-December.

Risks:

- Smart contract bug

More on yields here: https://twitter.com/n2ckchong/status/1318700419808284672

Rari offers an ETH yield pool that utilizes money markets to obtain yields on ETH. Rari is also offering RGT on all deposits until mid-December.

Risks:

- Smart contract bug

More on yields here: https://twitter.com/n2ckchong/status/1318700419808284672

5/ Yearn Vaults (soon)

Yearn devs are expected to roll out the second version of the ETH yVault in the weeks ahead.

The first iteration offered like 50% APY before it was unwound.

Risks:

- Smart contract bug

Yearn devs are expected to roll out the second version of the ETH yVault in the weeks ahead.

The first iteration offered like 50% APY before it was unwound.

Risks:

- Smart contract bug

6/ ETH as collateral

Mint or borrow stablecoins with ETH, then deploy stables into yVaults, Pickle Jars, etc.

Simple but involves liquidation risk.

Risks:

- Liquidation risk if ETH drops

- Keeper failure (Black Thursday)

- Smart contract bugs (flash loan exploits)

Mint or borrow stablecoins with ETH, then deploy stables into yVaults, Pickle Jars, etc.

Simple but involves liquidation risk.

Risks:

- Liquidation risk if ETH drops

- Keeper failure (Black Thursday)

- Smart contract bugs (flash loan exploits)

7/ AMMs

There are many trading pairs on AMMs like Uniswap and SushiSwap that provide high yields (30%+) by simply offering liquidity.

Traders pay a small fee to LPs when they trade on AMMs.

Risks:

- Impermanent loss; the more volatile a pair, the more IL you will incur.

There are many trading pairs on AMMs like Uniswap and SushiSwap that provide high yields (30%+) by simply offering liquidity.

Traders pay a small fee to LPs when they trade on AMMs.

Risks:

- Impermanent loss; the more volatile a pair, the more IL you will incur.

8/ Hegic underwriter

Hegic is an options protocol. Underwriters pool their capital and are collectively short volatility. If options expire worthless, LPs profit.

Hegic LPs are also paid ~250% in future HEGIC.

Risks:

- Volatility can cause LP loss

- Smart contract bug

Hegic is an options protocol. Underwriters pool their capital and are collectively short volatility. If options expire worthless, LPs profit.

Hegic LPs are also paid ~250% in future HEGIC.

Risks:

- Volatility can cause LP loss

- Smart contract bug

9/ Holding ETH

There's nothing wrong with holding the ETH that you get back from your Uniswap LP shares.

We're entering a bull market, which could result in ETH passing its previous all-time highs at $1,400.

We're increasingly seeing ETH act as a high beta Bitcoin.

There's nothing wrong with holding the ETH that you get back from your Uniswap LP shares.

We're entering a bull market, which could result in ETH passing its previous all-time highs at $1,400.

We're increasingly seeing ETH act as a high beta Bitcoin.

Err... to conclude

Please do your own research and properly swallow the risks when yield farming. A contract may be "audited" but that doesn't mean it's safe.

Don't put all your eggs in one basket.

etc. etc. etc.

Please do your own research and properly swallow the risks when yield farming. A contract may be "audited" but that doesn't mean it's safe.

Don't put all your eggs in one basket.

etc. etc. etc.

There's a lot of nuances I had to skip out with farms like Hegic and ETH2 due to Twitter's 280 character limit.

May expand on those in later threads.

May expand on those in later threads.

Read on Twitter

Read on Twitter