Thread on a truly crazy week in factor land

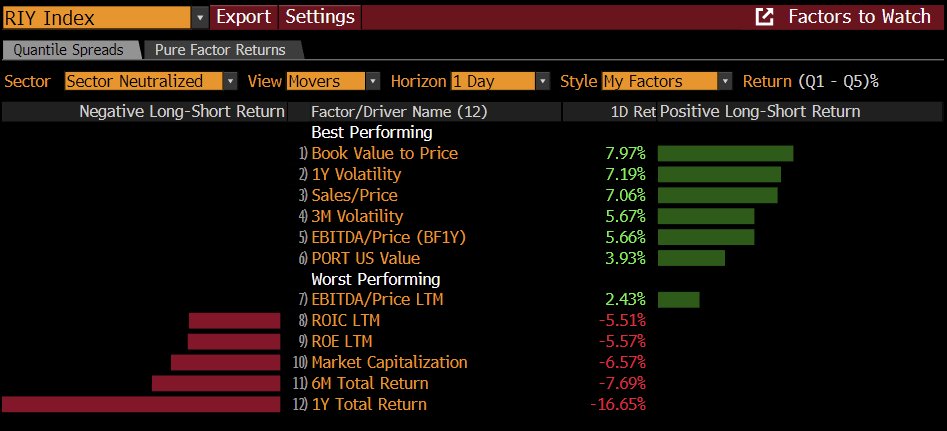

Monday's enormous move lower for momentum and higher for value set the stage for the week ...

Monday's FTW<go> screen:

1Y Total Return move good lord...

1Y Total Return move good lord...

Monday's enormous move lower for momentum and higher for value set the stage for the week ...

Monday's FTW<go> screen:

1Y Total Return move good lord...

1Y Total Return move good lord...

How big was the move in momentum on Monday?

I will refrain from using X std dev statistics in an effort not to get mocked ... but it was very very large.

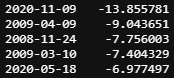

Our BI L/S momentum factor was down -13.85% percent on the day, the largest 1-day move since 2000:

5 largest declines:

I will refrain from using X std dev statistics in an effort not to get mocked ... but it was very very large.

Our BI L/S momentum factor was down -13.85% percent on the day, the largest 1-day move since 2000:

5 largest declines:

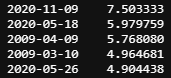

BI's L/S value factor was up 7.5% on Monday.

While not as big of an outlier as the momentum move, this is still the largest 1-day move higher over the last 20 years.

5 largest daily increases:

While not as big of an outlier as the momentum move, this is still the largest 1-day move higher over the last 20 years.

5 largest daily increases:

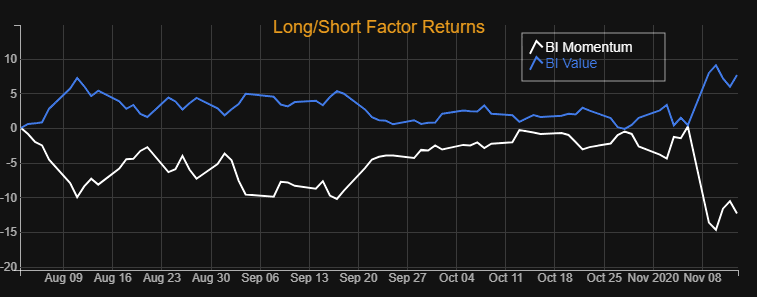

This week's factor moves continued the trends in place since August, though admittedly changing what was a very moderate trend (being kind) into a full-blown rotation.

Since August, I see L/S value now up 7.64% while L/S momentum is down -12.33%

Since August, I see L/S value now up 7.64% while L/S momentum is down -12.33%

Valuations, for what they are worth, argues for a continuation of this rotation

Momentum Factor Valuations remain expensive:

Q1 Momentum (high) median PX/Ebitda = 16.80

Q5 Momentum (low) median PX/Ebitda = 9.24

Momentum factor value spread = 7.56 (90th percentile since 2010)

Momentum Factor Valuations remain expensive:

Q1 Momentum (high) median PX/Ebitda = 16.80

Q5 Momentum (low) median PX/Ebitda = 9.24

Momentum factor value spread = 7.56 (90th percentile since 2010)

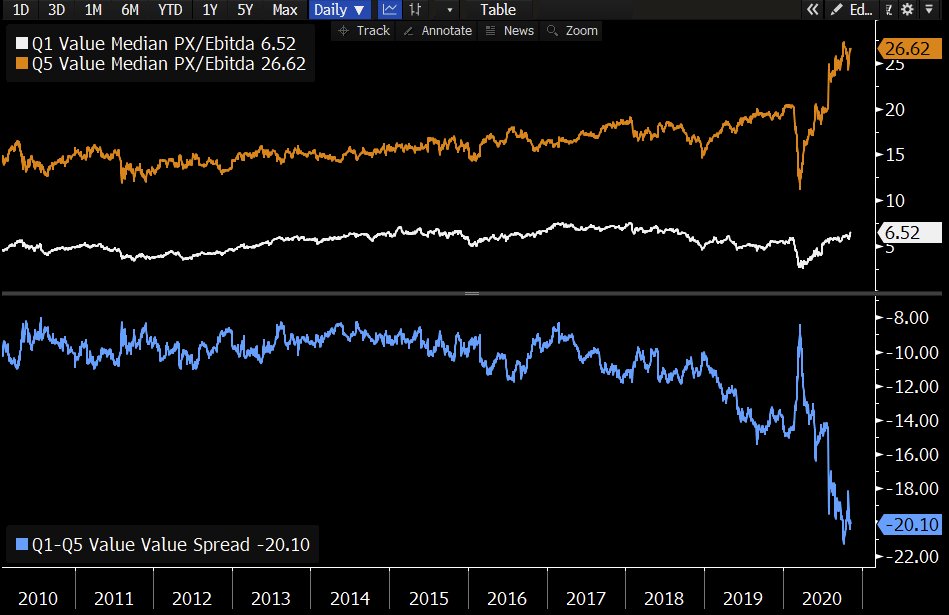

Value factor valuations are cheap (duh)

Value Factor Valuations:

Q1 Value (cheap) median PX/Ebitda = 6.52

Q5 Value (expensive) median PX/Ebitda = 26.62

Value factor value spread = -20.10 (1st percentile since 2010)

Value Factor Valuations:

Q1 Value (cheap) median PX/Ebitda = 6.52

Q5 Value (expensive) median PX/Ebitda = 26.62

Value factor value spread = -20.10 (1st percentile since 2010)

With positive trends (factor momentum) and cheap valuations spreads, the value factor should be set up for a run of outperformance...

Or it can break our heart per usual

Time will tell....

Or it can break our heart per usual

Time will tell....

Read on Twitter

Read on Twitter