But professor...

When you told me #Bitcoin was a Ponzi scheme you left out the part about the four-year halving cycle and two-week difficulty adjustment...

was a Ponzi scheme you left out the part about the four-year halving cycle and two-week difficulty adjustment...

How does that work?

//Thread Post 1

When you told me #Bitcoin

was a Ponzi scheme you left out the part about the four-year halving cycle and two-week difficulty adjustment...

was a Ponzi scheme you left out the part about the four-year halving cycle and two-week difficulty adjustment...How does that work?

//Thread Post 1

So you've probably heard your professor or resident expert economist tell you that #Bitcoin  is a scam. Well, guess what, it's not. Everyone keeps claiming it's dead, but here we are, it keeps coming back and with a vengeance. How is that happening? Easy. The code is designed

is a scam. Well, guess what, it's not. Everyone keeps claiming it's dead, but here we are, it keeps coming back and with a vengeance. How is that happening? Easy. The code is designed

is a scam. Well, guess what, it's not. Everyone keeps claiming it's dead, but here we are, it keeps coming back and with a vengeance. How is that happening? Easy. The code is designed

is a scam. Well, guess what, it's not. Everyone keeps claiming it's dead, but here we are, it keeps coming back and with a vengeance. How is that happening? Easy. The code is designed

to slowly gain entrenchment into the existing financial rails and eventually take over as a global reserve settle money. If it happens too quickly or linearly, governments would attempt to shut it down. But If it happens slow enough - and volatile enough - deep entrenchment

is possible. And guess what, that's where we are today. Banks like Fidelity are recommending 5% portfolio allocation into #Bitcoin  and an entire legal framework is being stood up to handle its ownership - worldwide. Listen to this if you have concerns. https://www.theinvestorspodcast.com/episodes/tip284-bitcoin-law-legal-implications-w-caitlin-long/

and an entire legal framework is being stood up to handle its ownership - worldwide. Listen to this if you have concerns. https://www.theinvestorspodcast.com/episodes/tip284-bitcoin-law-legal-implications-w-caitlin-long/

and an entire legal framework is being stood up to handle its ownership - worldwide. Listen to this if you have concerns. https://www.theinvestorspodcast.com/episodes/tip284-bitcoin-law-legal-implications-w-caitlin-long/

and an entire legal framework is being stood up to handle its ownership - worldwide. Listen to this if you have concerns. https://www.theinvestorspodcast.com/episodes/tip284-bitcoin-law-legal-implications-w-caitlin-long/

So how did this slow-roll, Trojan horse, #Bitcoin  protocol perform this feat? Enter the 4 year halving cycle. You see, every 4 years, the protocol tightens the issuance of new coins. In fact, it gets twice as tight every four years.

protocol perform this feat? Enter the 4 year halving cycle. You see, every 4 years, the protocol tightens the issuance of new coins. In fact, it gets twice as tight every four years.

protocol perform this feat? Enter the 4 year halving cycle. You see, every 4 years, the protocol tightens the issuance of new coins. In fact, it gets twice as tight every four years.

protocol perform this feat? Enter the 4 year halving cycle. You see, every 4 years, the protocol tightens the issuance of new coins. In fact, it gets twice as tight every four years.

To put this into context, think about gold mining operations where every mining company in the world starts finding half as much gold...but it only happens every four years. What impact would that have on the price? That's right, the sell-side would get exhausted and

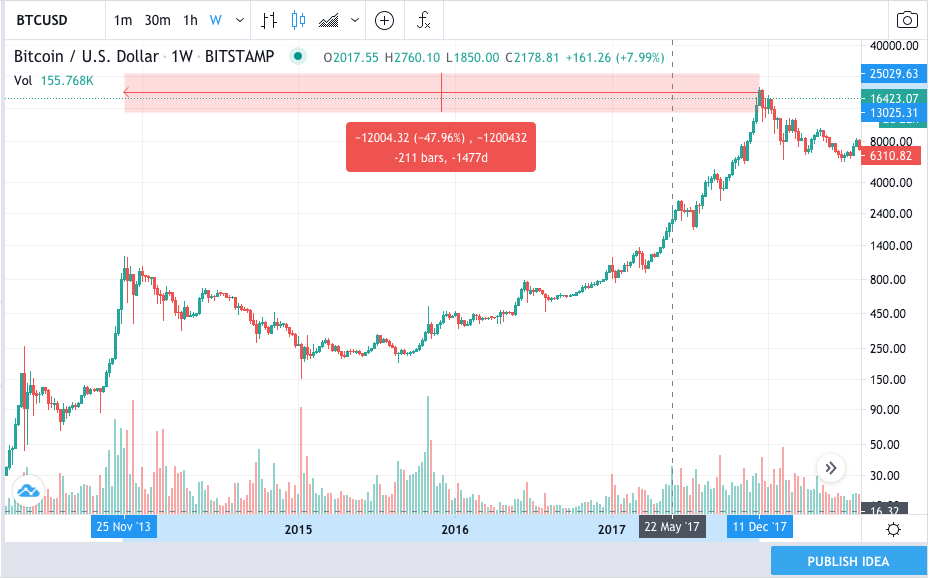

the price would go up. So if this is happening every four years, we should be able to see that in the price chart, right? Well, yeah, you can. Here's an example. The last all-time time high (ATH) was on 11 DEC 2017 and the previous ATH was 1,477 days prior.

