More meticulous, clever & hugely helpful work (in the main) from @JamesSmithRF and @resfoundation team yesterday.

But found the logic on consolidation -- and the rationale that gets to £40bn in particular -- uncharacteristically weak on its own terms. https://www.resolutionfoundation.org/publications/unhealthy-finances/

But found the logic on consolidation -- and the rationale that gets to £40bn in particular -- uncharacteristically weak on its own terms. https://www.resolutionfoundation.org/publications/unhealthy-finances/

Two quick reflections.

First, lack of breadth. Authors point out "fiscal sustainability" is state-contingent & uncertain.

Presumably this requires assessment across different scenarios? But paper seems preoccupied with just one scenario: fiscal "limits" binding at low levels.

First, lack of breadth. Authors point out "fiscal sustainability" is state-contingent & uncertain.

Presumably this requires assessment across different scenarios? But paper seems preoccupied with just one scenario: fiscal "limits" binding at low levels.

What if they bind at higher levels? Or what if the level of fiscal aggregates themselves aren't even that relevant?

We don't know.

That's why there needs to be consideration/weight given to the costs of unnecessary/excessive consolidation too. But this barely features at all.

We don't know.

That's why there needs to be consideration/weight given to the costs of unnecessary/excessive consolidation too. But this barely features at all.

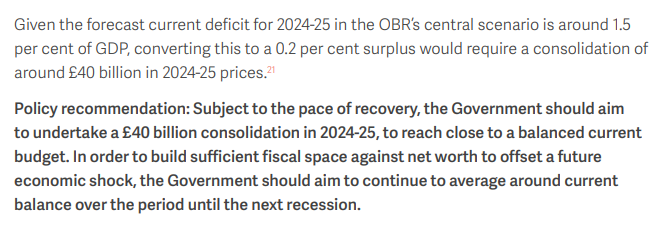

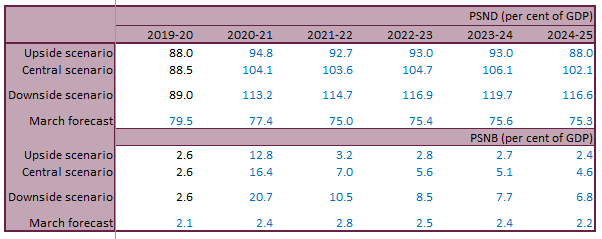

Second, the £40bn figure is oddly precise, given it's highly sensitive to an OBR baseline forecast that has a vast error term and is also now very out of date (eg its pre-winter lock down).

The difference alone *between* (now out of date) OBR scenarios (>2%GDP in 2024/25) would seem enough to tip RF's calculation for £40bn (1.7%GDP) consolidation into either far deeper consolidation, or indeed, no consolidation at all.

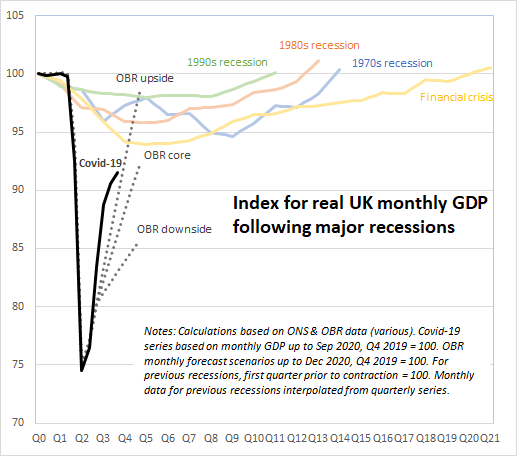

But recent path for GPD has in fact sat *outside* the OBR's scenarios, emphasizing degree to which we are dealing with uncertainty in all of this.

Normal recessions tend to embody more uncertainty than economists tend to acknowledge, but this is also a recession like no other.

Normal recessions tend to embody more uncertainty than economists tend to acknowledge, but this is also a recession like no other.

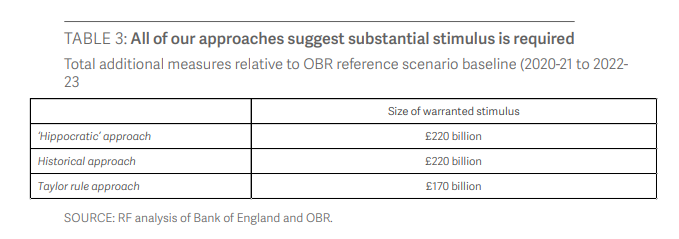

And then of course there is policy uncertainty. @resfoundation have done really valuable work showing how there is a significant missing stimulus in the UK economy over the short/medium term.

Such a stimulus would also have a big impact on OBR forecasts for fiscal aggregates.

Such a stimulus would also have a big impact on OBR forecasts for fiscal aggregates.

Which brings me back to the first point about why the paper seems so preoccupied with just one, albeit broad, scenario for 'fiscal limits'?

With thanks again to @resfoundation for really clear and thought provoking work - I'd be very keen to learn if I am missing something?

With thanks again to @resfoundation for really clear and thought provoking work - I'd be very keen to learn if I am missing something?

Read on Twitter

Read on Twitter