1/ The Final Boss: Bitcoin vs Central Bank Digital Currencies

A question I often get asked is “Do you think Central Bank Digital Currencies (CBDCs) are a threat to Bitcoin?”

A thread

A question I often get asked is “Do you think Central Bank Digital Currencies (CBDCs) are a threat to Bitcoin?”

A thread

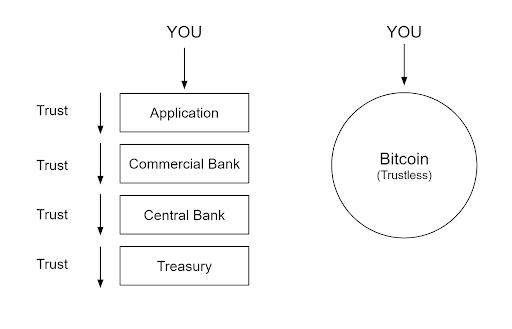

2/ What is a CBDC? It’s a digital currency issued by the central bank that enables consumers and businesses to directly interface with it. Right now business and consumers can’t directly “bank” with the central bank, but instead through various intermediaries (ex: JP Morgan)

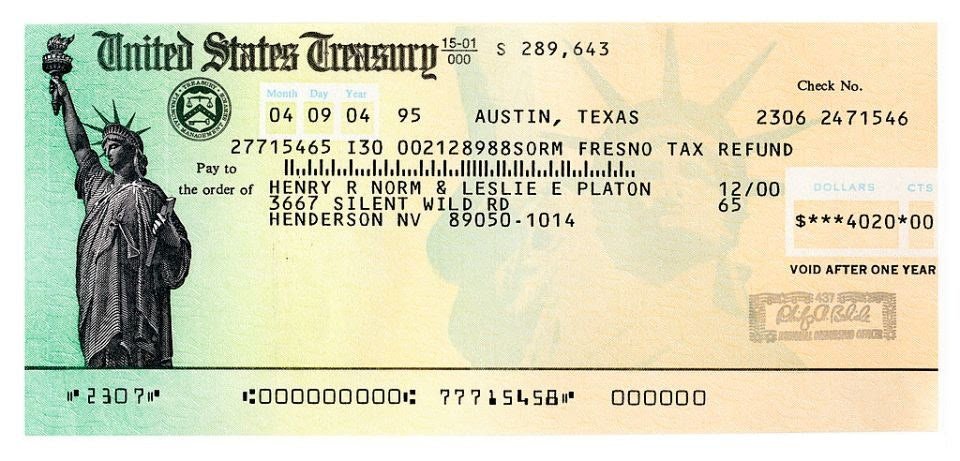

3/ The supposed benefits of a CBDC are that it would decrease transaction and settlement costs, improve distribution of stimulus checks, etc. via this direct access, however the true intention is a bit more sinister.

4/ The idea of CBDCs became more popular w/:

- The rise of stablecoins and FB's Libra

- During COVID, countries struggled to distribute stimulus checks directly to consumers/businesses

- Countries like China have looked into it as a way to complete the shift away from cash

- The rise of stablecoins and FB's Libra

- During COVID, countries struggled to distribute stimulus checks directly to consumers/businesses

- Countries like China have looked into it as a way to complete the shift away from cash

5/ Bitcoin enters the chat

Some folks think that Bitcoin’s innovation is being a “digital currency for cheap payments,” hence the confusion with CBDCs. However, digital versions of fiat currencies existed far before Bitcoin and CBDCs: bank accounts, brokerages, PayPal, etc.

Some folks think that Bitcoin’s innovation is being a “digital currency for cheap payments,” hence the confusion with CBDCs. However, digital versions of fiat currencies existed far before Bitcoin and CBDCs: bank accounts, brokerages, PayPal, etc.