Or in other words 4.04 years prior. Not only is the 4-year halving cycle quite interesting for keeping the protocol governed for a certain speed of adoption, but it also has a 2-week difficulty adjustment. Going back to our gold example, let's use that so we can understand

how the 2-week difficulty adjustment works. If everyone knows the supply is going to get tighter and tighter every four years, the miners would hire more workers to front-run the future margins. In the short term, this would cause an increased amount of supply,

more selling, and sluggish prices. But, what if the earth somehow found a way to make the amount of gold being mined, more difficult to find, relative to the number of people showing up for work each day? What would that mean?

In this situation, it's akin to a god enforcing a fixed rate of supply per day regardless of how many workers show up for the job. So if 10 people show up to mine, it's no different than 1 million people showing up to mine. They'll still find the same amount of gold every day.

This is how Bitcoin works. The difficulty adjustment ensures that only so much flow can be dropped into the market every day. What that means for the price is interesting because it helps calm the urge to front-run the future halving events. Why?

Because as the halving event approaches, it's also the most competitive time for miners. As more sharks enter the water for feeding time, less food is split amongst them, and as a result, they need to sell more reward treasury which has been sitting on their balance sheet.

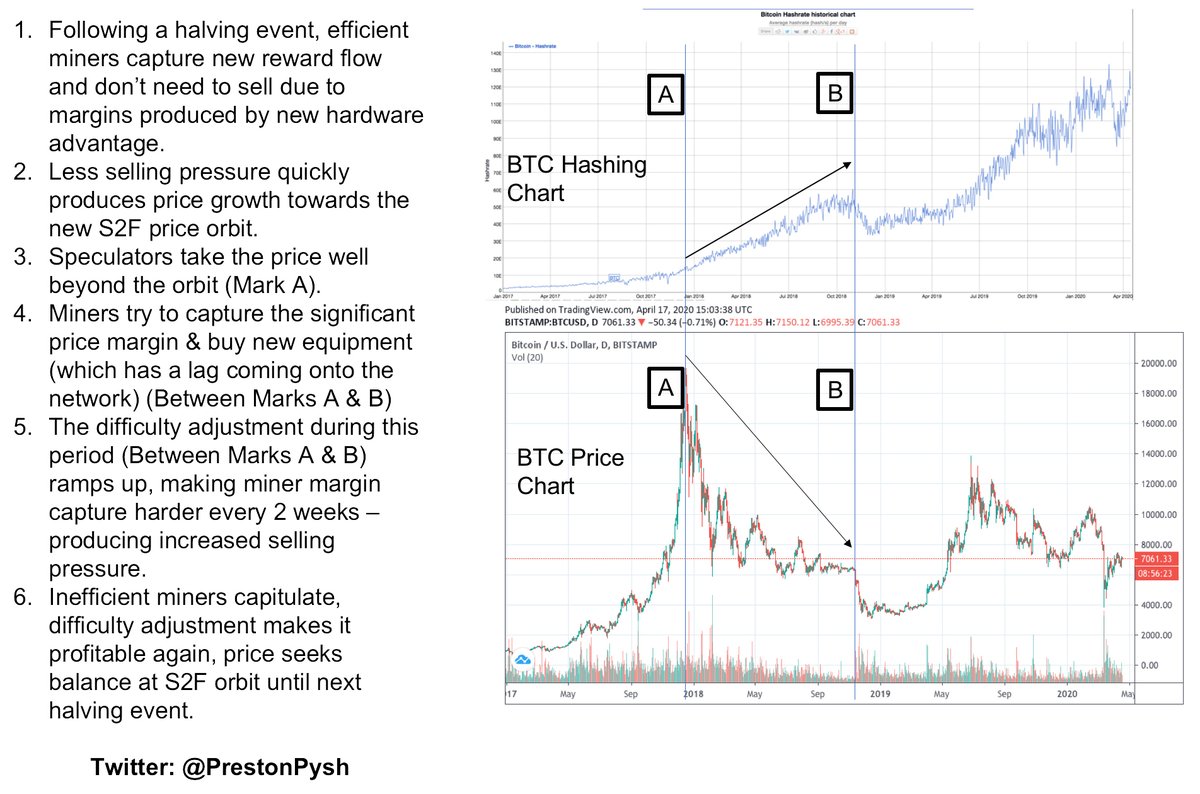

This increases selling to remain solvent and puts a drag on the price. Here's a chart I built earlier in the year that attempts to capture this interesting and unique dynamic.

Similar to how solids turn into liquid and then into gas, Bitcoin makes these jumps from one price orbital to another. After the 4-year jump, the price is volatile but that's because

it's seeking a symbiotic relationship between, miners settling electrical expenses denominated in fiat, demand from long-term BTC holders, and growing competition in anticipation for front running the halving event but with a fixed reward flow.

An anon account called PlanB ( @100trillionUSD) has modeled these price orbitals with shocking accuracy and transparency. Just look at the modeled prediction and the actual price thus far. So, where does this take us moving forward?

Well, that all depends on how much the world continues to trust fiat currencies as their unit of account (UoA) for conducting economic calculation. Regardless of whether it becomes preferred global money for settlement or not, it appears these price jumps aren't going away.

In fact, the protocol's designer(s) might actually prefer if the world continues to remain skeptical even longer. It appears doubt is the sword that supplies the cuts to Bitcoin's Trojan Hydra neck.

Thanks for reading and be sure to share this thread with all your professors.

Thanks for reading and be sure to share this thread with all your professors.

Read on Twitter

Read on Twitter