Maryam Nawaz & Her Father Nawaz Sharif arguing unravelling of Pakistan’s economy is a consequence of Supreme Court’s disqualification of Nawaz Sharif on July 28, 2017 implying a conspiracy is beyond ludicrous.

The Macroeconomic legacy of PML-N government was beyond destructive.

The Macroeconomic legacy of PML-N government was beyond destructive.

While some of the effects of unchecked debt infused growth of past several years have started to unfold, a lot remained below the surface especially in the energy sector which rose its ugly head in the recent past.

The external current account deficit reached nearly $19 billion in FY2018 (5.8% of GDP), the highest ever in the country’s history in absolute terms. FY2017, when NS himself was the PM, CAD was $12.6 billion, which was 5 times the size of CAD of $2.5 billion in FY2013.

Record trade deficit due to snowballing imports and relatively weak exports had been the primary reason behind surging external CAD. SBP’s FX reserves of around $ 9.5 billion were equivalent to less than 2 months of country’s imports, a dangerously low level.

Total external debt and liabilities increased to a massive $ 92 Billion by March 2018. Total external debt & liabilities were $61 billion in June 2013.

Consolidated budget deficit for FY2018 at Rs. 2,300 billion (6.8%) of GDP. Even FY2017, it was Rs. 1,860 billion (5.8% of GDP).

Consolidated budget deficit for FY2018 at Rs. 2,300 billion (6.8%) of GDP. Even FY2017, it was Rs. 1,860 billion (5.8% of GDP).

Total public debt (external plus domestic) crossed 72% of GDP in June 2018, far higher than the mandatory limit of 60% set under the fiscal responsibility and debt limitation act. They even changed the definition of Public debt through act of Parliament to show less Number.

Elephant in the Room

PML-N’s policy adding massive power generation capacity on long-term (25-30 years) take-or-pay contracts pushed the country into a capacity trap. New power generation projects added around $ 4.0 billion annually to total capacity payments pool of CPPA.

PML-N’s policy adding massive power generation capacity on long-term (25-30 years) take-or-pay contracts pushed the country into a capacity trap. New power generation projects added around $ 4.0 billion annually to total capacity payments pool of CPPA.

For The burden of additional capacity payments to be passed on to consumers in shape of substantially higher electricity tariff. Similarly, natural gas prices increased to meet higher cost of imported LNG and to provide return on investment affixed by Pmln’s Government.

The Real Effective Exchange Rate (REER) series, published by SBP, is the most credible indicator of exchange rate valuation. REER value of 100 reflects fair valuation, while values higher than 100 represents overvaluation and less than 100 undervaluation.

REER was at 104 in June 2013 when PML-N government came into office. However, it climbed up to 127 by December 2016, which was indicative a massive exchange rate overvaluation of 27%.

Economists raised concerns about exchange rate overvaluation were ridiculed & criticised by Dar

Economists raised concerns about exchange rate overvaluation were ridiculed & criticised by Dar

The overvalued exchange rate had twin negative effects. Firstly, it stimulated demand for imported goods. Secondly, it hurt exports by adversely affecting competitiveness, which with absence of focus on export sectors resulted in underinvestment in export oriented industries.

It is no surprise that the Pakistan’s exports fell from $25 billion in FY2014 to $20 billion in FY2017. Imports on the other hand jumped from $45 billion in FY2014 to $61 billion in FY2018.

Pmln government had been fixated with high visibility infrastructure projects even if they had low or negative value. Projects like metro bus in Islamabad or orange train in Lahore are a few cases in point.

The massive capacity expansion in the power sector were undertaken without professional due diligence of Pakistan’s demand/supply projections & impact on affordability and sustainability. Annual capacity payment of one 660 MW coal base power plant $190 Million.

while that of one 1200 RLNG based power plant $170Million. 4 x 660 MW coal based and 3 x 1200 MW RLNG based power plants were completed, entailing aggregate annual capacity payments of $1.3Billion with a large number of power projects under construction & capacity payment burden

