0/ Our team @Delphi_Digital put out a note earlier this week updating all our clients on the current state of @Nexus_Mutual and why our long term thesis for $NXM is stronger than ever.

A preview thread below, but full post can be read here: https://www.delphidigital.io/reports/nexus-mutual-update-and-outlook/

A preview thread below, but full post can be read here: https://www.delphidigital.io/reports/nexus-mutual-update-and-outlook/

1/ The Capital Pool has experienced an outflow of almost 30k ETH since October 1st. It was initially fueled by the defi decline and then exacerbated by the programmatically increasing MCR.

2/ Since MCR (measured in ETH) was growing by 1% per day, it was increasing by a gradually larger amount while capital pool inflows were slowing down, eventually turning negative. This created downward pressure on price & disincentivized growth of the capital pool until 130% MCR

3/ The purpose of MCR is to dictate capacity, which is why it was programmatically grown through most of Nexus' existence. Now that capacity was substantial enough to address current cover demand, continuing to grow it would only serve as a deterrent to capital pool growth.

4/ Its impact as a deterrent was especially prominent with DeFi sentiment transitioning from bullish to bearish. As a result, we proposed pausing MCR early last month, a proposal that was successfully passed. https://twitter.com/NexusMutual/status/1316673682681532417?s=20

5/ As MCR was gradually declining, Degen Spartan put out a thread explaining the dynamic and suggested capital could keep exiting all the way down to MCR of 100%. As expected, this accelerated the decline. https://twitter.com/DegenSpartan/status/1323330703589662720?s=20

6/ While we agree with most of his assumptions, I don’t believe a sizable unlock is to be expected 90 days after the August price spike.

Few reasons why:

Few reasons why:

7/ Less than 10% of the supply is actually locked to begin with. The makeup of stakers is mostly those that stake and unstake immediately (to minimize lockup length period while still capturing some rewards) and those that stake for extended periods of time.

8/ Tracking inflows to the wallet used for staking also shows that some of the early stakers, that have been sitting in massive unrealized gains for well over 90 days, continue to stake.

@HughKarp is also a large holder that unlocks soon, and intends to restake (shocker)

@HughKarp is also a large holder that unlocks soon, and intends to restake (shocker)

9/ I think it’s unlikely that MCR hits 100% because it’s a momentum play, and MCR decline has slowed considerably. NXM price sensitivity to inflows and outflows declines with MCR %, which reduces the EV of trying to sell here and buy back lower.

10/ As MCR declines, remaining potential sellers are mostly those worried about getting locked in and traders thinking about opp cost

It's tough to quantify them, but seeing the MCR decline trend gradually reverse provides confidence that there's exhaustion among those sellers.

It's tough to quantify them, but seeing the MCR decline trend gradually reverse provides confidence that there's exhaustion among those sellers.

11/ The immediate silver lining is that this situation has virtually no effect on the ability of the protocol to function as intended.

Cover capacity remains unchanged from much higher levels of MCR %.

Cover capacity remains unchanged from much higher levels of MCR %.

12/ The programmatic growth of MCR coupled with the effects of the SAFE launch and the slowdown of yield farming has likely allowed MCR to grow beyond the capacity needed for individual users at this exact moment.

There are benefits to this though...

There are benefits to this though...

13/ This creates the opportunity for @NexusMutual to offer large, protocol-wide cover, like @HughKarp suggested for @MakerDAO.

Incorporating this type of 'commercial' cover purchasing should create a much more consistent and sizable level of demand. https://forum.makerdao.com/t/makerdao-protocol-cover-using-nexus-mutual/4761

Incorporating this type of 'commercial' cover purchasing should create a much more consistent and sizable level of demand. https://forum.makerdao.com/t/makerdao-protocol-cover-using-nexus-mutual/4761

14/ These policies will be tailored for each protocol, offering unique protection that currently doesn't exist in the market.

Some projects are already looking to internally generate funds to purchase cover. We expect to see other projects purchase this type of cover as well.

Some projects are already looking to internally generate funds to purchase cover. We expect to see other projects purchase this type of cover as well.

