LEVERAGE - A Thread

1. “My partner Charlie says there are only three ways a smart person can go broke: liquor, ladies, and leverage. Now the truth is, the first two he just added because they started with ‘L’ – It’s leverage.” Warren Buffett

1. “My partner Charlie says there are only three ways a smart person can go broke: liquor, ladies, and leverage. Now the truth is, the first two he just added because they started with ‘L’ – It’s leverage.” Warren Buffett

2. Leverage magnifies wins and losses using borrowed money to purchase a greater amount of something than one could had they used their own cash.

Investors use it with a self-confidence that investments will increase by an amount exceeding the cost to borrow, boosting returns.

Investors use it with a self-confidence that investments will increase by an amount exceeding the cost to borrow, boosting returns.

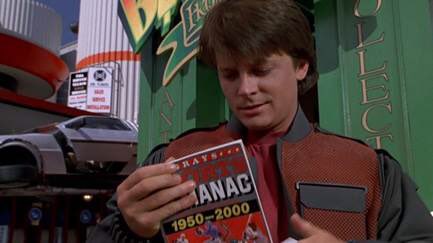

3. Why would someone risk more than they have? Well, let’s use “Back to the Future 2” as an example.

“The Cubs win the World Series?” -Marty McFly

“I sure wish I could go back in time and put money on the Cubs.” -Man on street

Marty’s face lights up with a great idea…

“The Cubs win the World Series?” -Marty McFly

“I sure wish I could go back in time and put money on the Cubs.” -Man on street

Marty’s face lights up with a great idea…

4. Marty purchases the movie’s macguffin, the Grays Sports Almanac, to score easy cash with knowledge of future results. This sets off a series of events that jeopardizes past, present and future… but what about leverage?

5. If his plan could go off without a hitch, Marty should put as much money as possible on the Cubs. And when he’s tapped out, he would want to borrow as much as he can – because his winnings will far exceed his cost to borrow.

A successful use of leverage!

A successful use of leverage!

http://6.An investor might not know the results beforehand like Marty, but if they have enough conviction, they can attempt to enhance their returns using leverage. What happens if they guess wrong? Let’s look at the good, the bad and the ugly…

7. The Good:

Grace has a $200,000 diversified stock portfolio. Using margin (leveraging the account), she borrows $100,000 through her brokerage to purchase additional securities, giving her a $300,000 invested portfolio. Soon after, the portfolio rises 20% to $360,000…

Grace has a $200,000 diversified stock portfolio. Using margin (leveraging the account), she borrows $100,000 through her brokerage to purchase additional securities, giving her a $300,000 invested portfolio. Soon after, the portfolio rises 20% to $360,000…

8. Pleased with the results, Grace cashes out her securities. After paying back the $100,000 loan (plus some interest), Grace has gained $60,000 from her original $200,000 investment, 50% more than she would have received had she not used leverage.

9The Bad:

Hearing about Grace’s recent triumph at a cocktail party, Bob decides to give it a shot. In his mind, the prior 20% market increase was pretty obvious (hindsight bias) and markets will continue to be lifted by the current top performing stocks (recency bias) …

Hearing about Grace’s recent triumph at a cocktail party, Bob decides to give it a shot. In his mind, the prior 20% market increase was pretty obvious (hindsight bias) and markets will continue to be lifted by the current top performing stocks (recency bias) …

10. So, Bob takes $200,000 from his savings, borrows $100,000 through his brokerage, and builds himself a $300,000 concentrated portfolio made up of the hottest growth stocks. Naturally, six months later, his portfolio is down 15% to $255,000...

11. What does Bob do next? He elects to be ‘in for a penny, in for a pound’ (sunk cost fallacy) and replaces his losers with an updated set of top performing stocks. Not even Bob is surprised when he rides the new positions down another 10%, before finally calling it quits.

12. The damage? Bob turned a $200,000 cash investment into $129,500 after paying back his loan (plus interest). Bob’s first, and likely last foray with using leverage has cost him an extra $23,500.

13. The Ugly:

Ulf is Bob’s twin brother. Ulf also wanted to participate but was not as liquid as Bob. So, Ulf took $70,000 from his savings, $130,000 from his home equity line of credit and borrowed $100,000 through his brokerage.

Yes, Leverage on top of leverage!

Ulf is Bob’s twin brother. Ulf also wanted to participate but was not as liquid as Bob. So, Ulf took $70,000 from his savings, $130,000 from his home equity line of credit and borrowed $100,000 through his brokerage.

Yes, Leverage on top of leverage!

14. What happened to Ulf? Just like his brother, the $300,000 investment declined to $229,500. But Ulf borrowed more than his brother. After paying back his bank and brokerage, Ulf’s original $70,000 investment is now worth… $0.

15. Final Tally

Good Grace:

Portfolio return +20%, Investor Return +30%

Bad Bob:

Portfolio return -23.5%, Investor Return -35%

Ugly Ulf:

Portfolio return -23.5%, Investor Return -100%

Good Grace:

Portfolio return +20%, Investor Return +30%

Bad Bob:

Portfolio return -23.5%, Investor Return -35%

Ugly Ulf:

Portfolio return -23.5%, Investor Return -100%

16. Most people will go, “That’s very risky. I’m never going to borrow money against my portfolio to buy more stocks.”

Why is it taboo to borrow 50% against a stock portfolio, yet completely normal to borrow 90% or more to invest in real estate?

Why is it taboo to borrow 50% against a stock portfolio, yet completely normal to borrow 90% or more to invest in real estate?

17. In either scenario, if the levered asset declines, the investor is exposed to a world of trouble.

The more you borrow the greater the risk and potential reward.

The more you borrow the greater the risk and potential reward.

Read on Twitter

Read on Twitter