This year saw many central banks arriving at swap agreements with the Federal Reserve. What determines which countries are able to access $ swap lines and (before 2002) emergency $ loans from the U.S Treasury? I explore this question in my job market paper (now updated). Thread

You can read it here: https://devikadutt.github.io/JMP/ . It's got some history, some theory weaved into the narrative, lots of descriptive stats, and some econometrics. The evolution of the global monetary system into a USD key currency system has meant that the issuers of USD have +

the "Exorbitant Privilege" or running sustained current account deficits/ capital account surpluses without running the risk of default. But it also means that the issuers of the USD have the unique ability to stabilize the global monetary system.

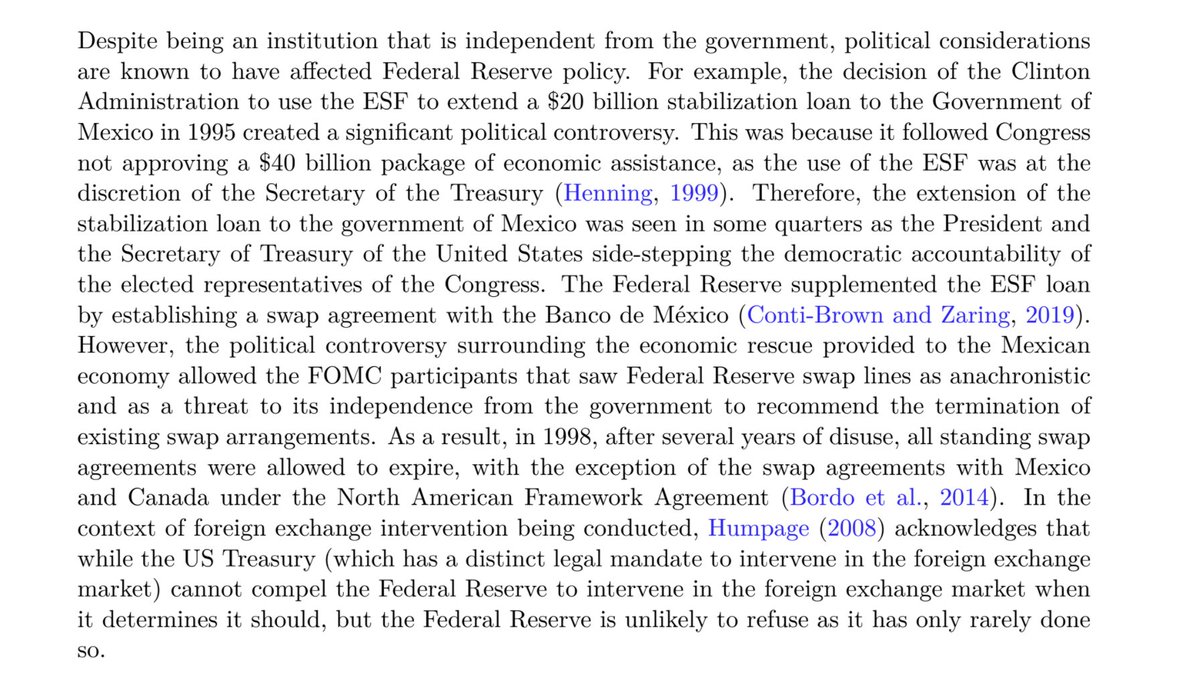

But the lenders of last resort, the Federal Reserve and the U.S. Treasury only embrace this role when the source of $ shortage-related instability is in some countries but not in others. What determines which countries prompt international lender of last resort (ILLR) action?

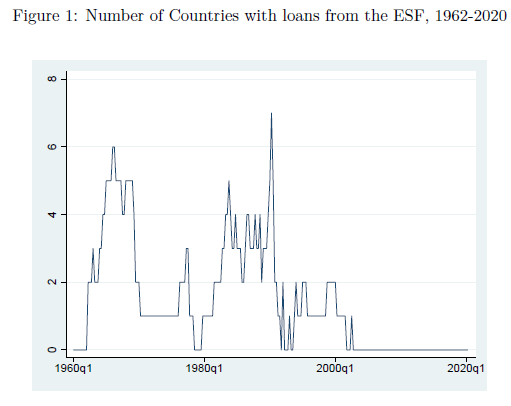

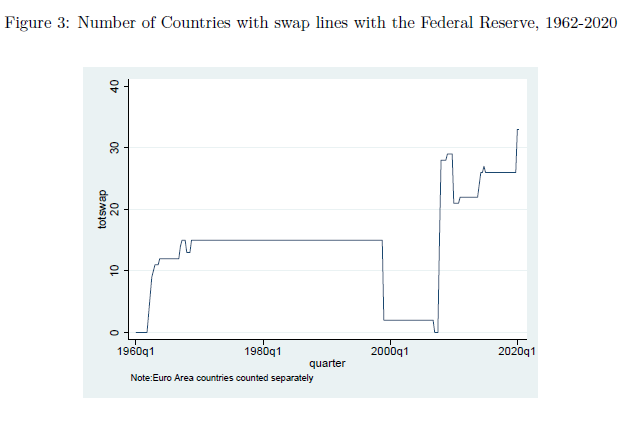

The U.S. State extends LLR support in two ways 1. Through the now much discussed swap agreements and 2. Until 2002, the Treasury Secretary/US President could use the Exchange Stabilization Fund (ESF) to make short term $ loans to foreign governments.