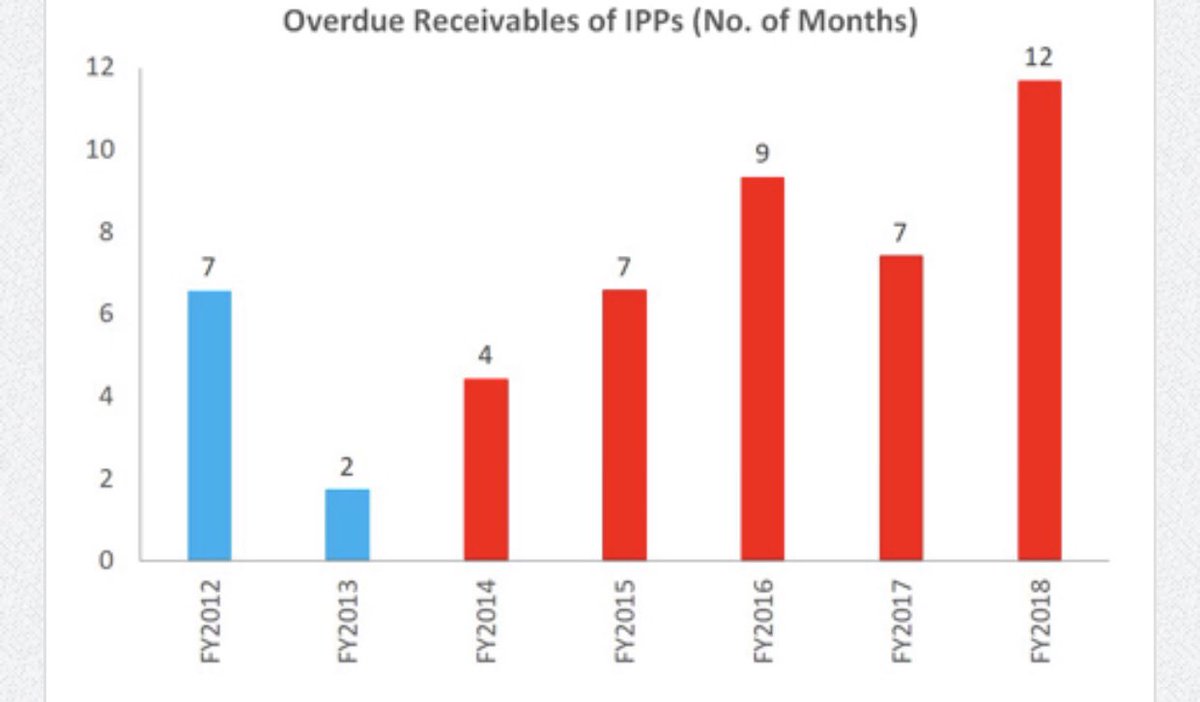

Contrary to Policies of Privatisation, Pmln Govt actually expanded the role of public sector by setting up a large number of new public sector enterprises. Claims of containing circular debt was fake,overdue receivables of power sector rose to 12 Months by Mar18 from 2 in Jun13.

