The QuadrigaCX bankruptcy trustee has issued a new report that shows Quadriga users may recover somewhere between 14% and 19% of their claims but highlights a conflict between those QCX users who held crypto and those who had fiat. A thread blob: https://documentcentre.ey.com/eac5991a-c4a5-453e-81d6-b01e900af264

blob: https://documentcentre.ey.com/eac5991a-c4a5-453e-81d6-b01e900af264

blob: https://documentcentre.ey.com/eac5991a-c4a5-453e-81d6-b01e900af264

blob: https://documentcentre.ey.com/eac5991a-c4a5-453e-81d6-b01e900af264

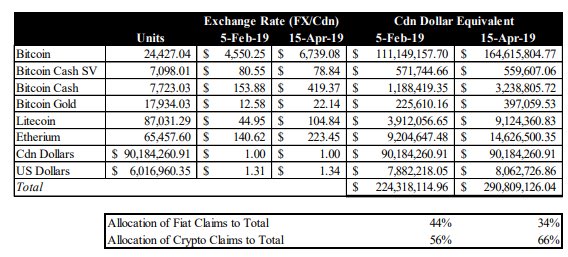

As at Sep 11, 2020, Quadriga users had made 17,053 claims with a total CAD value of either $224M or $291M, depending on whether you use prices at Feb 5 2019 or Apr 15 2019 to convert crypto and USD into CAD (more on those dates below). Or at today’s prices, $665M.

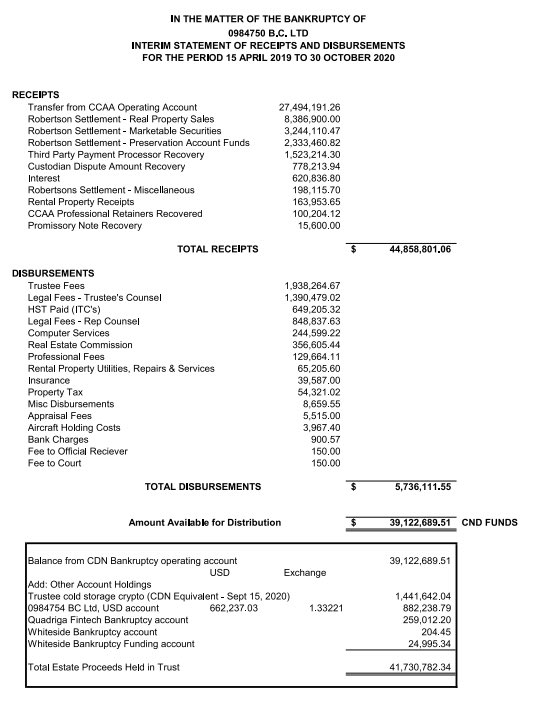

On the asset side, the Quadriga trustee has recovered about CAD$14.3M from its settlement with Gerald Cotten’s estate and widow. The trustee has also recovered funds from payment processors: CAD$778K, from Costodian/Billerfy, and $1.5M from another unnamed payment processor.

All told, as at Oct 30 2020, the QuadrigaCX trustee had CAD$39.1M in cash, plus about CAD$1.4M in crypto and some other funds in other accounts. The total amount in trust is approx CAD$41.7M.

Leaving aside future costs and any further claims, including any tax claim by the CRA, recovery on claims appears to be approx 19% using Feb 5 2019 as the valuation date, or 14% using Apr 15 2019. (And 6% at today’s prices.)

So what’s the issue with the date? The issue is that the majority of the claims are for crypto or USD, but the Quadriga trustee will be paying out CAD, so the trustee needs to figure out how to convert crypto and USD to CAD. This means picking a valuation date.

The trustee’s report examines two dates: Feb 5 2019, when Quadriga got court protection to restructure, and Apr 15 2019, when Quadriga was placed into bankruptcy. However, between February and April 2019, crypto generally went up in value in CAD terms.

As I observed a while back, this sets up a conflict between Quadriga users who have mostly claims for crypto and users who have mostly claims for fiat. The fiat claimants will want the earlier date; the crypto claimants will want the later date. https://twitter.com/evanmthomas/status/1260687049155321857?s=20

The trustee’s report confirms this. Based on the trustee’s numbers, a user with a claim for only CAD will recover 23% less in CAD if Apr 15 2019 is used. But a Quadriga user with a claim for only BTC will get 14% more in CAD if Apr 15 2019 is used.

So which date? The trustee says the date of bankruptcy should be used. The trustee points to the bankruptcy law, which refers to “all debts and liabilities, present or future, to which the bankrupt is subject *on the day on which the bankrupt becomes bankrupt*”.

The trustee suggests that this supports using the date of bankruptcy as the valuation date. But on its face, this is referring to liabilities that exist on the date of bankruptcy; it is not clearly saying those liabilities need to be valued as at the date of bankruptcy.

The general presumption for assessing the value of damages is at the date of breach of an obligation. One could argue that the better date for assessing damages for Quadriga users’ claims is Feb 5 2019, when it became clear Quadriga was insolvent and wasn’t allowing withdrawals.

This is just an unresearched argument, not an opinion. The only point is that there could be arguments in favour of Feb 5 2019, not Apr 15 2019, to value Quadriga claims. Ultimately, the court will decide, and not every Quadriga claimant will be happy with the outcome.

Read on Twitter

Read on Twitter