In March, Congress gave billions in COVID relief to the @federalreserve to help struggling businesses. The Fed pledged these taxpayer dollars would *not* bail out Wall Street banks. They went back on their word—to the tune of 2 billion dollars. So I'm calling them out. (THREAD)

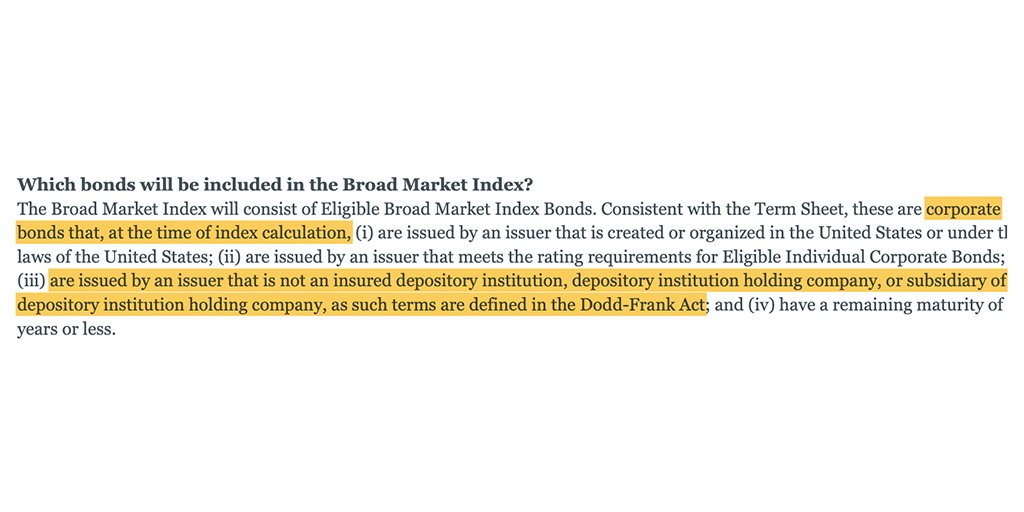

The Fed explicitly stated that COVID relief funds would not help “insured depository institutions”—aka banks. That makes sense, since many of those banks have had record profits during the coronavirus pandemic. And we just bailed them out in 2008-2009. (2/5)

Yet, the Fed used COVID relief funding to purchase $1.3 billion of Exchange-Traded Funds (ETFs). ETFs are baskets of stocks, similar to mutual funds, and they contain billions of Wall Street's debt. (3/5) https://www.wsj.com/articles/federal-reserve-discloses-holdings-of-1-3-billion-in-exchange-traded-funds-11590782661?adobe_mc=MCMID%3D59634828373946770323978863549584710469%7CMCORGID%3DCB68E4BA55144CAA0A4C98A5%2540AdobeOrg%7CTS%3D1605144727

Back in October, I wrote to the head of the Federal Reserve about this clear abuse of taxpayer dollars. I never got a response. (4/5) https://twitter.com/RepKatiePorter/status/1319014610255503360

So yesterday, I followed up with @federalreserve Vice Chair Randy Quarles directly. Rather than being honest about purchasing debts of megabanks like @jpmorgan, Mr. Quarles tried to hide behind a loophole.

Watch (5/5)

(5/5)

Watch

(5/5)

(5/5)

Read on Twitter

Read on Twitter