This report is entirely ignorant of decades of academic literature on fiscal consolidation. Spending cuts have negligible effects on growth and sometimes positive effects. See Alesina, Giavazzi, Ardagna, Romer & Romer etc. https://twitter.com/TorstenBell/status/1326892627929796610

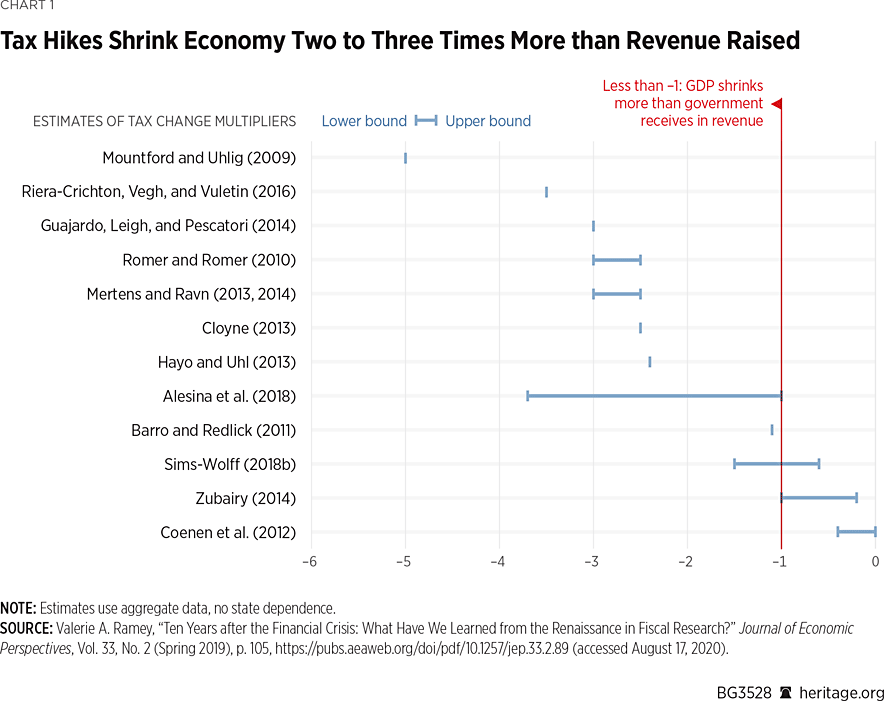

Tax hikes on the other hand cause deep and long lasting economic contractions. My friend Adam Michel did a great job of reviewing a decade of Ramey's work on tax multipliers: "Tax hikes shrink economy 2 to 3 times more than revenues raised" (see graphic).

It's also important to note that, not only are tax hikes contractionary and spending cuts not contractionary. But, consolidations focusing primarily on tax hikes are almost always unsuccessful at reducing deficits and debt levels.

Our own analysis of the existing literature and data on fiscal consolidations from 1995 to 2018 reveals that successful consolidations focus at least 60% of their adjustments on spending reductions. Spending cuts succeed and tax hikes fail at consolidating deficits and debt.

Using different data and control variables for tax/spending data going back to 1947 reveals that each additional £1 raised from tax hikes results in an additional £1.17 in government spending.

All of these studies are quite well known among the fiscal consolidation experts, which is why I am surprised that this report completely overlooks all of it. In a literature review of 26 peer-reviewed journal articles, all but three find a negative effect of taxes on growth

Tax hikes 1) encourage more spending and 2) lower economic output and employment levels. This leads to a smaller tax base, reduced productivity, diminished wage growth, and a subsequent worsening in fiscal condition.

Read on Twitter

Read on Twitter