15/ The need for an insurance type product is clear, and as a result, we’ve seen some other competitors come about.

None are live quite yet, and we’ve yet to see an insurance model design or team that compares with @NexusMutual

We touch on the flaws of comps in the note

None are live quite yet, and we’ve yet to see an insurance model design or team that compares with @NexusMutual

We touch on the flaws of comps in the note

16/ While the current Nexus Mutual outflows don’t create systemic risks for the platform, it’s certainly beneficial to have capital flowing back into the mutual.

Solvency isn’t an issue, but it creates additional buffer room to absorb claim events.

Solvency isn’t an issue, but it creates additional buffer room to absorb claim events.

17/ In the long run, it’s important to continue growing the mutual because this speculation induced reflexivity of price up -> increased cover capacity -> increased fee inflow from purchases, is healthy to sustain

There are a few things Nexus Mutual is doing to curb the outflow

There are a few things Nexus Mutual is doing to curb the outflow

18/ Currently the outflows have appeared to slow down.

This is important because the sentiment can now shift from fear around approaching 100% MCR to opportunity, in the sense that you’re buying near an actual price floor.

This is important because the sentiment can now shift from fear around approaching 100% MCR to opportunity, in the sense that you’re buying near an actual price floor.

19/ One initiative is to begin investing assets from the capital pool, which ATM is primarily made up of $ETH + a little $DAI

A more developed mutual would follow a strong asset liability matching system (shifting mutual assets to match currency denomination of existing cover)

A more developed mutual would follow a strong asset liability matching system (shifting mutual assets to match currency denomination of existing cover)

20/ Nexus Mutual currently plans to keep a majority of mutual assets in ETH until appropriate to rebalance away from it.

Plans are to allocate a portion of that to the @iearnfinance Eth vault, along with a few other venues to reduce concentration risk

Plans are to allocate a portion of that to the @iearnfinance Eth vault, along with a few other venues to reduce concentration risk

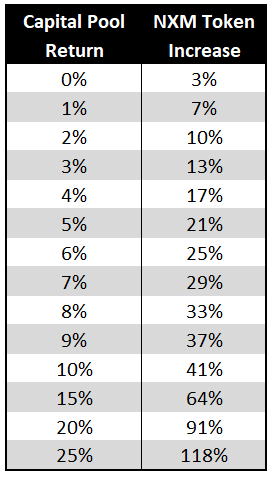

21/ Using the current size of the mutual and assuming there are no new inflows or outflows, we show the price impact below based on different levels of return.

The ability of the BC-based price calc to translate flow to the pool into strong price appreciation is clear below.

The ability of the BC-based price calc to translate flow to the pool into strong price appreciation is clear below.

22/ We believe this is very synergistic with the design and value prop of NXM.

A widely used investing framework for committing capital to the pool is that it provides you with higher upside beta exposure to ETH.

A widely used investing framework for committing capital to the pool is that it provides you with higher upside beta exposure to ETH.

23/ Now you’re able to add on the yields from the yETH pool to this exposure, but in an amplified way.

Rather than just getting the yield from the yETH pool, you’re receiving the impact of that yield on the capital pool, which generates a considerably higher return.

Rather than just getting the yield from the yETH pool, you’re receiving the impact of that yield on the capital pool, which generates a considerably higher return.

24/ We dive into a few more reasons why we continue to hold $NXM in the full note, but the TLDR is this:

Our long term thesis is unchanged. @NexusMutual is the clear leader in a sector that’s both necessary and difficult to compete with the incumbent in.

Our long term thesis is unchanged. @NexusMutual is the clear leader in a sector that’s both necessary and difficult to compete with the incumbent in.

25/ Nexus Mutual isn’t feasible to fork because of the capital pool, the existing scale and capacity, and their strong team. We have no reason to believe they won’t continue to be the clear leader in Insurance.

Read the full write-up here: https://www.delphidigital.io/reports/nexus-mutual-update-and-outlook/

Read the full write-up here: https://www.delphidigital.io/reports/nexus-mutual-update-and-outlook/

Read on Twitter

Read on Twitter