Both these institutions have embraced this ILLR role in the past. In recent years, especially in the case of the Federal reserve after the previous financial crisis. Why consider these two instruments together?

Two reasons 1. The effect of loans from the ESF and in the form of swap agreements are similar despite one being on the balance sheet of the US govt and the other on the balance sheet of the Fed. 2. Incidents of coordinated loans. I discuss this at greater length in the paper.

Building on the incredible work done by @daniel_mcdowell and @aditi_saha1084 in particular, I investigate the politically economy factors behind access to the lenders of last resort.

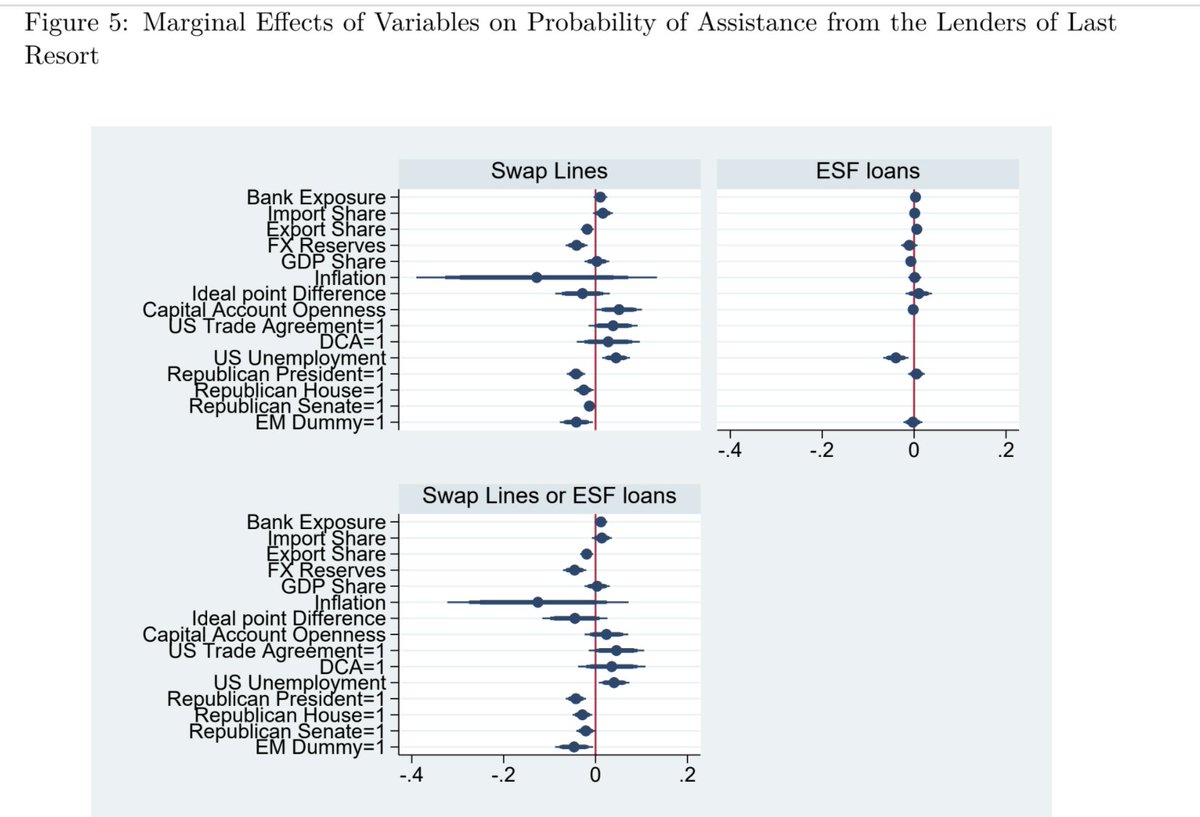

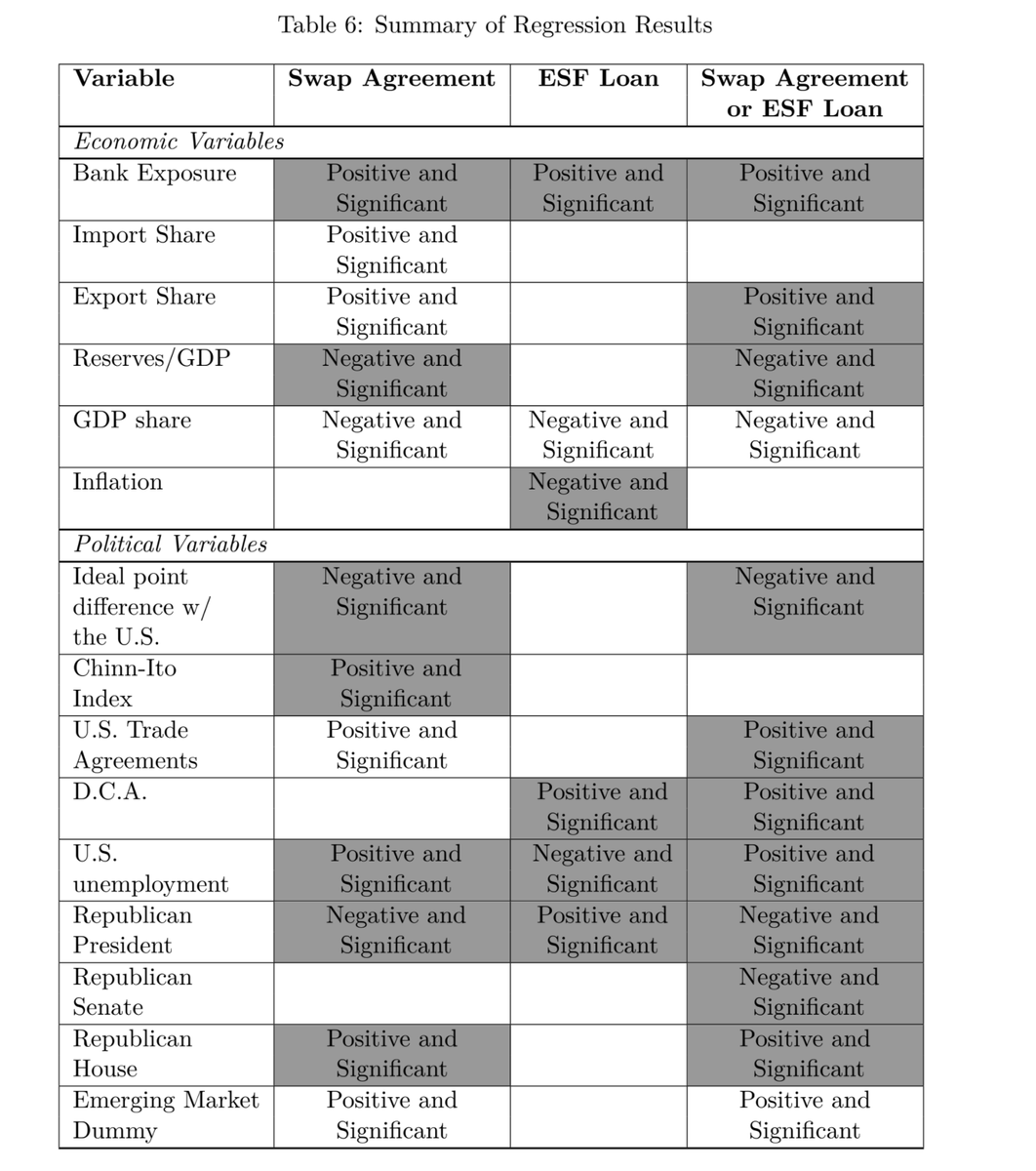

The consensus in the literature is that exposure of U.S. banks to an economy is the most important in predicting access to ILLR support. I also examine the role of trade, size of the economy, and inflation, and several political variables, namely,

the deviation of a country's voting record from that of the U.S. in the United Nations (Ideal point diff), capital account openness, trade or defense cooperation agreements with the U.S., unemployment in the U.S., and the party composition of U.S. govt.

These are my results. The results in the table that are shaded in gray are the ones that are robust to alternative specifications (boring details of empirical strategy in the paper).

I confirm that higher exposure of U.S. banks to a country increases the likelihood of having a swap agreement. I also find that a closer voting record to that of the U.S. in the UN, a trade or defense cooperation agreement, & higher capital account openness also increases the +

likelihood of access to the ILLR. Interestingly, a swap line is more likely to be extended under a Democratic President, but a Republican President was more likely to use the ESF to make loans to foreign govts.

Why does this matter? Why should the Fed and the U.S. Treasury care about USD shortages in other parts of the world? Well, 1. Because $ shortages in some parts of the world economy can and will directly affect financial stability in the U.S. and

2. These institutions have the ability to stabilize any volume of dollar shortages, or do "whatever it takes" as a LLR. Lack of financial stability in the global monetary system due to a $ shortage can be traced to the lack of emergency USD support.

The trouble is, ofc, that this is not their madate. Basically a global monetary system in which a national currency is the key currency is a perilous one, in which only the issuer of the key currency can stabilize the global system, but may not have the willingness to.

Throwing it all the way back to Kindleberger :)

Read on Twitter

Read on Twitter