New data on Help to Buy Equity Loan book performance have been published for the first time. Time for a thread.

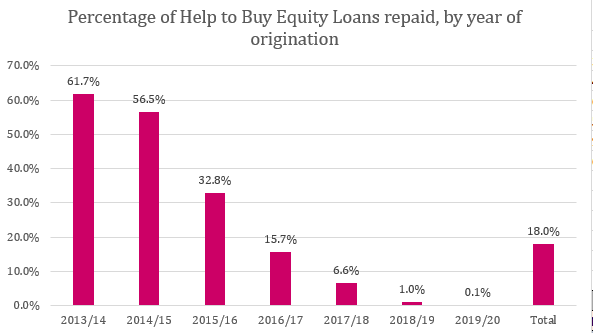

18% of the 272k Help to Buy loans have been repaid with the return on those investments coming in at just over 10% for the taxpayer.

18% of the 272k Help to Buy loans have been repaid with the return on those investments coming in at just over 10% for the taxpayer.

So far then 49,020 loans have been repaid. Those loans had an original value of £2.25bn. The redemption value paid to Homes England was £2.48bn, 10.3% higher than original value.

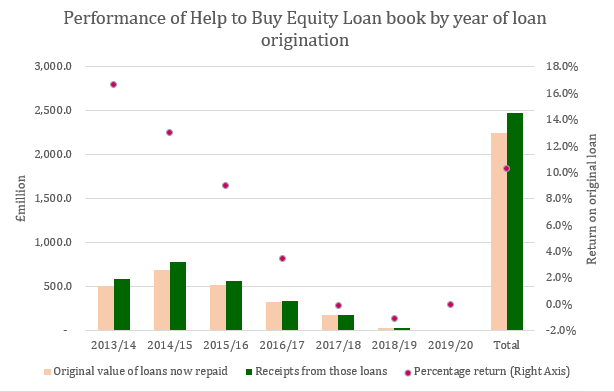

Unsurprisingly, performance of early loans is best but, very recent ones redeemed early perform okay.

Unsurprisingly, performance of early loans is best but, very recent ones redeemed early perform okay.

Now let's look at the loans repaid just last year (the 12 months to 31 March 2020)...

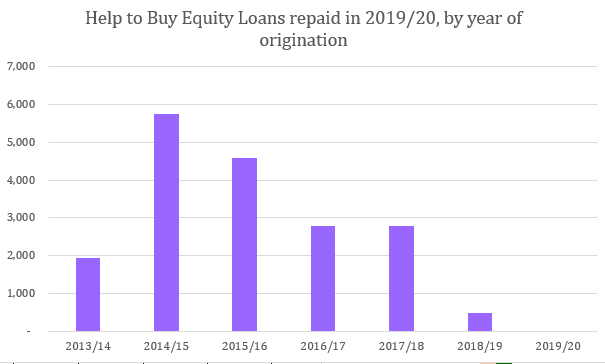

Unsurprisingly, the bulge in redemptions last year came from the 2014/15 cohort

Unsurprisingly, the bulge in redemptions last year came from the 2014/15 cohort

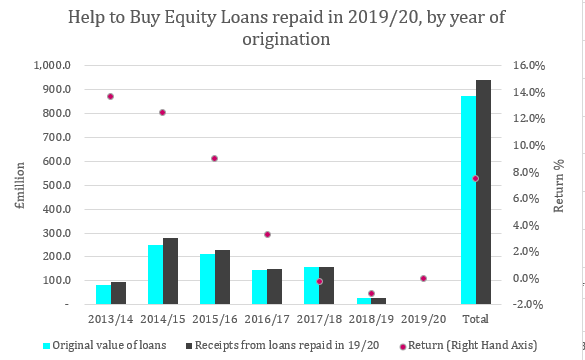

£941m was received by the Exchequer last year from repayment of Help to Buy Equity Loans. Of the loans repaid during 2019/20, total return was £66m, 7.5% up on the original £875m of these 18,375 loans

6.7% of all loans in the book were repaid during the course of 2019/20. Loans from 13/14 and 14/15 saw double digit % returns at 13.7% and 12.5% respectively.

This is a great set of data. Long overdue. One wonders if this may change some opinions about the scheme. Of course, the accusation now will be that as we head into a potentially more difficult time for the market, this strong performance of the book will soften.

I guess that's likely but if the scheme spends the next few years generating even small returns it will seemingly have been an excellent investment.

What a day.

What a day.

Read on Twitter

Read on Twitter