The @BIA_UK has worked with @BritishBBank to produce the most comprehensive analysis of UK life science VC funds to date. Here's a blog all about it but if you don't have time to read that, here's a thread too... https://www.bioindustry.org/news-listing/life-science-vc-investments-perform-equally-or-better-than-other-sectors-new-data-shows.html

We encouraged VCs in our membership and network to provide their data to BBB for this analysis because the lack of publicly-available performance info could be a barrier to many investors taking a deeper look at the opportunity of UK biotech.

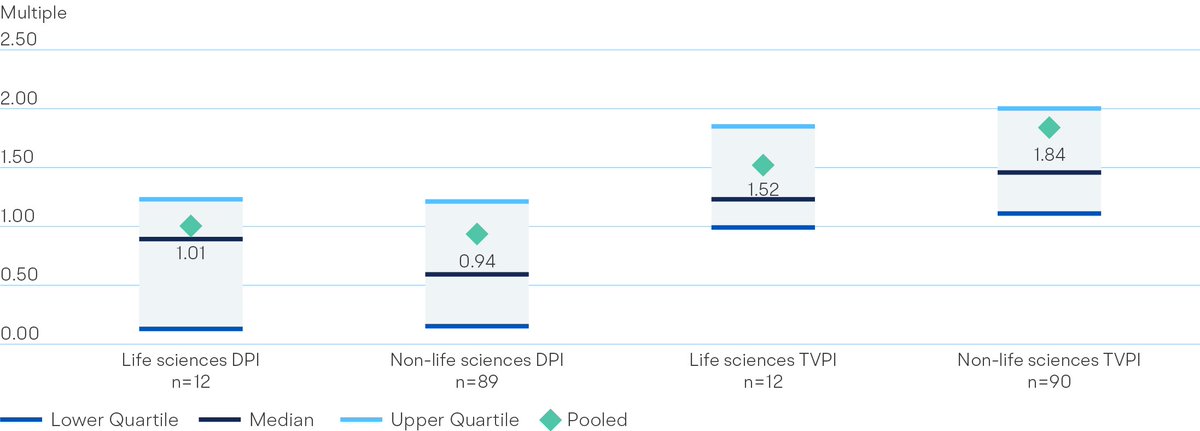

The results show that life science funds perform better than non-LS funds on realised returns (DPI), but it's not statistically significant. The spread of returns also suggests life sciences is no more risky than other VC investments.

However, for non-realised returns (TVPI) non-LS funds perform better. This measure is based on the VCs' estimates of the value of their portfolio, and it's documented that LS investors don't mark up their value as much or often as other investors: https://lifescivc.com/2013/05/debunking-myths-about-biotech-venture-capital/

The DPI measure for life sciences is 1.01, meaning investors got back £1.01 for every £1 invested - not great. But it is important to remember the cohort we analysed were founded between 2002 and 2015, so...

... many will be very young and won't have exited (realised) their investments. As they mature we expect their DPI to go up (i.e. for them to become more profitable).

The cohort was only of 12 life science VC funds, so we will continue to encourage more VCs to share their anonymous data with the BBB. We also look forward to seeing this dataset mature and provide more concrete evidence of the returns investors can reap from UK life sciences.

For more information about investing in UK biotech, check out the @BIA_UK guide: https://www.bioindustry.org/policy/invest-in-biotech.html

END

END

Read on Twitter

Read on Twitter