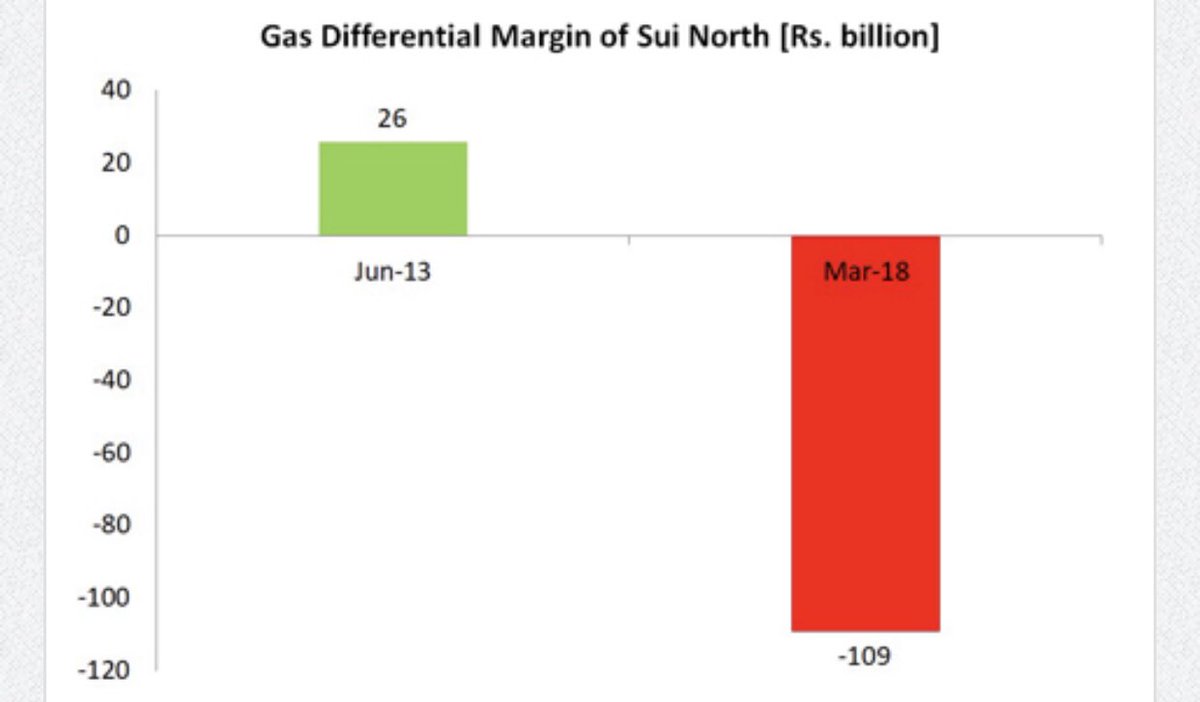

The financial position of Sui gas companies was very weak. Sui North had Gas Differential Margin payable of PKR 26 billion June 2013, which turned into a net deficit of PKR 109 billion as of March 2018 encouraging increase in Gas tariffs to recover these amounts from consumers.

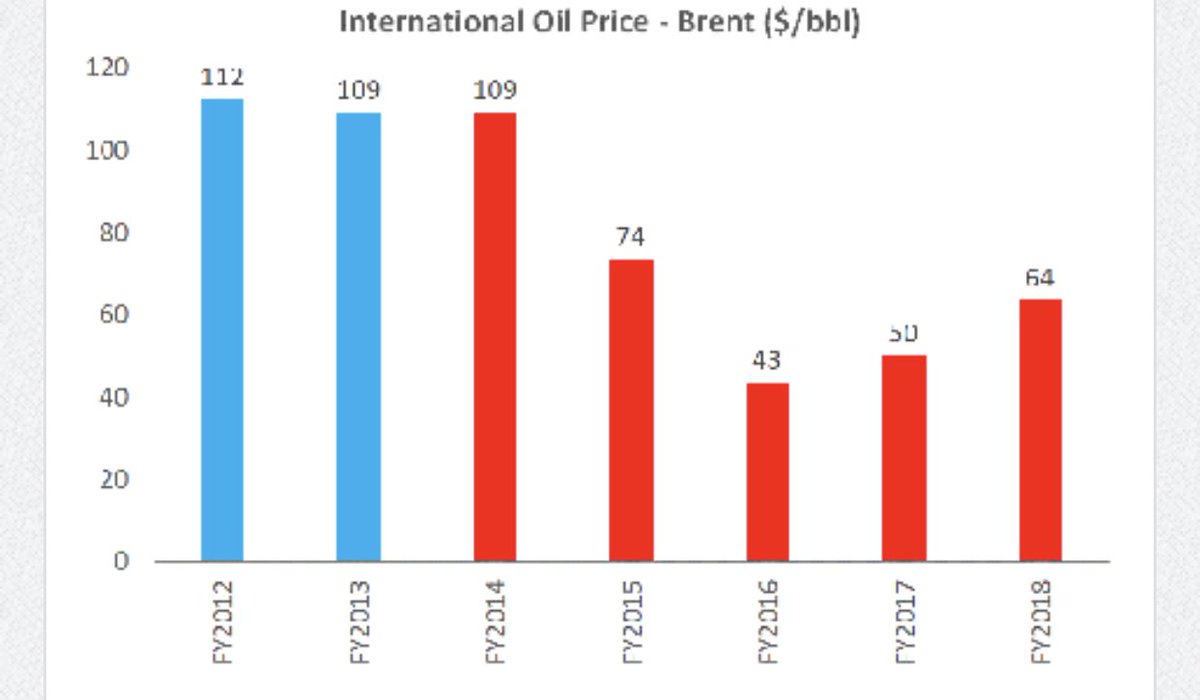

Unlike PTI’s inherited Economic Mess & Volatility in Global Oil Prices,Pmlns Govt was lucky as Brent oil averaged $68 per barrel during 5 years Pmlns Govt( FY14 to FY18). This was more than $40 per barrel lower than the average of $110 per barrel in FY2012-13.

Cumulative savings in oil import bill alone amounted to more than $25 Billion in 5 years of Pmlns government as well as benefited from Cumulative benefit of higher remittances as another $25 billion during the their 5 years.

It was purely their flawed policies that led Country into an Economic Crisis that wasn’t witnessed before.

Economic Crisis are culmination of years of excesses and misguided macroeconomic policies & Blaming it on conspiracy theories resulting ousted is pure Political Demagoguery.

Economic Crisis are culmination of years of excesses and misguided macroeconomic policies & Blaming it on conspiracy theories resulting ousted is pure Political Demagoguery.

Read on Twitter

Read on Twitter