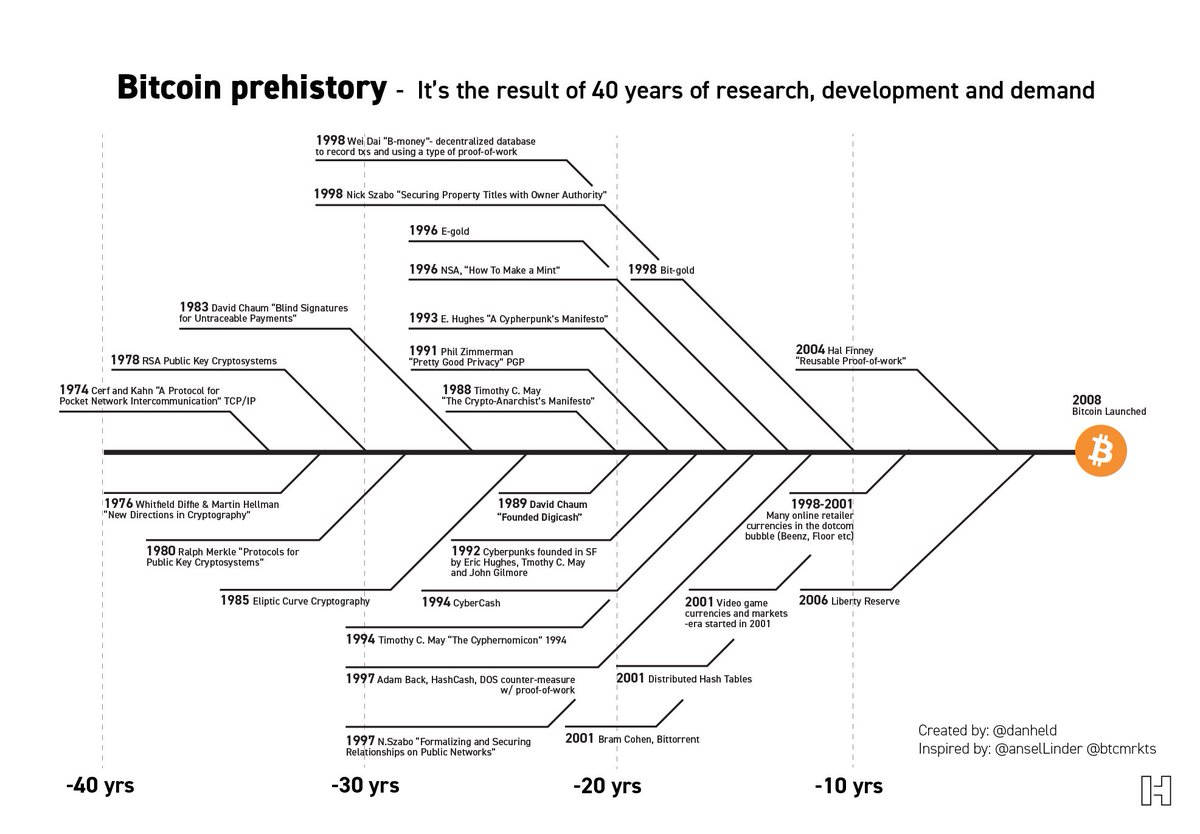

6/ Even when we extend the definition of digital currency into “digital cash/gold” or cryptocurrency, we find that Bitcoin was late to the game.

7/ “A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them" - Satoshi

Bitcoin was 40 years in the making.

Bitcoin was 40 years in the making.

8/ Bitcoin wasn’t created to make payments cheap, it was built to enable true ownership of money without having to trust a government or third party.

9/ “The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money...” - SN

10/ Starting to get the theme? Satoshi created Bitcoin to solve the problem of trust with money.

And why is that important? Since the dawn of humankind, governments have sought to seize and censor the transactions of their citizens.

And why is that important? Since the dawn of humankind, governments have sought to seize and censor the transactions of their citizens.

11/ Bitcoin breaks that power over citizens by enabling anyone, anywhere to transact with whomever they like and preserve their wealth without trusting anyone else.

That’s the magic.

That’s the magic.

12/ The end game

CBDCs largely do not solve problems for consumers. For the supposed marginal improvement in efficiency (and since when are Governments efficient?) it would extend their control into every single business and personal transaction.

CBDCs largely do not solve problems for consumers. For the supposed marginal improvement in efficiency (and since when are Governments efficient?) it would extend their control into every single business and personal transaction.

13/ Governments would:

- Be able to automatically tax every transaction.

- Be able to censor transactions from specific individuals.

- Would have visibility into every transaction and counter party.

This is where freedom goes to die.

Thankfully, we have Bitcoin.

- Be able to automatically tax every transaction.

- Be able to censor transactions from specific individuals.

- Would have visibility into every transaction and counter party.

This is where freedom goes to die.

Thankfully, we have Bitcoin.

14/ With CBDCs looming on the horizon, Bitcoin’s value prop becomes even sharper: a digital swiss bank that cannot be touched or censored by governments.

Bitcoin offers us a way out of this dystopian novel.

Bitcoin offers us a way out of this dystopian novel.

15/ Like this tweet storm?

If you sign up for my newsletter, you’ll get this content a day before its tweeted (will be publishing weekly)! https://danheld.substack.com/subscribe

If you sign up for my newsletter, you’ll get this content a day before its tweeted (will be publishing weekly)! https://danheld.substack.com/subscribe

And check out the livestream later today if you prefer video content!

Going live in 1.5 hrs

Going live in 1.5 hrs

Read on Twitter

Read on Twitter