Thread. Many are discussing student debt forgiveness. (e.g. @MattBruenig) One question is if forgiveness primarily benefits higher income households.

tldr; Survey of Consumer Finances is a key data source for determining who holds student debt, but is not well suited to the task.

tldr; Survey of Consumer Finances is a key data source for determining who holds student debt, but is not well suited to the task.

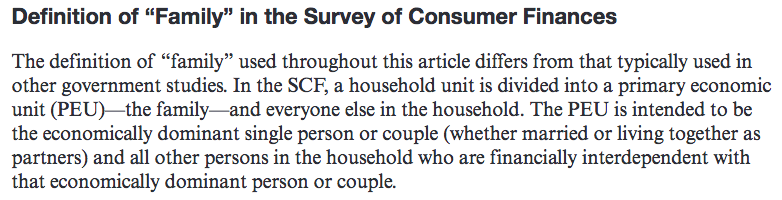

Reports describe SCF as a survey of "families." That is actually not quite right. It is a survey of a subset of households. Each household contains a "Primary Economic Unit" (PEU) that consists of the "economically dominant single person or couple" and their dependents.

The survey is addressed to this PEU subset and captures all their assets and debt.

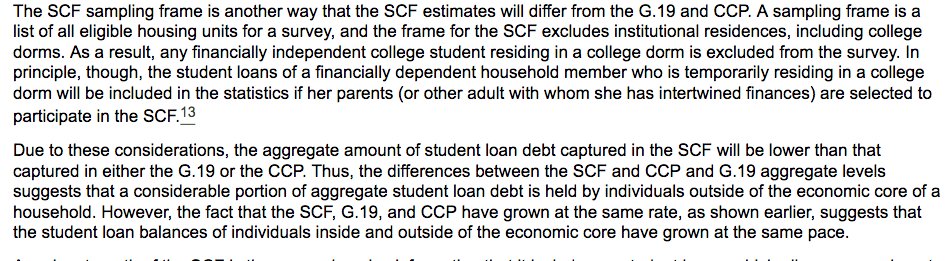

*But* many people, particularly younger adults, are not part of a PEU and have no opportunity to be interviewed. These include adult children, roommates, those in institutional housing, etc.

*But* many people, particularly younger adults, are not part of a PEU and have no opportunity to be interviewed. These include adult children, roommates, those in institutional housing, etc.

If someone wants to know the characteristics of who holds student debt, SCF can only provide an estimate of debt held by those who are part of the "economically dominant single person or couple."

Other debt holders who live with their parents or roommates are not represented.

Other debt holders who live with their parents or roommates are not represented.

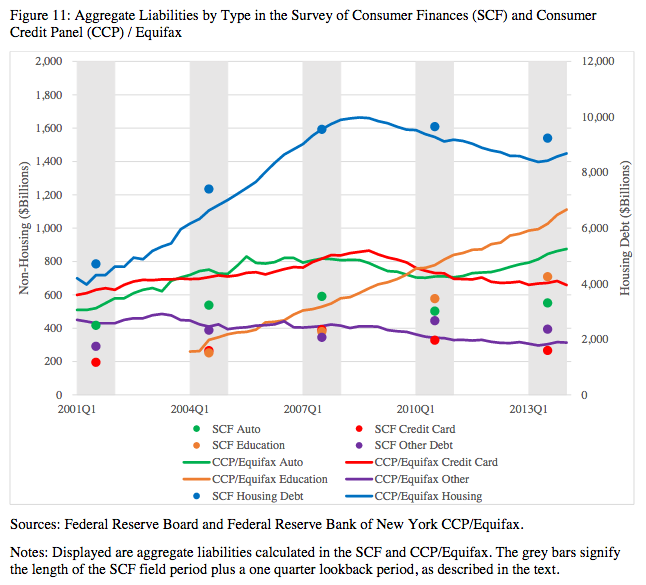

This would not be a problem if debt was overwhelmingly held by "dominant" household members. We can check this issue by comparing total student debt estimated by SCF against other aggregate measures. In 2013, SCF underestimated student debt by about 30%.

https://www.federalreserve.gov/econresdata/feds/2015/files/2015086pap.pdf

https://www.federalreserve.gov/econresdata/feds/2015/files/2015086pap.pdf

Here is another analysis from the Fed making the same point about the sample and the failure of SCF to reflect all outstanding student debt.

https://www.federalreserve.gov/econresdata/notes/feds-notes/2015/how-much-student-debt-is-out-there-20150807.html

https://www.federalreserve.gov/econresdata/notes/feds-notes/2015/how-much-student-debt-is-out-there-20150807.html

A 2014 paper asks, "Are SCF young adults representative of all young adults?" They "compare the SCF data with those in sources that are representative at the individual (rather than household) level."

*They find young people in SCF have higher income.*

https://files.stlouisfed.org/files/htdocs/publications/review/2014/q4/dettling.pdf

*They find young people in SCF have higher income.*

https://files.stlouisfed.org/files/htdocs/publications/review/2014/q4/dettling.pdf

New 2019 SCF data indicate that total outstanding student debt is $1.1 trillion. However, the Fed's G.19 data report $1.6 trillion.

That means about $500 billion or 31% of all student debt is not accounted for by the "dominant" household members included in the 2019 SCF.

That means about $500 billion or 31% of all student debt is not accounted for by the "dominant" household members included in the 2019 SCF.

That means about $500 billion or 31% of all student debt is not accounted for by the "dominant" household members included in the 2019 SCF.

That means about $500 billion or 31% of all student debt is not accounted for by the "dominant" household members included in the 2019 SCF.

Read on Twitter

Read on Twitter