Acrysil Ltd *The Big Opportunity*

:Monopoly play, Ready to Expand its Wings

Market Cap : 420 cr

CMP : 157

Sales : 259 cr

PEG : 0.81

:Monopoly play, Ready to Expand its Wings

Market Cap : 420 cr

CMP : 157

Sales : 259 cr

PEG : 0.81

About Acrysil

:Acrysil is the pioneer in composite Quartz Technology in India and is one of the largest producers of quartz kitchen sinks in the world

Acrysil Brands

:Carysil

:Sternhagen

:Tek Carysil

:Homestyle Products (UK)

:Acrysil is the pioneer in composite Quartz Technology in India and is one of the largest producers of quartz kitchen sinks in the world

Acrysil Brands

:Carysil

:Sternhagen

:Tek Carysil

:Homestyle Products (UK)

Product Segment

1.Quartz Sink

2.Stainless Steel Sinks

Press

Quadro

3.Tiles (3D)

4.Bathroom Sanitary

http://5.Kitchen Appliances

Chimney

Oven

Wine Chillers

1.Quartz Sink

2.Stainless Steel Sinks

Press

Quadro

3.Tiles (3D)

4.Bathroom Sanitary

http://5.Kitchen Appliances

Chimney

Oven

Wine Chillers

Kitchen Sinks : Growth of Indian Household

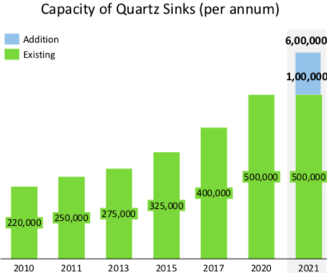

:Acrysil has amped up its production capacity of quartz sinks as per the growing demands of the consumers and to benefit from the economies of scale

:Capacity now stands at 5 lakh sinks p.a in FY20

:Acrysil has amped up its production capacity of quartz sinks as per the growing demands of the consumers and to benefit from the economies of scale

:Capacity now stands at 5 lakh sinks p.a in FY20

Kitchen Sinks (Contd)

Growth Potential

:Huge uprise in market share of Quartz sink from Stainless steel which is produced by only 4 players in world

:Domestically increasing trend in per capita spend in these products

:Rise of nuclear families in India

Growth Potential

:Huge uprise in market share of Quartz sink from Stainless steel which is produced by only 4 players in world

:Domestically increasing trend in per capita spend in these products

:Rise of nuclear families in India

Sternhagen *Premium Brand*

:With distribution network of Acrysil domestically as well as in international markets, they will leverage that for Sternhagen aiming to make it most favored brand in luxury bathroom suites segment

:Sternhagen being a premium brand has pricing power

:With distribution network of Acrysil domestically as well as in international markets, they will leverage that for Sternhagen aiming to make it most favored brand in luxury bathroom suites segment

:Sternhagen being a premium brand has pricing power

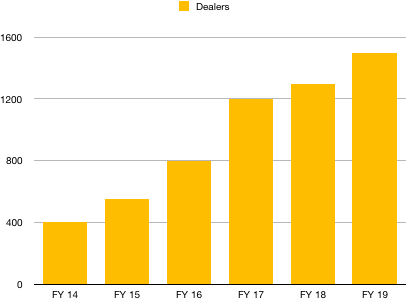

Domestic Market: Strengthening the Carysil Brand

:Revenue from domestic market

FY 12 : 5%

FY 20 : 21%

:Revenue from domestic market

FY 12 : 5%

FY 20 : 21%

Global Play

:Acrysil Exports to 55 countries at present and plans to export to 70+ countries in coming 3 years

:Acrysil holds 100% in Homestyle Products through Acrysil UK Ltd

:Acrysil incorporated “Acrysil USA Inc” with intent to expand in their presence in USA

:Acrysil Exports to 55 countries at present and plans to export to 70+ countries in coming 3 years

:Acrysil holds 100% in Homestyle Products through Acrysil UK Ltd

:Acrysil incorporated “Acrysil USA Inc” with intent to expand in their presence in USA

Global Partnership

:Acrysil signed an agreement with German leading brand GROHE for supply of quartz kitchen sinks

:Acrysil entered strategic partnership with IKEA for manufacturing and supply of composite quartz sinks, which can generate additional revenue upto 45cr

:Acrysil signed an agreement with German leading brand GROHE for supply of quartz kitchen sinks

:Acrysil entered strategic partnership with IKEA for manufacturing and supply of composite quartz sinks, which can generate additional revenue upto 45cr

Financials

Sales growth 3y CAGR : 15%

Profit growth 3y CAGR : 42%

EBITDA Margin

H1 FY20 : 17.6%

H1 FY21 : 20.8%

Product wise revenue

Quartz sinks : 78%

Steel sinks : 13%

Other Appliances : 8%

Dividend Policy : 15% of net profit

Sales growth 3y CAGR : 15%

Profit growth 3y CAGR : 42%

EBITDA Margin

H1 FY20 : 17.6%

H1 FY21 : 20.8%

Product wise revenue

Quartz sinks : 78%

Steel sinks : 13%

Other Appliances : 8%

Dividend Policy : 15% of net profit

Valuations *Candidate for Earning Expansion & PE Rerating*

PEG : 0.81

PE : 16.6

EV/EBIT

Acrysil : 11.57

Cera : 32.83

Kajaria ceramics : 36.95

SHIL : 21.83

PEG : 0.81

PE : 16.6

EV/EBIT

Acrysil : 11.57

Cera : 32.83

Kajaria ceramics : 36.95

SHIL : 21.83

Future Outlook

:Debt reduction

:Improve working capital days

:Reduction in Inventory turnover days

:CAPEX for additional 1,00,000 quartz sink production by March 2021

:Planning to export to 20 newer countries in next 3 years

:Debt reduction

:Improve working capital days

:Reduction in Inventory turnover days

:CAPEX for additional 1,00,000 quartz sink production by March 2021

:Planning to export to 20 newer countries in next 3 years

Please Note

:Long way to go, Don't rush in at once.

Disc - Invested.

:Long way to go, Don't rush in at once.

Disc - Invested.

Read on Twitter

Read on Twitter