Now that all the major hotel brands have announced their Q3 2020 results, a few themes emerge. Early green shoots and headwind from potential lockdown  due to 2nd wave Covid.

due to 2nd wave Covid.

due to 2nd wave Covid.

due to 2nd wave Covid.

1/ Summer leisure travel + significant improvement in China helped. Lower mid-scale brands (WH and CHH) have recovered the most while upscale and luxury (Accor and Hyatt) have been slow.

2/ In spite of Covid impacted lockdowns, all these brands continue to open up new hotels. Partly because they were started before Covid, but management teams continue to be confident about the return of travel.

3/ I'm reminded of Bill Miller's comment during summer- "If you don't own airlines, you are betting against a vaccine." I think it's applicable to these hotel brands as well.

4/ On Monday (11/9) on Pfizer's vaccine news, these franchise revenue, capital light, hotel stocks saw double-digit price increase - an early taste of what's to come!

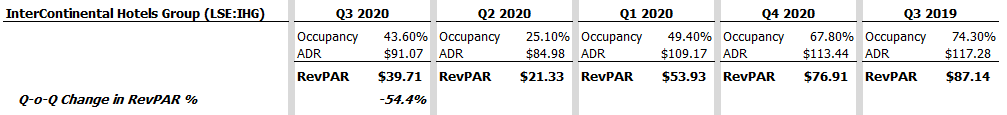

5/ InterContinental Hotels Group $IHG - Holiday Inn and Holiday Inn Express brands continue to be the lynchpin of the company's progress.

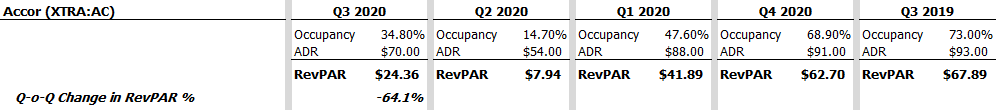

5/ Accor $AC.FP is the worst hit of the big brands. For example, the Hajj pilgrimage in the Middle East used to attract 2 mill pilgrims, but attracted about 1,000 this year.

6/ Hyatt $H another one with more hotels in urban areas continues a slow recovery. Cash burn rate of $60 - $65 mill/month!

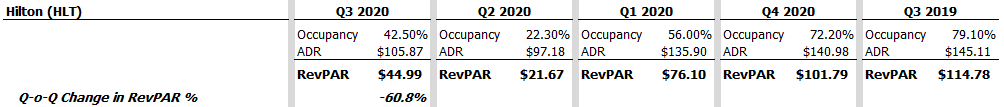

7 / Hilton $HLT with portfolio mix closer to that of $IHG continues its robust pace of opening new hotels - development pipeline of 2,640 hotels in 33 countries!

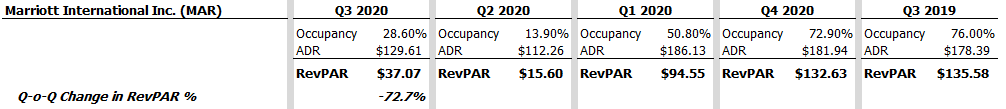

8/ Marriott International's $MAR CEO Arne Sorenson had the most interesting comment in this season - as a result of permanent cost cuts..."we have reduced breakeven occupancy by 3 to 5 points, something like that depending on the brand."

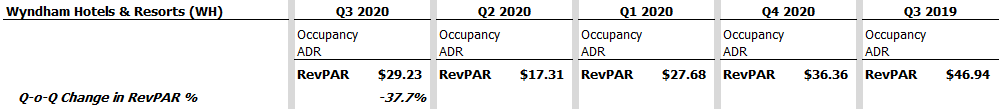

9/ Wyndham Hotels & Resorts $WH saw occupancy peak at 50% in July, 49% in Aug, 47% in Sep. Leisure/Business - 70%/30%; 1/3rd weekend travelers, 1/3rd family visits, 1/3rd stop along a trip.

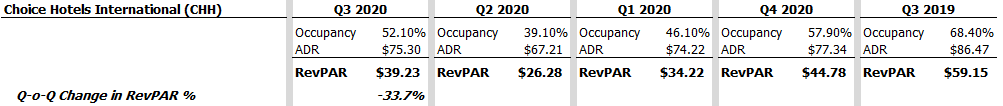

Choice Hotels International $CHH - again leisure/business - 70%/30%

Read on Twitter

Read on Twitter